- Get to Know

Capcom - Management

Strategy - Business Activity

Achievements - ESG-based Value

Creation - Financial Data

Features of Capcom Corporate Governance

Four Features of Capcom Corporate Governance

1

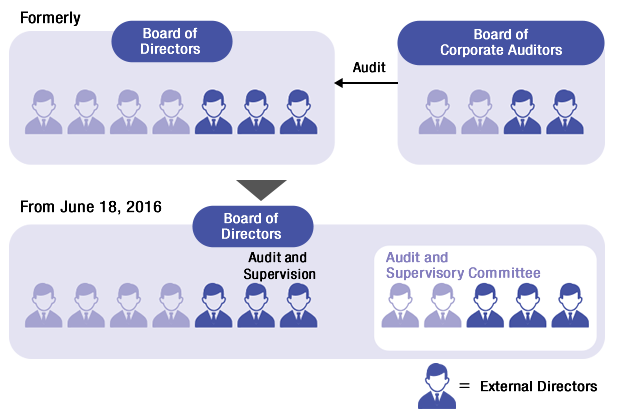

Transition into a company with an audit and supervisory committee to strengthen governance

Capcom established an Audit and Supervisory Committee and grants voting rights at Board of Directors’ meetings to directors who are also Audit and Supervisory Committee members. In addition, Capcom aims to further strengthen supervisory functions across the entirety of management and further enhance corporate governance via the implementation of propriety audits together with conventional legal audits.

2

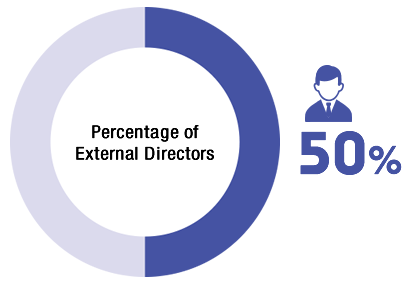

Proactive appointment of external directors

Capcom has reached our highest ever rate of external directors at 50% through proactively appointing external directors since June 2001. The advice, opinions, and scrutiny provided by external directors increases the transparency and credibility of Board of Directors’ meetings and vitalizes the same, while also strengthening the function of the meetings to supervise management.

3

Full disclosure of 73 Corporate Governance Code items

Capcom has disclosed all 73 of its Corporate Governance Code items in order to fulfil its responsibility to explain each item while reaffirming the current state of the company’s governance system contrasted with its ideal state. Capcom attaches particular importance to 26 items, which are comprised of 10 items which contribute to our growth strategy, 3 items which contribute to our management system, and 13 items which serve as the base for achieving these, and provides greater detail concerning the same.

| Items which contribute to our growth strategy |

|

| Items which contribute to our management system |

|

| Items which serve as a base for the above |

|

Capcom IR [Management Objectives] Corporate Governance

4

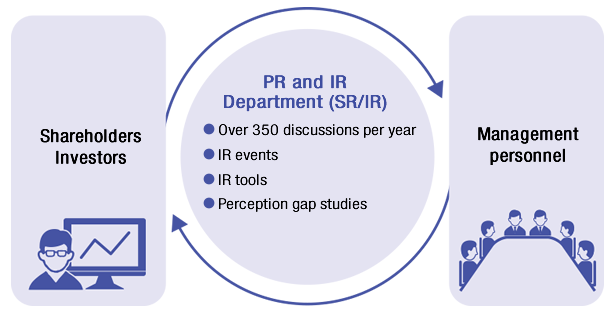

Mechanism for reflecting investor and analyst opinions in management

Capcom’s IR Department engages in discussions with analysts and investors over 350 times per year. In addition to promoting understanding of management policies and business strategies, the IR Department applies these activities to corporate management, summarizing market opinions and providing feedback to management personnel. Capcom is also further enhancing events and tools for investors, strengthening shareholder and investor relations activities.

Message from an External Director

Masao Sato

External Director (Independent Director)

Focusing on controlling risks in order to further

our growth strategies

I believe that discontinuing Capcom’s takeover defense measures has been one of our tougher challenges for governance over the past year. Despite the pains taken in reintroducing the defense measures previously, I feel that the decision to discontinue them—which broke with convention—after taking into account all of our discussions with shareholders to date, and vigorously debating the issue from square one at the Board of Directors, was a very significant one.

Principal Discussions at Board of Directors Meetings Held in Fiscal 2016

In the drastically changing video game industry, Capcom sees boosting its corporate value and improving performance through sustained, stable growth as the best defense from takeovers. The importance of controlling risk in order to pursue our growth strategies is increasing even further.

In my work with police administration and electric power companies, I was involved with business oversight and crisis management, preparing for unforeseen events. I would like to bring this experience to bear on the game industry, where fluctuations in performance can be substantial, and would like to contribute to Capcom’s increased corporate value through sustained, stable growth and more transparent operations.

Specifically, from a risk management (or, defensive) perspective, this year I have encouraged the Company to clarify the scope of the impact of the UK Modern Slavery Act 2015 and the Advance Pricing Agreement (APA).* Additionally, as an offensive approach to governance, given the high level of accuracy of plans in the Amusement Equipments business, I have been advising that the Consumer business (which has large discrepancies between estimated results and actual results) should learn what it can from the Amusement Equipments business, and incorporate that into their marketing, sales, and other activities.

Going forward, we will remain keenly aware of the roles expected of our six external directors, while providing diverse opinions and carrying out roles that encompass both offense and defense in order to achieve our growth strategies.

*A pre-determined agreement on transfer pricing methodology

Message from the Chairman of the Audit and Supervisory Committee

Takayuki Morinaga

External Director (Independent Director)

Chairman of the Audit and Supervisory Committee

Striving to overcome the challenges that have come to the

fore one year after transitioning to a new corporate structure

In the year since transitioning into a company with an audit and supervisory committee, Capcom has strengthened its governance over previous levels, though some operating challenges have also become apparent. In terms of strengthening, having an Internal Audit Department that is an organization directly subordinate to the Audit and Supervisory Committee has allowed broader in-house monitoring of not only legal audits, but also propriety audits, which facilitates better understanding than we previously had of the status of each business segment. We are able to deepen our understanding of the current state of the business by receiving reports from the Internal Audit Department on issues identified during monitoring.

As a result, when taking decision-making steps regarding audits, we can offer instructions and advice after thoroughly understanding and discussing matters. For example, when we addressed a proposal for an interim dividend increase, we pointed out the imperative of adhering to our year-long plan, and received a commitment at the Board of Directors meeting.

[Management Strategy] CEO Commitment

Meanwhile, it is a challenge to translate issues identified in propriety audits into concrete actions for resolutions. This involves business policies and execution, which makes it clear that having proper agreement and understanding with top management and executive directors is now more important than ever.

In the drastically fluctuating video game industry, I firmly believe that having speedy decisions and execution by the founder are significant strengths. Conseuently, I will do my part to overcome the above challenge and fulfill my role in an offensive approach to governance that accelerates our growth strategies.

PDF download

-

ESG-based Value Creation (PDF:2.43MB/ 20 pages)