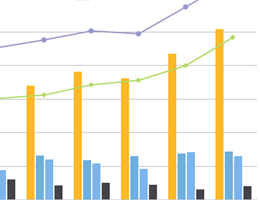

Stock Quote

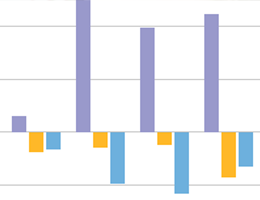

Balance Sheets (Japan GAAP)

Close

For more details, please see our Financial Results on the "Quarterly Reports" page.

Related Article

-

-

January 27, 20263Q FY2025 Financial Results Announcement

-

December 22, 2025-January 26, 2026Quiet Period

-

December 08, 2025Integrated Report 2025 added.

-

Integrated Report

Integrated Report-

IR Materials Download

-

IR Social Accounts

-

Top 5 Recommended Pages

(as end of Dec. 31, 2025)