- Capcom’s Value Creation

- Medium- to Long-Term

Growth Strategy - The Heart of

Value Creation - ESG-Based

Value Creation - Financial Analysis

Corporate Governance Structure and Initiatives

Shareholders and investors have made the practical and effective functioning of internal control into a key issue amidst an epidemic of corporate misconduct in Japan and overseas. In this section, Capcom will explain the corporate governance

structure and systems that it has initiated so far based on the key concepts of "effectiveness and visibility" in terms of the results of third party assessment.

(Assessment areas are highlighted in yellow.)

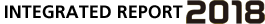

Corporate Governance Structure

Enhancing Management Soundness and Transparency While Responding to Changes in the Environment

Capcom is aware that comprehensive corporate governance ranks among management’s most important priorities. Because of this, in addition to enhancing management soundness and transparency, we are increasing corporate value by building a trusting relationship with our stakeholders. These stakeholders include shareholders, business partners, employees and regional societies.

❶ Shareholders’Meeting

(Convened on June 11, 2018)

Determines Important Matters as the Highest Decision-Making Body

The general shareholders’ meeting serves as Capcom’s highest decision-making body and determines important matters as well as serves as a place for reporting audit results of consolidated financial statements.

Invitations to the general shareholders’ meeting are issued approximately three weeks before convening the session, and efforts are made to allow for greater attendance by having the session about 10 days before the date on which most other companies hold their meetings. We have also made it possible for shareholders to exercise their voting rights over the internet using a computer or smartphone. In addition, we participate in an electronic voting rights exercise platform for institutional investors.

Four resolutions were brought up for discussion at the shareholders’ meeting this year, all of which were approved and passed.

❷ Board of Directors Supervision

(Convened 15 times in the year ended March 31, 2018)

Management Decisions that Incorporate External Directors’ Opinions

In addition to the regular Board of Directors meeting being convened once every month, it is also convened when the need arises.

The Board of Directors is composed of eight directors (excluding Audit and Supervisory Committee members), three of whom are external directors, in addition to three directors who are Audit and Supervisory Committee members (two of whom are external directors), for a total of 11 directors.

More than one-third of directors are external directors (five out of eleven) and all five of the external directors have been registered with Tokyo Stock Exchange, Inc. as independent directors.

❸ Audit and Supervisory Committee Audit

(Convened 16 times in the year ended March 31, 2018)

Cooperating with Accounting Auditors and the Internal Audit Department to Audit and Supervise

The Audit and Supervisory Committee is composed of three directors, two of whom are external directors. We carry out organizational audits and supervision by selecting two full-time members of the Audit and Supervisory Committee to collect and share information, while also making use of our internal control system.

To this end, we have established an Internal Audit Division, etc. with 18 full-time staff members directly under the control of the Audit and Supervisory Committee. This Division makes regular reports and carries out appropriate work through organizational audits that include issuing instructions and other actions as necessary.

❹ The Nomination and Remuneration Committee

Providing Consultation on the Selection of Candidates for Director and Recommending Details of Director Compensation

Capcom has established a voluntary Nomination and Remuneration Committee with five members, a majority of whom are external directors. The committee has an external director as committee chairman, and serves as a consulting organization to the Board of Directors, as necessary, to ensure the objectivity and appropriateness of the decision-making process for nominating candidates for director and for setting the compensation of directors (excluding directors who are members of the Audit and Supervisory Committee).

❺ The Compliance Committee

(Convened four times in the year ended March 31, 2018)

Focusing on Compliance as an Important Management Issue

To ensure compliance, Capcom has established a Compliance Committee that meets quarterly and has an external director, who is also a certified attorney, as the chairman. In order to prevent illegal activities and misconduct, and so that all employees can directly report any instances of these, Capcom has established Compliance Hotline Rules and an internal hotline. Capcom also regularly monitors its compliance status with a compliance check sheet. To ensure effectiveness, Capcom properly disposes of problems confirmed by this committee and other issues that must be dealt with.

❻ Accounting Auditors Audit

Ensuring and Verifying Accounting Transparency

Capcom has engaged KPMG AZSA LLC for financial audits as prescribed by the Companies Act and financial audits as prescribed by the Financial Instruments and Exchange Law. There is no special relationship involving financial or other interests between Capcom and this audit corporation or the engagement partners at this firm who perform audits at Capcom.

Auditor Remuneration (Year ended March 31, 2018)

| Compensation for Audit Operations | Compensation for Non-Audit Operations | |

|---|---|---|

| Delivery company | 43 million yen | – |

| Consolidated subsidiary | 1 million yen | – |

| Total | 44 million yen | – |

| Auditing Company | Names of Certified Public Accountants | |

|---|---|---|

| KPMG AZSA LLC, a limited liability audit corporation |

Designated Limited Liability Partners | Yasuhito Kondo |

| Hiroshi Miura | ||

| Takuya Obata | ||

Note: The financial audit team was composed of 10 certified public accountants (CPA), candidates for CPA who passed the new CPA exam and associates in charge of system audit, and a Certified Pension Actuary etc. (total 12).

❼ Internal Audit Division Audit

Ensuring and Verifying Legal Compliance and Operating Efficiencies

We have established an Internal Audit Division, etc. as an auditing body to support the Audit and Supervisory Committee. This division conducts regular monitoring of each division and Group company, primarily from the standpoint of risk management. The Internal Audit Division collects and analyzes information on legality, propriety, and efficiency, accurately assesses Group internal operational risk and inefficiencies, and works to prevent the occurrence of crises and improve operations. Additionally, in the event of an unforeseen situation, the Internal Audit Division contributes to making appropriate management decisions by quickly giving a report examining and analyzing the causal factors to the Audit and Supervisory Committee in order to minimize losses to the Company.

❽ Corporate Management Council Implementation

(Convened 15 times in the year ended March 31, 2018)

Supporting the Board of Directors’ Decisions

The Chairman, President and Executive Corporate Officers participate in the Corporate Management Council, which meets the day before a meeting of the Board of Directors. The Corporate Management Council ensures the fairness and transparency of the decision-making process by carefully reviewing special items, items brought up to the Board of Directors, and items delegated to Representative Directors.

❾ Board of Corporate Officers Implementation

(Convened 12 times in the year ended March 31, 2018)

Executing Operations Based on Clear Management Policy

In order to clarify monitoring and business operation functions, Capcom adopted the corporate officer system. The Board of Corporate Officers is convened, in principle, once a month. In addition to carrying out business based on Board of Directors’ decisions, reports on business affairs policy are given and plans are formulated at meetings of the Board of Corporate Officers. Status reports on business being carried out by Corporate Officers are given at the meetings of the Board of Directors.

External Directors

Using External Perspectives to Ensure Effective Governance

External directors ensure the effectiveness of the corporate governance function by playing key roles in the Compliance Committee and the Nomination and Remuneration Committee. They also focus efforts on compliance and the prevention of corrupt or illegal activities, and openly exchange opinions and provide counsel at Board of Directors meetings in an effort to strengthen the management audit function. The Secretariat staff helps with the work of the external directors who are not members of the Audit and Supervisory Committee. For external directors who are members of the Audit and Supervisory Committee, the full-time staff of the Internal Audit Division helps with their work.

Reasons for Selection of External Directors and Their Rate of Attendance (Year ended March 2018)

| Name | Independent director |

Reasons for selection | Board of Directors/Audit and Supervisory Committee Rate of Attendance (Year ended March 2018) | |

|---|---|---|---|---|

| External Directors | Hiroshi Yasuda | ✓ | In overall consideration of his excellent insight, wealth of experience, and career holding positions of importance | Board of Directors: Attended 15 of 15 meetings (100%) |

| Masao Sato |

✓ | Due to expectations for his ability to contribute to the auditing and supervision of the Board of Directors through his rich experience and knowledge from many years serving in police administration | Board of Directors: Attended 15 of 15 meetings (100%) | |

| Toru Muranaka | ✓ | Due to expectations for his ability to contribute to the auditing and supervision of the Board of Directors through precise counsel and advice as a legal expert | Board of Directors: Attended 15 of 15 meetings (100%) | |

| External Directors (Audit and Supervisory Committee) |

Yoshihiko Iwasaki | ✓ | Due to his experience with tax administration, he is expected to be beneficial to the Company | Board of Directors: Attended 15 of 15 meetings (100%) Audit and Supervisory Committee: Attended 16 of 16 meetings (100%) |

| Makoto Matsuo | ✓ | Due to his ability to enable effective corporate governance through precise counsel and advice as a legal expert | Board of Directors: Attended 15 of 15 meetings (100%) Audit and Supervisory Committee: Attended 16 of 16 meetings (100%) |

|

| Takayuki Morinaga | ✓ | Due to expectations for his ability to strengthen the auditing and supervision of the Board of Directors through management expertise, practical experience, and a track record that he has acquired at other companies | Board of Directors: Attended 15 of 15 meetings (100%) Audit and Supervisory Committee: Attended 16 of 16 meetings (100%) |

Officer Remuneration

The Nomination and Remuneration Committee Makes Recommendations to Ensure Fairness and Transparency

To ensure fairness and transparency, the compensation of Directors (excluding directors who are members of the Audit and Supervisory Committee) is consulted on with the voluntary Nomination and Remuneration Committee, which has an external director as chairman. The Board of Directors sets remuneration based on this committee’s recommendations. The current remuneration system is composed of set monthly remuneration and performance-based bonuses paid in cash, however, the percentage of set remuneration is high. Because of this, we are looking into introducing a new remuneration system to increase the directors’ incentive to increase corporate value over the medium-to-long term. Also, as part of an overall environment to support risk-taking, the remuneration linked to performance will be set to an appropriate percentage.

Regarding the Decision on the Calculation Method and Amount of Directors’ Remuneration

1 Regarding remuneration of directors (excluding directors who are members of the Audit and Supervisory Committee)

To ensure fairness and transparency of directors’ remuneration, the Board of Directors consults the Nomination and Remuneration Committee, which has an external director as chairman. The Nomination and Remuneration Committe considers each board member’s position, duties, tenure, and full/part-time service, as well as individual job performance and Capcom’s earnings, and recommends an appropriate amount. The Board of Directors makes a decision based on this amount.

- Monthly remuneration is fixed.

- The bonuses are set within a reasonable range based on monthly remuneration and the Company’s performance.

- In addition to the remuneration listed above, appropriate remuneration based on individual achievement may be paid within a set range.

2 The remuneration of the directors who serve as members of the Audit and Supervisory Committee

In order to secure their independence, the remuneration of the directors who serve as members of the Audit and Supervisory Committee is not linked to performance; it is a fixed amount determined through discussions, taking the difference of full-time or part-time service into account, by the directors who serve as members of the Audit and Supervisory Committee.

Officer Remuneration (Year ended March 31, 2018)

Total remuneration, total amount by type of remuneration, and number of directors the remuneration was paid to, by type of director

| Type of director | TotalRemuneration (million yen) | Total of remuneration by type (million yen) | Number of directors paid | |||

|---|---|---|---|---|---|---|

| Basic remuneration | Stock Options | Bonus | Severance | |||

| Director (excluding Audit and Supervisory Committee and external directors) | 296 | 226 | – | 70 | – | 4 |

| Member of Audit and Supervisory Committee (excluding external directors) | 28 | 28 | – | – | – | 2 |

| External director | 29 | 29 | – | – | – | 3 |

| Member of Audit and Supervisory Committee (external directors) | 45 | 45 | – | – | – | 3 |

Note: The above includes one director (an Audit and Supervisory Committee member) who left office due to his tenure ending on September 30, 2017

Total amount of consolidated remuneration by director of delivery company

| Name | Total of consolidated remuneration (million yen) |

Type of director | Type of company | Total of consolidated remuneration by type (million yen) | |||

|---|---|---|---|---|---|---|---|

| Basic remuneration | Stock options | Bonus | Severance | ||||

| Kenzo Tsujimoto | 110 | Director | Delivery company | 80 | – | 30 | – |

Note: Total consolidated remuneration, etc. is listed only for those with remuneration of 100 million yen or more.

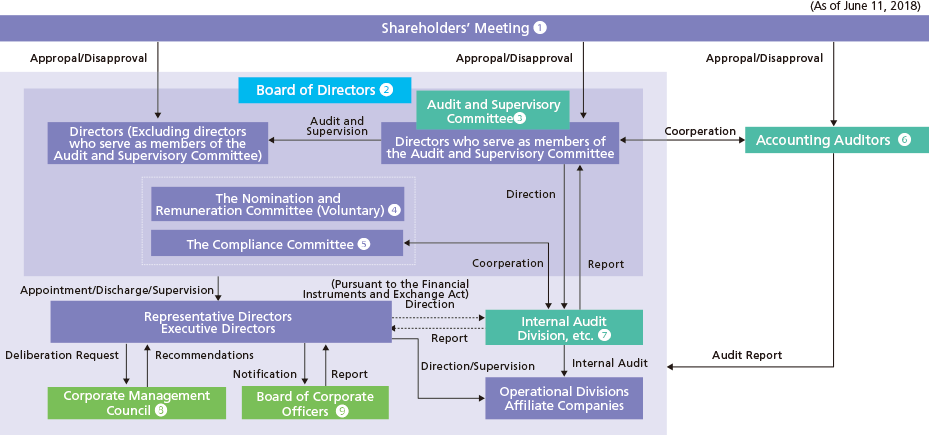

Third-Party Assessment

Promoting More "Visible" Governance

An analysis of an assessment performed by a third-party organization into the validity and effectiveness of Capcom’s corporate governance shows that the company ranked 184th among 3,548 listed companies in Japan in the “NEEDS-Cges” assessment developed by Nikkei Digital Media, Inc.

NEEDS-Cges has an established reputation as a system that quantitatively assesses corporate governance using scores on a scale of 1 to 10 for eight categories, including capital efficiency, information disclosure, and external regulations, among others, based on some 150 indicators calculated from data of publicly released company documents, such as financial reports.

As of the end of June 2018, Capcom’s total score was 7.20 points, placing us in the top 5.2% of Japan’s listed companies, exceeding the 4.91-point average for all listed companies and the 7.02-point average for the industry. We also received the maximum score of 10 for "equity market evaluation" and "information disclosure."

The main evaluation factors are given in the table below, but areas highlighted in yellow indicate measures that received particular notice. Going forward, we will continue making improvements based on consideration of external data to earn an even stronger assessment, and further promote the external visibility of our governance by posting this and other data on our IR web page.

Third-Party Assessment Results of Capcom’s Corporate Governance

Comparison of the Industry Average and the Average for All Listed Companies

Details of Capcom’s Corporate Governance

| Total Score | 7.20 |

|---|---|

| Rank | 184 |

| Categories | Score |

|---|---|

| Capital efficiency | 9 |

| Equity market’s assessment | 10 |

| External regulations | 9 |

| Board of Directors | 6 |

| Officer remuneration | 8 |

| Information disclosure | 10 |

| Capital policies | 5 |

| Effectiveness | 4 |

Details of Highest Rated Categories

| Highest Rated Categories | Score | Areas that Received Particular Notice |

|---|---|---|

| Capital efficiency | 9 | Statistics related to free cash flow |

| Equity market’s assessment | 10 | Statistics related to Tobin’s Q Ratio; equity returns |

| External regulations | 9 | Presence (or absence) of takeover defense measures |

| Information disclosure | 10 | Timing of Shareholders’ Meetings (avoiding congested periods), degree of website detail, early timing of Shareholders’ Meeting invitations, utilization of electronic voting, presence or absence of English disclosure materials |

Source: NEEDS-Cges from Nikkei Inc.

Basic Policies Regarding IR Activities

1. Disclosure Policies

Capcom is aware that comprehensive corporate governance ranks among management’s most important priorities. As such, in addition to increasing corporate value by enhancing management soundness and transparency, we are building a relationship of trust with our stakeholders, such as shareholders, business partners, employees and regional societies.

2. Disclosure Criteria

Capcom provides timely disclosure in accordance with the Securities and Exchange Law and other regulations including the "Rules on Timely Disclosure of Corporate Information by Issuer of Listed Security" (hereinafter Timely Disclosure Rules) stipulated by the Financial Instruments and Exchange Act and the Tokyo Stock Exchange.

It is our policy to disclose as much information as possible, including the disclosure of information not required by the Timely Disclosure Rules and other regulations, to accommodate our investors’ needs.We also disclose information through our corporate website in an attempt to provide quick and fair disclosure. Shareholders are informed of operating results and business conditions through shareholder letters.

3. Quiet Period

To prevent the unauthorized disclosure of quarterly earnings information prior to official announcements, Capcom has established a quiet period starting the day following the end of a fiscal period and ending on the day that financial information for that period is announced. During this period, we refuse all inquiries relating to our business performance. However, if significant changes to our earnings outlook are anticipated during the quiet period, we will disclose this information pursuant to the Timely Disclosure Rules and other regulations.

Initiatives for the General Shareholders’ Meeting

Making Shareholders’ Meetings Lively and Facilitating the Exercise of Voting Rights

To ensure our General Shareholders’ Meetings are lively, we hold our meeting about 10 days before the period when most Japanese companies typically hold their meetings in an attempt to encourage the attendance of as many shareholders as possible.

Also, voting rights can be exercised via computer, smartphone, and mobile phone. In addition, we have participated from an early stage in a platform for the online exercise of voting rights, so institutional investors are ensured a sufficient amount of time to consider proposals starting on the day the convocation notices are distributed. We also post convocation notices in English on our corporate website to promote the exercise of voting rights by shareholders worldwide.

Shareholders’ Meeting Resolutions

The following presents the results of voting at the fiscal 2017 General Shareholders’ Meeting.

| Resolutions | Approval Votes | Opposed Votes | Abstained Votes | Approval Rate (%) | Voting Results |

|---|---|---|---|---|---|

| First proposal: Proposed Appropriation of Retained Earnings |

446,934 | 169 | 32 | 99.05 | Approved |

| Second proposal: Election of Eight Directors (excluding Directors who are members of the Audit and Supervisory Committee) |

|||||

| Kenzo Tsujimoto | 434,925 | 12,176 | 32 | 96.39 | Approved |

| Haruhiro Tsujimoto | 438,477 | 8,625 | 32 | 97.17 | Approved |

| Yoichi Egawa | 440,700 | 6,402 | 32 | 97.67 | Approved |

| Kenkichi Nomura | 440,157 | 6,945 | 32 | 97.55 | Approved |

| Kunio Neo | 439,284 | 7,818 | 32 | 97.35 | Approved |

| Masao Sato | 441,958 | 5,145 | 32 | 97.94 | Approved |

| Toru Muranaka | 441,182 | 5,921 | 32 | 97.77 | Approved |

| Yutaka Mizukoshi | 442,014 | 5,089 | 32 | 97.96 | Approved |

| Third proposal: Election of Three Directors as Members of the Audit and Supervisory Committee |

|||||

| Kazushi Hirao | 434,516 | 12,586 | 32 | 96.30 | Approved |

| Yoshihiko Iwasaki | 438,349 | 8,753 | 32 | 97.14 | Approved |

| Makoto Matsuo | 437,527 | 9,575 | 32 | 96.96 | Approved |

| Fourth proposal: Election of One Director as a Substitute Member of the Audit and Supervisory Committee |

442,440 | 4,662 | 32 | 98.05 | Approved |

Capcom IR [Stock & Debt Information] Shareholders’ Meeting – Shareholders’ Meeting Resolutions

Third-Party Assessment of IR Activities

High Praise for Proactive IR Initiatives

In recognition of our ongoing pursuit of timely and appropriate information disclosure, our IR activities and various IR tools have received a number of awards from third-party organizations. With an awareness of the importance of accountability, we will continue our efforts to earn the trust of investors and provide timely disclosure.

Fiscal 2017 Third Party Evaluations

| Corporate | US-based financial publication Institutional Investor’s 2017 All-Japan Executive Team rankings, Software sector "Best IR Company" Third Place |

| Integrated Reports | Capcom’s integrated report chosen for excellence by asset management companies contracted with GPIF |

| Capcom’s integrated report chosen for "marked improvement" by asset management companies contracted with GPIF | |

| 20th Nikkei Annual Report Awards, Excellence Prize | |

| IR Website | US-based financial publication Institutional Investor’s 2017 All-Japan Executive Team rankings, Software sector "Best Website" First Place |

| Daiwa Investor Relations Co., Ltd. (Daiwa IR), "Internet IR Award 2017," Grand Prize | |

| Morningstar Japan K.K., Gomez Consulting Dept.’s "Investor Relations Site Ranking 2017," First place | |

| Nikko Investor Relations Co., Ltd., "Fiscal 2017 Listed Company Website Quality Ranking," Second Place |

Making Use of Shareholder and Investor Opinions

Reflecting Results of Dialogues with Investors and Analysts in Management

Through meetings with investors and analysts, Capcom’s IR Department attempts to promote an understanding of management policies, strategies and future outlook with these parties. Furthermore, their opinions are gathered and provided to management, and are utilized for corporate management going forward. As a company based in Osaka, proactive IR meetings with these parties enables us to minimize asymmetric information as we strive to achieve appropriate corporate value.

In fiscal 2017, we set up top management meetings between the chairman and CEO, the president and COO, and investors where medium- to long-term strategies and the direction of marketing strategies were explained. This also included candid discussions concerning management and development. Furthermore, we held an online individual investor briefing to allow individual investors from anywhere in the world to take part, as one of a variety of new pursuits informed by stock market views and demands. In addition, Capcom conducts a perception gap study every year targeting institutional investors and analysts in Japan and overseas. Being aware of investor perception gaps gives us feedback on corporate management and IR activities. Questionnaires are also given to attendees at our Presentation of Financial Results and individual investor briefing sessions, allowing us to make proactive use of market opinions as one criterion in management decisions. Specific examples of the diverse use of this information include: (1) reviewing disclosure materials (disclosing new KPI) and (2) assessing earnings briefing sessions and (3) holding meetings with management personnel.

Fiscal 2017 IR Measures

| By category | Frequency |

|---|---|

| Interviews accepted | 211 |

| Visited domestic investors | 138 |

| Visited overseas investors | 71 |

| Total | 420 |

IR Events

| Event | Details |

|---|---|

| Top Management Meeting | Speakers: Chairman and CEO, Kenzo Tsujimoto President and COO, Haruhiro Tsujimoto Executive Director and CFO, Kenkichi Nomura |

| Supplementary explanatory earnings administrative officer conference call | Conference call after earnings announcement / before financial results presentation to explain the results |

| Online individual investor briefing | Posted information sessions online for individual investors |

| Conducted perception gap study | Conducted assessment survey targeting institutional investors and analysts regarding Capcom’s management targets, strategies and IR activities, provided feedback to management |

Outcomes from Our Perception Gap Study with Investors (excerpts)

- Q. Rather than earnings and performance matters, I would like to see opportunities created where we can ask top management and those in charge of development about their ideas, management theories and philosophy. In particular, since the founder is the Capcom CEO, this would be extremely informative for investors like us.

- A. We held such a meeting.

We held a top management meeting to communicate the management policies and strategies being considered by the Chairman and CEO (our founder) and the President and COO (his successor), in addition to shedding some light on their personalities. The attendees seemed tremendously pleased and the event facilitated a deeper understanding of Capcom’s business strategies. We will continue to have such meetings to provide opportunities for even more meaningful, mutual dialogue. - Q. The recording of development costs in the Consumer business is difficult to understand. I would like to see a little more disclosure.

- A. We have made additional disclosures.

With the advance of digitization, consumer games have adopted longer sales cycles than before. Consequently, following accounting principles, Capcom now records expenses in accord with the sales period and, in principle, depreciates costs over approximately two years.

IR Activities on Our Website

Providing a Website Easily Accessible to Everyone

Since 2001, Capcom has made proactive use of its corporate website as a tool for disseminating information pertaining to IR activities. The main reasons for this are to ensure fairness for a wide range of stakeholders, and because it ensures information is easily available for inspection immediately in approximately 200 countries worldwide. Capcom’ s corporate website is also positioned as our most cost-effective tool.

IR Team

Full-Time Staff Engaged in a Wide Variety of Activities

Capcom IR activities are conducted by four full-time staff members in addition to the chairman, the president, and the director overseeing IR for shareholders and investors in Japan and overseas. For earnings information and other IR-related inquiries, please use the contact information below.

Public Relations & Investor Relations Section

Phone: +81-6-6920-3623 E-mail: ir@capcom.co.jp

Business Hours: 9:00–12:00, 13:00–17:30 (JST)

(excluding weekends and public holidays)

PDF download

-

ESG-Based Value Creation (PDF:3.69MB/24 pages)