- Capcom’s Value Creation

- Medium- to Long-Term

Growth Strategy - The Heart of

Value Creation - ESG-Based

Value Creation - Financial Analysis

An Analysis of the Market and Capcom

Game Industry Characteristics

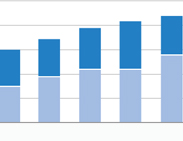

Characteristics of Each Market

Consumer Market Characteristics

Consumer Market Characteristics

(Package + Digital Download Contents)-

Package and digital download contents are a 24.4 billion dollar market, forecast to grow 46% over the next five years to 35.6 billion dollars by 2022. The customer base is composed mainly of core users who are highly loyal to game titles. They have relatively high willingness to purchase sequels and remakes along with low sensitivity to price and economic conditions. Hereafter, we expect the market to grow as we capture the casual user segment, which has high sensitivity to price conditions, in conjunction with a higher digital sales ratio, shrinking the gap between the margin in this market and those in the other two markets.

[An Analysis of the Market and Capcom]

Explanation of Market Trends and Forecasts  Mobile Market Characteristics

Mobile Market Characteristics-

This is a 59.4 billion dollar market, forecast to grow to 92 billion dollars by 2022. The customer segment is primarily composed of casual users, many of whom play games in their spare time, thus they demonstrate the lowest loyalty toward game titles. They have a limited willingness to purchase games and have the highest sensitivity to price and economic conditions. Although this is the most profitable among the three markets, only a limited number of titles are able to generate stable earnings over the long term. Going forward, we expect smartphones will continue to grow rapidly as the most pervasive game device.

[An Analysis of the Market and Capcom] Mobile Contents Market

PC Online Market Characteristics

PC Online Market Characteristics-

This is a 38.4 billion dollar market, forecast to grow about 19% over the next five years to 45.8 billion dollars by 2022. The customer base is primarily composed of core users who demonstrate the highest loyalty toward game titles. They have a fairly strong willingness to engage in ongoing purchases, and are unique for having the lowest sensitivity to price and economic conditions. Among the three markets, profitability is comparatively high, and hit titles tend to generate stable earnings over the long term; however, the influx of new customers is expected to taper off, causing growth to be sluggish in the future.

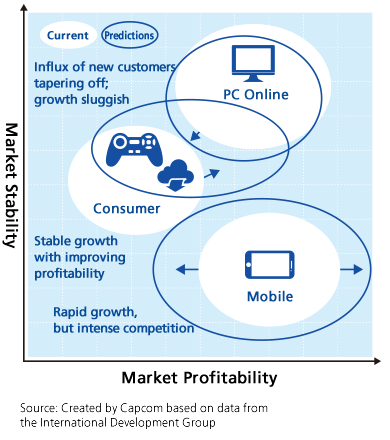

Five Competitive Factors Related to the Consumer Market (Five Forces Analysis)

Capcom Business Characteristics

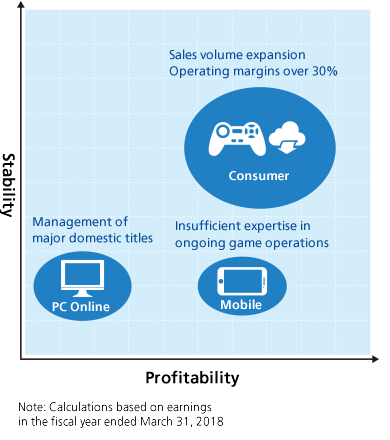

Digital Contents Business Portfolio

Consumer Market Characteristics

Consumer Market Characteristics

(Proportion of Net Sales: 69%)

Package + Digital Download Contents-

Capcom’s core business is to create a multitude of original content for home video game consoles. The regular release of sequels to popular IPs and an increased download sales ratio have, in recent years, led to a greater volume of sales and operating margins of up to around 30%.

Mobile Contents Market Characteristics

Mobile Contents Market Characteristics

(Proportion of Net Sales: 4%)-

This business distributes games featuring popular Capcom content on smartphones, cultivating new markets such as the casual user segment to create new earnings opportunities. However, insufficient know-how in ongoing game operations, which differs from Consumer, has resulted in sales underperforming market growth.

PC Online Market Characteristic

PC Online Market Characteristic

(Proportion of Net Sales: 5%)-

We are working to distribute PC Online games utilizing our popular content and ensure stable management of our existing content in Japan and Asia.

Capcom Management Resource VRIO Analysis and Evaluation/Measures

V: Value R: Rarity I: Inimitability O: Organization

◯: High △: Medium ×: Low

| Area | Management Resource | V | R | I | O | Evaluation |

|---|---|---|---|---|---|---|

| Management | Top management with strong leadership dedicated to high-quality production and trusted by employees | ◯ | ◯ | ◯ | ◯ | Ongoing competitive advantage |

| Development/ technology |

Development capabilities to produce original titles of world-class quality | ◯ | ◯ | ◯ | ◯ | Ongoing competitive advantage |

| RE ENGINE for streamlined development and the technological prowess to create games with full-VR support | ◯ | ◯ | ◯ | ◯ | ||

| Corporate culture of training younger employees | ◯ | × *1 |

△ | ◯ | Other companies possess this strength as well | |

| Governance | Promotion of governance reforms (independent director ratio / company with an audit and supervisory committee) | ◯ | △ | × | ◯ | Some companies are even more progressive |

| Swift decision-making system | ◯ | △ | × | ◯ | Strength seen at many founder-run companies | |

| Brand | Many popular, global IPs | ◯ | ◯ | ◯ | ◯ | Ongoing competitive advantage |

| Corporate brand known worldwide for action games | ◯ | × | ◯ | ◯ | There are more widely recognized companies | |

| Finances | Paid dividends for 28 consecutive years since listing | ◯ | △ | × | ◯ | There are about 40 companies that have provided dividends for 10 consecutive years or more |

| Sales | Consumer digital sales ratio of more than 40% | ◯ | △ | × *2 |

◯ | Major overseas companies are ahead |

| Marketing | Bolstering of lineup through revival of dormant IP and catalog titles | ◯ | △ | △ | ◯ | Companies with popular IP can roll them out in other media |

| Single Content Multiple Usage strategy of rolling out popular IP to multiple media | ◯ | × | △ | × *3 |

||

| External partners | Trusted by hardware manufacturers | ◯ | △ | ◯ | ◯ | High rank compared to competitors |

Note: Prepared in-house based on interviews of analysts.

Measures to address evaluation

- *1 With respect to the low evaluation of the originality of our system for training younger employees, we are working on system development that includes (1) providing an environment conductive to taking on new challenges through visualization of management, and (2) developing an environment of friendly rivalry through the promotion of younger employees and consolidation of offices.

- *2 With respect to the low evaluation globally despite being ahead of other companies in Japan, we are promoting measures such as (1) taking advantage of our many popular IPs by re-releasing past million-sellers (86 titles) in digital format and (2) extending the sales period with brand strategies for each IP.

- *3 With respect to the low evaluation of not successfully rolling out IPs to mobile platforms despite their relative strength, we are promoting measures such as (1) assigning capable creators to internal production and (2) forming alliances with mobile game companies possessing abundant game operations know-how.

PDF download

-

Financial Analysis and Corporate Data (PDF:1.20MB/ pahes)