- Capcom’s Value Creation

- Medium- to Long-Term

Growth Strategy - The Heart of

Value Creation - ESG-Based

Value Creation - Financial Analysis

Features of Capcom Corporate Governance

Four Features of Capcom Corporate Governance

1

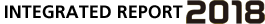

Transition into a Company with an Audit and Supervisory Committee to Strengthen Governance

In June 2016, we transitioned into a company with an audit and supervisory committee. The Audit and Supervisory Committee works so that the internal control system functions effectively, auditing the execution of operations by directors and employees based on auditing policies and, as necessary, submitting items found in audits and giving advice and making suggestions for corrections, etc. Additionally, we have established an Internal Audit Division directly under the control of the Audit and Supervisory Committee to ensure the committee can perform duties smoothly and appropriately. This division has a full-time staff of 18 who help with the execution of operations of the Audit and Supervisory Committee.

2

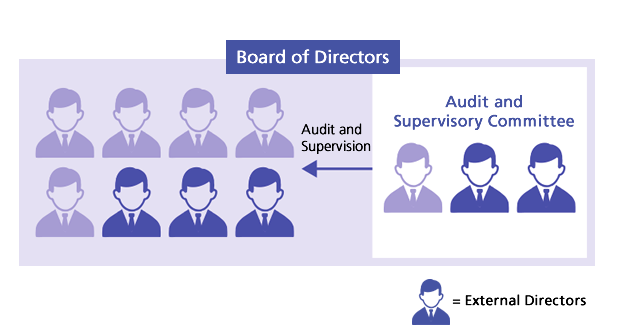

Proactive Appointment of External Directors

Capcom’s current ratio of external directors is 45.5% through proactively appointing external directors since June 2001. The advice, opinions, and scrutiny provided by external directors increases the transparency and credibility of Board of Directors’ meetings and vitalizes the same, while also strengthening the function of the meetings to supervise management.

3

Full Disclosure of 73 Corporate Governance Code Items

Capcom has disclosed all 73 of its Corporate Governance Code items in order to fulfil its responsibility to explain each item while reaffirming the current state of the company’s governance system contrasted with its ideal state. Capcom attaches particular importance to 26 items, which are comprised of 10 items that contribute to our growth strategy, three items that contribute to our management system and 13 items that serve as the base for achieving these, and provides greater detail concerning the same.

| Items which contribute to our growth strategy |

|

| Items which contribute to our management system |

|

| Items which serve as a basis for the above |

|

4

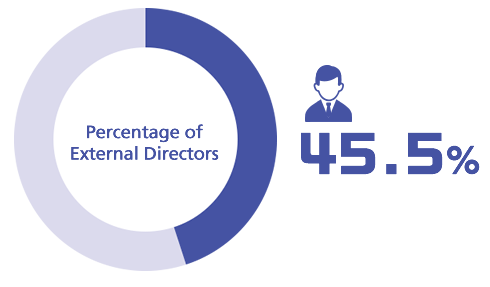

Mechanism for Reflecting Investor and Analyst Opinions in Management

Capcom’s IR Department engages in discussions with analysts and investors over 400 times per year. In addition to promoting understanding of management policies and business strategies, the IR Department applies these activities to corporate management, summarizing market opinions and providing feedback to management personnel. Capcom is also further enhancing events and tools for investors, strengthening shareholder and investor relations activities.

PDF download

-

ESG-Based Value Creation (PDF:3.69MB/24 pages)