- Capcom’s Value Creation

- Medium- to Long-Term

Growth Strategy - The Heart of

Value Creation - ESG-Based

Value Creation - Financial Analysis

CEO Commitment

Chairman and

Chief Executive Officer (CEO)

Kenzo Tsujimoto

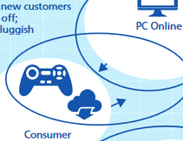

Six Elements Required for the Sustainable Enhancement of Corporate Value

It has been 35 years since I founded Capcom. However, I have no interest in past successes. Even now that we have once again achieved record earnings, we are always focused on the world in 5, 10 or 50 years from now, wondering what we should be aiming for and what kind of mechanism can we create that will lead to sustainable growth.

I believe this will require the linking of six elements: 1 a corporate philosophy and culture that fosters the ambitions and values set out at our founding, 2a business model that is a competitive advantage, 3 important management indicators that function as quantitative guideposts, 4a management strategy focusing our strengths, 5a relationship with society and 6governance that reduces risks and enhances sustainability.

On the following pages, I will explain to our shareholders how we are favorably and uniquely positioned with respect to each of these six elements that facilitate the sustainable enhancement of corporate value.

1 Corporate Philosophy and Culture ——Aim to be the Best in the World

"From Osaka to the World": Our Motto,

and The DNA to Continue Taking on Global Challenges

I jumped into the world of entertainment 50 years ago with the idea that "games are luxury items, not essentials. This is why the brand must be of world-class quality." I still believe this to be true even today.

Accordingly, Capcom’s basic philosophy is to create an entertainment culture through the medium of games by developing highly creative content that excites and stimulates the senses. In other words, we help build an emotionally rich society by creating entertainment culture with the world’s most entertaining games.

CAPCOM IR [Corporate Information]Corporate Philosophy

In 1983, I founded Capcom under the motto of "originality and ingenuity," with the vision of developing games offering world-class quality.

Underpinning this was my belief that increasingly sophisticated graphics and more immersive worlds would eventually make games as moving and impressive for the world as a Disney film.

35 years later, I have amassed more than 2,900 colleagues who share this vision. Under the slogan "From Osaka to the World," these values have become our corporate culture and DNA, with (1) a spirit that is always eager to take on new challenges and (2) a sense of pride to constantly strive to be world-class deeply ingrained in every Capcom employee.

Again and again, we have been able to produce unique series, including Street Fighter, Resident Evil and Monster Hunter because of the fertile soil of a corporate culture cultivated over many years.

2 Business Model——Competitive Advantage Centered on Global IP

Business Development Leveraging Development

and Technological Capabilities and BrandAdvantages

Capcom’s strengths are (1) the development and technological capabilities to create world-class, high-quality games and (2) numerous popular branded IP known the world over.

In addition, for the past six years, we have hired over 100 new employees every year, increasing our development staff to over 2,100 people and further enhancing our strengths. From game market characteristics and competitive factor analysis, the Consumer sub-segment has high entry barriers; combining the aforementioned strengths with our capital and the relationships of trust we have with hardware manufacturers creates significant competitive advantages (profitability). Against this backdrop, in the consumer market, technological standards and development costs rise with each hardware cycle, resulting in a situation where only branded popular titles continue to sell over the long term, creating a situation where consumer spend and time is more concentrated.

[Financial Analysis] An Analysis of the Market and Capcom

Furthermore, in sub-segments other than Consumer, our rollout of popular IP across multiple mediums contributes as a stable source of earnings. This is because, in addition to the fact that our IP consists of products developed 100% in-house, possessing numerous global IP amplifies the effect of our multiple usage strategy. Also, marketing activities utilizing Hollywood movies further enhances the global competitiveness (brand power) of our IP, and maximizes synergistic effects.

[Medium- to Long-Term Growth Strategy] The COO’s Discussion of Growth Strategies

3 Key Performance Indicators (KPI)

——Focused on Stable Growth for 5–10 Years into the Future

——Focused on Stable Growth for 5–10 Years into the Future

Creating a Framework Using Systematization and Establishing a Leaner Structure by Improving Performance Indicators

1. Analysis of Management Performance in the Fiscal Year Ended March 2018 (Summary)

In the fiscal year under review (ended March 2018), we achieved the fifth consecutive year of operating income growth, and all profit items from operating income downward reached record highs. What I want to point out here is that (1) we successfully positioned Monster Hunter: World as a global brand, (2) catalog sales (past titles, including rereleases and HD versions) also grew, increasing the density of our earnings platform and (3) digital unit sales rose to 53%. All three of these items are part of our growth strategy and demonstrate our successful executions of these initiatives up to now.

[Financial Analysis] Financial Review(PDF: 440KB)

2. Medium-Term Management Goal Assumptions and Indicators (KPI)

(1) Management Direction——Thinking About What to Target in the Next Five Years

I am always thinking about what our management targets should be in the next five years. In this way, I am even able to quickly notice small changes two years from now. And, at present, our management policies are to (1) create exciting, world-class content (IP), (2) maximize earnings by leveraging our rich library of IP across multiple platforms and media and (3) maintain these activities to become a company of continuous, sustainable growth.

(2) Management Goals——Stable Growth Every Year

We have established operating income growth each fiscal year as the goal for achieving the above. Rather than struggling to coordinate major title launch periods for this, we intend to take a natural approach of establishing a model of stable growth through build-up by expanding our title lineup among other efforts. This will enable institutional investors managing pensions and individual investors on fixed incomes to maintain long-term holdings with confidence. As we are emphasizing annual growth, we have not announced a specific rate of increase, but we are considering a profit growth rate between 5%–10%.

(3) Key Performance Indicators (KPI) and Shareholder Value Creation Achievements

In terms of management, I place importance on operating income (growth indicator) as the basis of corporate earning power, operating margins (efficiency indicator), which are the basis of profitability, and cash flows.

The game industry is prone to drastic change; in terms of engaging in management that is always focused five years ahead, we use the above fundamental indicators, as well as a matrix that compares figures to net sales, year-over-year and to our forecast, to check for anomalies and quickly identify and address problems. This has led to a 204% increase in operating income and a 9.3-points improvement in operating margins over the past 10 years, placing Capcom at the top compared to other companies in our industry.

Operating Income / Operating Margin Rate of Improvement (Compared to the Fiscal Year Ended March 2010)

| Operating income | Operating margins | |

|---|---|---|

| CAPCOM | +204% | +9.3 points |

| KONAMI HOLDINGS | +167% | +12.9 points |

| SQUARE ENIX HOLDINGS | +6% | -3.6 points |

| SEGA SAMMY HOLDINGS | -43% | -4.2 points |

| BANDAI NAMCO HOLDINGS | +3,085% | +8.7 points |

Note: Comparison of the fiscal year ended March 2010 and the forecast for the fiscal year ending March 2019.

Source: Financial reports and earnings materials.

Further, if we improve these performance indicators, ROE and other related indicators also increase, creating shareholder value. Specifically, in line with improved margins, ROE has improved for five years straight. And, in the fiscal year ending March 2019, the equity spread (ROE – cost of capital) is expected to be 8.46%, adding to corporate value and exceeding the average for companies listed on the Tokyo Stock Exchange (3.28%) as well as those in the same industry.

ROE / Equity Spread

| ROE | Equity Spread | |

|---|---|---|

| CAPCOM | 14.05% | +8.46% |

| KONAMI HOLDINGS | 12.61% | +6.35% |

| SQUARE ENIX HOLDINGS | 10.90% | +5.97% |

| SEGA SAMMY HOLDINGS | 3.90% | -2.34% |

| BANDAI NAMCO HOLDINGS | 11.12% | +5.91% |

| TSE Average | 9.39% | +3.28% |

Note: Forecast for the fiscal year ending March 2019

Source: Financial reports, Bloomberg

In addition, I think it is important to reward shareholders who trust our Company and hold Capcom shares over the medium-to-long term, and I have strived to deliver sustainable earnings growth and returns to shareholders. As a result, over the past five years capital gains and dividends, which constitute total shareholders return (TSR), are 27.85%, beating TOPIX (12.91%) and propelling Capcom to the top position compared to other companies in our industry.

Total Shareholder Return (TSR)

| Five-year period (annual rate) | |

|---|---|

| CAPCOM | +27.85% |

| KONAMI HOLDINGS | +25.56% |

| SQUARE ENIX HOLDINGS | +39.17% |

| SEGA SAMMY HOLDINGS | -0.08% |

| BANDAI NAMCO HOLDINGS | +18.82% |

| TOPIX | +12.91% |

Note: Five-year period from fiscal years ended March 2014 to March 2018

Source: Bloomberg

Going forward, we will create a framework for management systematization with the aim of creating a leaner corporate structure by improving basic performance indicators.

[Medium- to Long-Term Growth Strategy] Financial Strategy According to the CFO

4 Management Strategy

——Development and Marketing Strategies Focused on Strengths

——Development and Marketing Strategies Focused on Strengths

Enhancing Brands and Expanding Customer

Segments with Proprietary Development and Marketing Strategies

1. Investing in Human Resources and Development Equipment to Create World-Class Games

"Without pursuing advancement, we cannot create world-class games." As a manager in the game industry for 50 years, I have always said, "World-class games are not just entertaining, they must also be technically advanced." The evolution of hardware and rising quality of market entrants are proof of this. Accordingly, we must amass human resources that are highly skilled in areas such as programming and the visual arts. We are already engaged in this effort.

I focused on future game market expansion and technological advances, and for the past six years Capcom has hired over 100 new employees every year. Neary all of them are "game natives" who have played games since they were very young and have witnessed the advances in games of the past 20 years. Moreover, they are overflowing with energy, and desire to use their skills to develop new markets, which is why they joined Capcom, whose DNA is rooted in a focus on global markets.

To make the most of the talents possessed by our gang of game natives, we are creating mechanisms for human resource development and aggressively investing in the world’s most advanced R&D centers and development equipment.

[ESG-Based Value Creation] The Head of Development Discusses Human Resources Strategy

2. Marketing Strategy for Creating Global Brands

Another critical factor is our approach to marketing, focused on branding and increasing awareness of hit titles.

As it takes about three years to develop a game, we used to have issues with a progressive decline in recognition during development. I came up with the idea that the most effective method for ongoing media exposure of game titles was to expand globally using Hollywood movie adaptations. In 1994, we decided to invest 4 billion yen to make a Street Fighter Hollywood movie. At that time, some thought I had taken up movies merely as a hobby, but this investment generated a 15 billion yen return and successfully established Street Fighter as a global brand. Although games receive only about two weeks of media exposure before and after their release, factors that led to the success of this Hollywood movie include (1) the theatrical release, (2) Blu-Ray and DVD sales, (3) cable television broadcasts and (4) broadcasts at hotels and in airplanes. It has been rebroadcast numerous times over years and decades, which has led to maintaining and even increasing the recognition of this title.

A condition to taking this marketing approach is that the games are of world-class quality; Capcom has already succeeded in a similar way with the branding of Resident Evil. We will continue to utilize this branding approach with other Capcom IP.

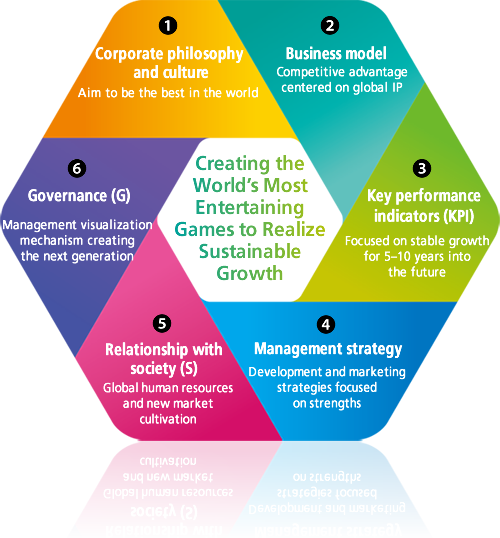

3. Growth Strategy Aimed at Increasing the User Base of Each IP

As the founder of Capcom, I think it is important to create a structure for passing the business on to the next-generation. As with any structure, building the foundation is the most challenging part, but efforts launched five years ago are finally starting to take shape. To establish solid growth strategies and further enhance corporate value, there are two risks that are critical to address; first, I will talk about the stable growth mechanism (control of earnings volatility risks).

To mitigate earnings volatility risks over the medium-to-long term, measures enabling sustainable growth must include (1) transforming the foundation of our Consumer business model from a traditional one-time sale "transactional model" to a continuous "recurring revenue model" and (2) creating a business portfolio and diversifying earnings risks by thoroughly leveraging Capcom’s basic strategy, Single Content Multiple Usage.

Historically, earnings in Capcom’s core Consumer business fluctuated depending on whether or not we created hit titles. Although we achieved some success (controlled earnings volatility) through timing the releases of multiple hit titles in the past, it did not meet my objectives for stable growth.

However, since 2013, game consoles have been equipped with robust online functionality, enabling us to develop growth strategies around digital elements.

Specifically, new titles will work as growth drivers as we (1) release approximately three major titles each year, (2) extend the sales life of these titles to 3–4 years with additional content and pricing strategies and (3) strengthen our presence overseas, which comprises approximately 85% of the total market.

Next, in terms of catalog titles, we will grow our user base and generate profits on a recurring revenue basis through (1) download sales of past titles and (2) rereleasing past hit titles for current-generation game consoles.

Furthermore, our Single Content Multiple Usage strategy has not yet been of a scale sufficient to offset volatility in Consumer games. In Mobile contents however, through the advance of G (generations of communication speed) and K (display resolution) technologies, we will build a business foundation as a second pillar for future growth by thoroughly leveraging our core strength of IP while pursuing in-house development, alliances, M&A and a variety of other possibilities.

In addition, with a focus on growth of the esports market five years from now, we will strengthen title branding and attempt to commercialize the esports business.

In the game industry, which is often called the "hit business," Capcom will establish a management structure and strategy able to achieve sustainable growth other companies have yet to achieve while enhancing corporate value.

5 Relationship with Society (S)

——Global Human Resources and New Market Cultivation

——Global Human Resources and New Market Cultivation

Developing Global Human Resources and

Contributing to Society through Game Development

I believe that corporate value is enhanced by resolving social issues through business activities. This includes the development of human resources able to play an active role on the world stage, the creation of new markets using cutting-edge technologies and the building of healthy relationships with stakeholders from the unique perspective of a game maker while generating social and economic benefits.

1. Building a Healthy Relationship Between Games and Society

Traditionally, games have provided joy and stress relief; in recent years however, following an increase in mobile games, new issues such as minors spending large amounts of money on in-game purchases, real money trading (RMT) and game addiction are beginning to appear. In recognition that this is a substantial problem for the industry overall, companies are working together primarily through industrial organizations to (1) establish guidelines and educate, (2) share information on issues and examples among member companies and (3) regularly exchange information with guardians, educators, consumer organizations and governments.

[ESG-Based Value Creation] Social – Relationship with Customers

In addition, Capcom conducts game literacy and career education to spread awareness of the proper way to interact with games as part of its educational support activities. These efforts are aimed at supporting the healthy development of young people and easing the concerns society has about the influence of video games.

[ESG-Based Value Creation] Social – On-Site Classes

2. Commitment to Regional Communities

The promotion of our Single Content Multiple Usage strategy provides society with a wide range of benefits. Specifically, these include the use of popular Capcom IP in local revitalization activities to support (1) economic development, (2) cultural development, (3) awareness for improved public safety and (4) awareness of elections. We are achieving quantitative social outcomes through solving the common problem of attracting and appealing to the youth demographic.

[ESG-Based Value Creation] Social – Regional Revitalization Activities

At the same time, these four activities deliver value to Capcom in the form of (1) improving existing customer satisfaction through event participation and (2) enhancing the image of games among the middle- aged and seniors. With respect to (2) in particular, this segment cannot be considered current customers, thus by contributing popular content to local communities, we are able to cultivate new game players through apps and games on their personal smartphones and devices.

3. Commitment to Employees

As can be seen from the fact that personnel expenses (costs) account for approximately 80% of development expenses, the game industry is a labor-intensive industry and an extraordinarily knowledge-intensive industry, thus human resources are an especially important management resource.

I recognize the importance of diversity for creating content that will resonate globally, thus Capcom promotes the retention and training of talented human resources without regard for gender or race. One example of our results from this is the creation of a hit title in a new genre thanks to a development team led primarily by women. We also conduct various development programs, because human resource development is directly linked to strengthening our R&D capabilities. In addition, we not only bring together the world’s most advanced development facilities and technologies, but also ensure a robust working environment that includes facilities such as Capcom Juku, an on-site daycare center, all of which allows developers to concentrate on their work. Regarding remuneration, in addition to regular bonuses, Capcom has introduced a system offering incentives and assignment bonuses for each title in an attempt to further increase motivation.

Furthermore, rather than a mere daycare center, I want to make Capcom Juku a facility for learning that looks after children until they enter middle school. The children who buy games are the ones investing the most in Capcom. Thus, we must give something back to these children. Japan is trailing the United States and other nations in the fields of AI and IT, but we will rise to the challenge with human resources capable of competing globally. To this end, we will support children until they enter middle school and those who join Capcom will be developed into business people and game creators that can succeed on the world stage. I think this is the best we can give back to Capcom supporters.

[ESG-Based Value Creation] Social – Relationship with Employees

In my view, the most critical aspect of human resource development is providing an environment that enables employees to take on new challenges. The manager’s role is to push employees to take on one new challenge after another, leaving alone what works and devoting their energy to devising measures when things are not working. This enables employees to take on challenges without fear of failure, develop the world’s most entertaining games and create new businesses leading to a virtuous cycle that creates business opportunities.

6 Governance (G)

——Management Visualization Mechanism Creating the Next Generation

——Management Visualization Mechanism Creating the Next Generation

Designing Systems and Developing

the Next Generation of Management to

Reduce Management Decision Risks

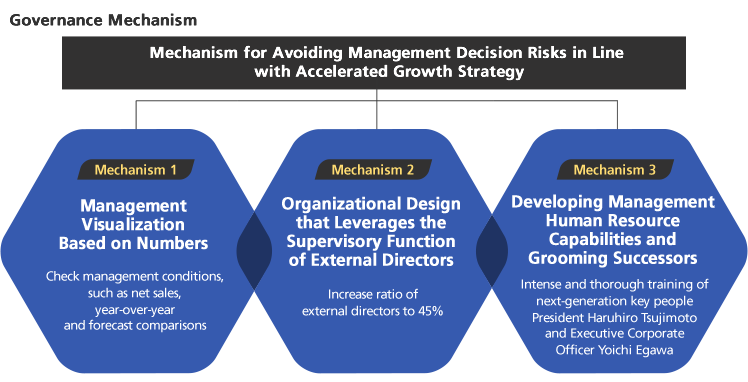

As Capcom further accelerates its growth strategies, the risks become proportionally higher, but I believe that governance is effective at reducing and avoiding these risks.

Specifically, with myself, Capcom’s founder, as CEO and my oldest son as COO, we can avoid management decision risks by sufficiently leveraging the supervisory function of the Board of Directors, which includes external directors, and building an unique mechanism for highly transparent and rational decision making.

Mechanism 1 Management Visualization Based on Numbers

Despite changes in corporate scale or business environment, to conduct flexible and integrated management, I require that materials (documents) used for decision-making are, in principle, quantitatively focused. Specifically, these materials compare and contrast net sales, year-on-year performance and earnings forecasts, which make it easier to identify problems by enabling us to confirm complex combinations of data.

Furthermore, these materials are used by external directors for supervisory purposes and provided to investors as part of our IR activities. This is part of the mechanism I call "management visualization." Management decisions based on visualizing operations enable us to evaluate the Company with two sets of eyes using a system attempting to achieve management transparency.

Even when I talk with developers, numbers are the common language. Using only qualitative words and sentences leaves significant room for arbitrariness on the part of the person in charge. In comparison, numbers enable comparisons from a variety of angles, facilitating decisions based on real conditions.

The risk control efforts I am focused on now involve passing on the management know-how I have accumulated as founder to the next-generation of management through actual practice and ensuring the Company functions reliably in the future by systematizing management. Both of these efforts are beginning to bear fruit.

Mechanism 2 Organizational Design that Leverages

the Supervisory Function of External Directors

For the past 19 years, Capcom has executed a variety of governance reforms.

Since introducing the external director system in the fiscal year ended March 31, 2002, external directors have increased to account for 45.5% of the Board of Directors. This stemmed from one particular investor’s concern that "as a founder-run company, Capcom can quickly make management decisions and respond to changes in the business environment, but isn’t there a risk of arbitrary decisions and execution?"

External director appointment criteria have not changed since the system was introduced, but in short, we appoint directors with insight who are highly proficient specialists in their respective areas, capable of objectively making decisions regarding Capcom’s management and business activities. With the avoidance of business investment risk as a priority issue, Capcom appoints individuals from Japan’s leadership class (in terms of business crisis management, law and government) who are able to provide sound opinions, especially when earnings are subpar, who are not intimidated by the company founder and are able to determine validity from the general public’s point of view.

I have determined that we must further enhance our management foundation to execute thorough risk management and ensure the stability of Capcom operations.

In addition, we proactively demonstrate the results of these supervisory mechanisms and monitoring in dialogues with investors. This arose due to a question from an investor back in 2013, who asked "Capcom’s Governance Report states that the Board of Directors engages in lively discussions, but is this really true?" We considered the fact that this effective mechanism was unrecognized to be a problem, so in the following year we began publishing Board of Director discussions in our Annual Report and holding small meetings between external directors and institutional investors, which led to deeper mutual understanding.

[ESG-Based Value Creation] Making Use of Shareholder and Investor Opinions

Mechanism 3 Developing Management Human Resource Capabilities and Grooming Successors

Within corporate management, people’s character and spirit are important management resources that have a substantial impact on corporate value. In the 2016 integrated report, I discussed my management philosophy and capabilities as founder. At present, one of the concerns among our investors is the thinness of our management team as a founder-run company; in other words, have we prepared a management structure (successor plan) for the next generation?

Key people for the next-generation are President Haruhiro Tsujimoto and Executive Corporate Officer Yoichi Egawa. Both have the qualities necessary for management.

For example, I have chosen my oldest son, President Tsujimoto, as my successor for two major reasons. The first is because he knows more about games than anyone else. He has assisted me since he was in middle school and Capcom was still a small company akin to a neighborhood business. As a result, he has accumulated over 40 years of experience in the industry with knowledge spanning the construction of game machines to software development.

The second reason is that he is prepared to stand his ground as a member of the founding family. Since he was a student, Haruhiro Tsujimoto has been willing and intended to take over the family business as the oldest son. He has looked after employees who joined Capcom as new graduates and their families for 50 years, and even when earnings were lackluster, he continued to create entertaining games for children, who invest the most in Capcom. Only a person who is willing to stand and fight can accomplish these things. I cannot allow Capcom to be run by someone with the tendency to give up as soon as his position becomes difficult.

Of course, as a Company, governance is important. Assuming the organization functions properly, the creation of this mechanism is as explained above.

In last year’s report, I discussed Yoichi Egawa’s qualifications. In addition to my intense and thorough training of these two very different types of people, when combined with the corporate culture we have cultivated over many years and the aforementioned management visualization and systematization, I believe I have prepared a deep management team that our long-term investors will think are the type of people they can rely on as managers.

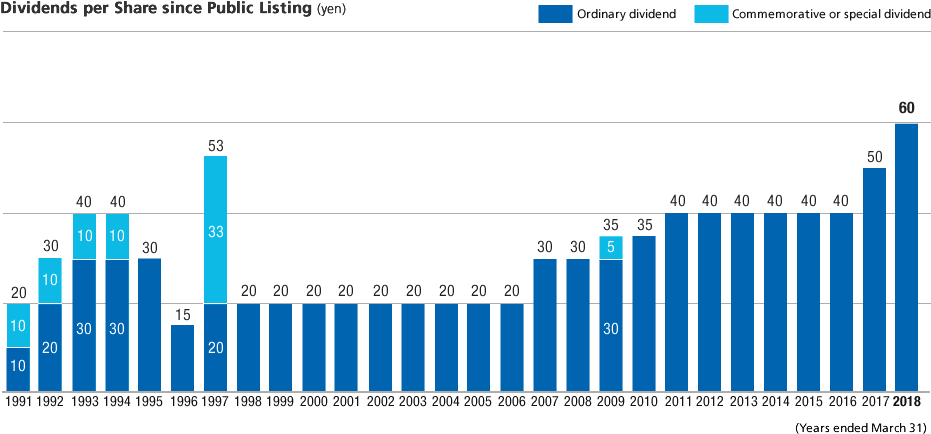

Rewarding Long-Term Shareholders with 28

Consecutive Years of Returns Since Capcom’s Listing and Record-High Dividends

1. Basic Policy Regarding Dividends

During my 35 years of management since founding Capcom, my philosophy has been to pursue stable corporate growth and reward long-term shareholders with steady increases in dividend payments despite the constantly changing nature of the game industry.

I have already mentioned the factors critical for sustainably enhancing corporate value; as shareholder returns are also an important management issue, dividends are determined with consideration for future business development and changes in the management environment.

Capcom’s basic shareholder return policy aims to (1) enhance corporate value through investment in growth, (2) continue paying dividends (30% payout ratio) while striving for stable dividends and (3) acquire treasure stock to increase the value of earnings per share.

The reason I think both the payout ratio and stable dividends are important is, for example, because a sudden decrease or cessation of dividends can be the difference between life and death for pensioners who depend on dividends to cover part of their lifestyle expenses. Regular and stable revenue enables the reliable establishment of future lifestyle plans. We also receive requests for stability from the long-term investors who manage those pensions.

Capcom shareholders represent all types of people, and I assume some of them may be facing these kinds of issues, which is why we have never once failed to provide dividends during the 28 years since we went public in 1990, and have doubled our dividend amount over the past ten years.

2. Dividends for This Fiscal Year and the Next

In the fiscal year ended March 31, 2018, the annual dividend reached an all-time high of 60 yen. In the next fiscal year (ending March 31, 2019), we plan to pay an annual dividend of 30 yen, which after our stock split, will substantively amount to another all-time high dividend similar to that in the year under review.

As a senior manager with 50 years of experience in this industry, my goal is to increase market capitalization and achieve corporate growth exceeding that of the past 35 years to continue meeting the expectations of all Capcom shareholders.

Kenzo Tsujimoto

Chairman and Chief Executive Officer (CEO)

PDF download

-

Medium- to Long-Term Growth Strategy (PDF:3.28MB/22 pages)