- Value Creation Story

(PDF) - CEO

Commitment - Growth

Strategies - Financial Strategy

- Latest

Creative Report - External Directors'

Messages

Accelerating our digital strategy for our long-term goal of becoming a digital content company whose scope goes beyond games.

Haruhiro Tsujimoto

President and

Chief Operating Officer (COO)

Growth strategy1

Digital content

Promote a digital strategy using our flagship IPs to bring us to a standard of 30 million units in sales annually

Growth strategy2

Esports & Amusement

Increasing IP awareness, expanding fan base, and a cycle of Consumer earnings

Growth strategy3

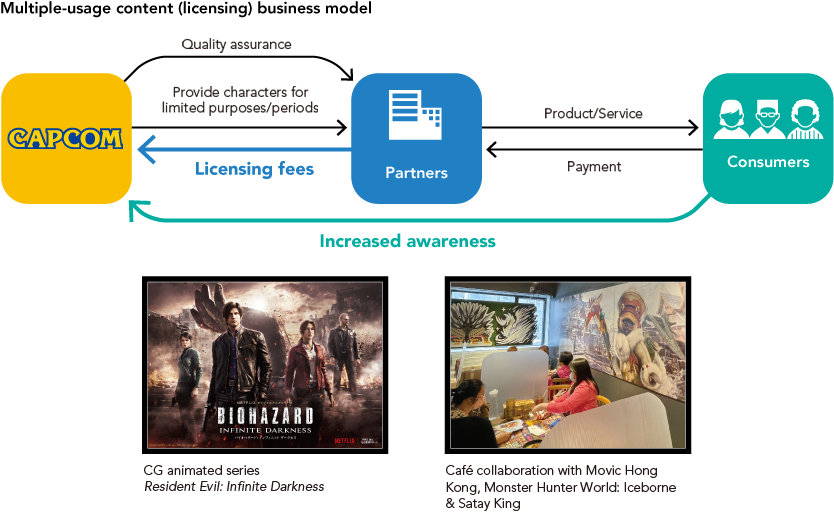

Multiple-usage content

Become a digital content company with a scope beyond games

I have been involved in the game industry for more than 35 years, and it has always been moving forward with great speed, but the global game software market has seen remarkable growth in recent years with a 140% growth rate over the last five years and an expected growth rate of 39% over the next five years. Behind this is the growth of digital sales in the Consumer home video game market and the globalization of the market, including mobile content. At Capcom, we are actively promoting a growth strategy that focuses on the Consumer home video game market, and our medium-term management goal is to achieve increased operating income of 10% each fiscal year.

Since the mid-2010’s, we have adopted a digital strategy as we work to achieve our medium-term goal, and by maximizing use of the Internet as a sales channel, we are strengthening global long-term sales of game software. In recent years, the sales data we have accumulated has helped us predict trends for new titles and improve the accuracy of our pricing strategies, leading to more efficient revenue acquisition. Also, we cannot forget that the traditional B2B business model in the game industry is now shifting to a B2C model. Getting closer to our users through digital marketing that makes use of our websites and social media will change the results we see in our business dramatically.

As our digital strategy comes to fruition and the scale of our annual global game sales volume reaches new domains, my vison for the future is to see Capcom becoming one of the world’s leading digital content companies with our brand’s content going beyond the boundaries of games as we adapt it to esports, movies, and merchandise, turning our brands into well-known staples worldwide.

I will now explain the path we have started along that will lead us to this vision of Capcom in the near future.

Digital content

Promote a digital strategy using our flagship IPs to bring us to a standard of 30 million units in sales annually

Achieve long-term sales globally by further increasing the digital ratio in our core Consumer sub-segment

It stands to reason that the Consumer sub-segment is the core of our business and the source of our content creation. As a result of our improved profitability and progress in our recurring revenue model due to our proactive measures for promoting digital sales in recent years, our operating margin, which had previously been stalled in the single digits, is gradually improving, and reached the 50% level by the fiscal year ended March 2021. This fiscal year we were also able to achieve what was previously a near-term goal of 30 million units in annual sales of software ahead of schedule.

The market is expected to grow by 65% to $70.6 billion by 2025, which will likely give the shift to digital a further boost. Considering these circumstances, Capcom will continue releasing high-quality content to the Consumer market underpinned by our world-leading development system in the next fiscal year and beyond.

We will also enhance our pricing strategies and digital promotion and address a broad range of user needs over the long term to reach a new high of 32 million units in annual sales of software in the next fiscal year and steadily grow toward the next milestone.

The Head of Development Discusses Strategy

Measure 1 Steady annual launch of core IP in global markets

The steady release of new high-quality titles is a prerequisite for digitalization, globalization, and for the evolution of our business structure. Since Capcom restructured in 2013, we have been using our “60-month map,” which is our medium term title portfolio map, in tandem with our “52-week map,” which manages the annual assignments of our developers, establishing a mechanism for the timely allocation of our roughly 2,450 developers (as of June 30, 2021) to the titles that require their skills. This has allowed us to continue releasing major titles each fiscal year contributing to stable growth.

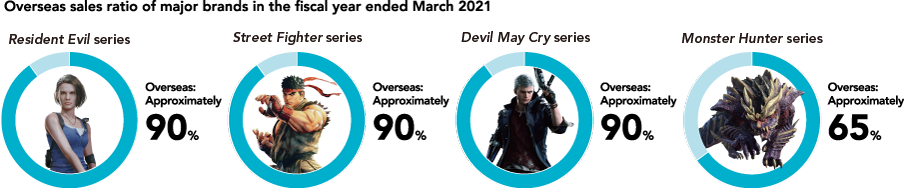

In addition, one of our strengths has been the fact that our most famous brands, such as Resident Evil and Street Fighter, are very popular outside of Japan, which accounts for 90% of the market. However, when we released Monster Hunter: World (referred to as MH:W herein) in 2018 as part of our strategy to globalize the Monster Hunter series, the title received worldwide acclaim and has sold a record 17.3 million copies (as of June 30, 2021). Moreover, most of the major titles we released thereafter employ the same meticulous approach to quality and digital strategy as MH:W, resulting in strong sales globally.

However, we have not yet amassed enough developers for our future growth. We will continue to hire more than 100 new graduates and combine that with the hiring of seasoned mid-career professionals in priority fields to utilize our dormant IPs in addition to our existing IPs. This is a necessary measure for our long-term growth along with the creation of entirely new IPs, such as Pragmata, which we announced in June 2020.

Measure 2 Increased profitability and long-term sales globally with the digitalization of sales channels

Here I will explain our digital strategy, a central pillar in our growth strategy. We feel the main advantages of digital sales are (1) improved profitability per unit due to package production cost reductions and avoidance of inventory risk, (2) additional earning opportunities and long-term sales of catalog titles, which is a sales opportunity that was not available at physical retail shops, and (3) marketization of emerging regions where game consoles were not distributed. These items brought a major transformation to the game business.

The strategy originated in 2013, before the latest game consoles at the time (PlayStation 4, etc.) were launched, after I learned that these game consoles would have constant internet connectivity. I knew a major change was coming to the game business and we established strengthening our digital adaptability as a priority strategy. Eight years have now past, and our digital sales, which were 5.2 billion yen in the fiscal year ended March 2013, have grown more than nine times to 48.0 billion yen in the fiscal year ended March 2021. During this time, our Consumer sub-segment improved significantly in profitability.

Digitalization increased earnings for each title, as mentioned above, but it also carries the further advantages of long-term sales and globalization. In the past, performance in the Consumer sub-segment was largely dependent on whether or not Capcom had released a new hit title that year, but now, once a high-quality new title is released, it contributes to earnings for more than 3-5 years. In addition to that, in package sales, second-hand distributors dominated sales of the last 36 years of Capcom’s content assets, but because we are now able to meet that demand directly through download sales, they have become a steady source of earnings for us. As a result, some 300 content assets are contributing to our earnings today. In addition, from the users’ perspective, digital has the substantial advantage of being available at the time you want it, and the digital ratio is rising each year, even for new titles. Our latest release Resident Evil Village has demonstrated a digital ratio exceeding 50% soon after its launch.

In recent years, PC platform versions have also increased their contribution to digital sales. We are now able to sell in more than 200 countries and regions, a number that far exceeds the conventional console market, and we have analyzed that there is strength in expanding sales in emerging regions, such as Asia, South America, Eastern Europe, and the Middle East. I think that there is great potential for future growth in this area and have designated PCs a priority platform.

We will continue promoting these digital strategies in the next fiscal year and project achieving record high net digital sales of 51.5 billion yen. As there is still room for growth in pipeline expansion, long-term sales, and in global markets, we expect the digital sales ratio to rise to a level of 80-90% in the medium-term and believe that the Consumer sub-segment profitability will continue to increase while we make progress in our recurring revenue model.

Measure 3 Greater efficiency and maximized opportunities with the shift to digital

Next, I will explain how digital has made the game business more efficient. As interest in digital transformation has grown in recent years, we have been focusing on using it more in our business. Games are a luxury item, and if we consider that in the near future digital natives will be the biggest consumers, it is extremely important that we meet users’ needs using digital communication.

In the initial stage, we established the Global Marketing Meeting, where management and global department heads meet each quarter to formulate our marketing plans and ensure that globally everyone at Capcom is on the same page regarding our digital measures. As a result, since launching MH:W in 2018, management, development and business have integrated, and utilized Capcom’s websites and social media to adjust the quality of our titles in line with users’ needs and establish an appropriate funnel for purchasing digital versions enabling us to institute a system that is expanding sales.

Next, in terms of long-term sales and globalization, we promoted detailed and flexible pricing measures, such as limited-time sale offers that consider the needs of each individual region and user demographic. As a result, in the year-end holiday sales seasons in both 2019 and 2020, we succeeded in generating higher digital sales than the previous year.

Another positive example is the long-term sales of MH:W. More than three years have passed since its release in January 2018, but as a result of maintaining sales while gradually lowering the price, its cumulative sales volume has exceeded 17 million units; more than half of which were sold in the second year or later. The lowest price it has sold for thus far is approximately 10 dollars, but its development costs have already been amortized, so even at 10 dollars or, as an extreme example, 5 dollars, it will contribute to income. We will continue to keep an eye on sales trends as we implement pricing measures that appeal to worldwide users who have not yet purchased the game in order to further expand our user base before the next title in the series is released.

I have been asked if this will create pressure to drop prices in the future, but I do not believe that is a concern. In the world of luxury items, as long as you can provide one-of-a-kind high-quality content, there will always be those with the need to play the newest content as soon as possible, even at full price. Pricing measures allow us to present users with a variety of prices so that they can make their purchase at a price where they feel satisfied, and this is an enormous advantage for both the seller and buyer.

As initiatives for the next fiscal year, (1) we are promoting the formulation of sales periods and pricing optimized for users’ needs by improving the accuracy of our pricing strategies, and (2) we are working to make the process from when users become aware of titles until they make a purchase more visible by strengthening digital promotions to further improve our business efficiency and maximize profit opportunities.

Measure 4 Support for mobile content and new services, such as cloud gaming

We expect Capcom’s growth resulting from the digital strategies I have set forth thus far to continue for the foreseeable future. Meanwhile, the appearance of new services and technologies, such as cloud gaming and 5G, have the potential to bring dramatic changes to the game industry over the next 10 years. In addition to adopting a multi-platform strategy, Capcom has a track record of being quick off the mark in adapting to new technologies, such as VR. It goes without saying that we will continue to maintain a keen awareness of new fields and conduct technical testing.

If we look at it from a historic perspective as well, we can see that it has been new services and technologies that have made games even more interesting. I have great expectations for the further evolution of the world of games, and further am also very interested to see what kind of merits it will bring to users.

Currently, I cannot say that we have had great success with mobile content yet. We have analyzed the issue to be that we have yet to acquire the know-how to monetize through the continuous services unique to the mobile arena. At this point, we are prioritizing the investment of our resources toward growing the Consumer sub-segment, so we are not in a rush to see results. However, with the new 5G communication standard, or its 6G successor, our dynamic, action-orientated content should become equally compatible with mobile devices. For example, we may see a breakthrough when it is combined with light-weight, next-generation VR devices. I have instructed the Development section to carry out technological research to ensure we are ready to grab the opportunity when it comes.

Finally, I want to properly convey that although our business format may change, Capcom’s top priority will not. That is to consistently produce world-class, meticulously refined content as we have always done. If we can continue to do that properly, then users will always choose our products to use with any platform or service. Conversely, if we fail to do so, even if we are able to ride the transient wave of a trend, we will not see medium or long-term growth. Our experience from many long years of standing at the forefront of the industry has convinced me of this.

Esports & Amusement

Increasing IP awareness, expanding fan base, and a cycle of Consumer earnings

Balancing the pursuit of business revenue and peripheral support geared toward improving our brand value

Our businesses outside Digital Contents play the role of (1) pursuing business revenue, in addition to (2) providing peripheral support geared toward improving our brand value.

First, from the perspective of business revenue, we are working on initiatives for acquiring expertise and monetizing real-life and online entertainment using Street Fighter in the rapidly growing esports market as an option for future growth. Our Arcade Operations and Amusement Equipments businesses are positioned as stable businesses contributing to Capcom’s revenue by providing underlying support. In addition, from the perspective of achieving long-term stable growth for the company as a whole, we are focusing on expanding awareness of our IPs and corporate brand and fostering loyal users through these businesses, which will lead to increased sales in our core Consumer sub-segment and generate a cycle of returning profits.

About esports

Esports stands for “electronic sports,” which are video games played in competitions viewed as sporting events. They became popular in Europe and North America in the late 90’s and now enjoy popularity among young people in particular, with numerous and varied game events held throughout the world, including in Japan and Asia. They are also garnering attention as a new category in the game business.

Measure Efforts to expand our esports foundation

The COVID-19 pandemic has forced us to reconsider the safety of players and spectators, and therefore the format of how we had planned to hold many of the live events this fiscal year changed. On the other hand, the fact that holding tournaments online is a viable online alternative is one of esports’ major advantages. In order to maintain the momentum we have built in popularizing esports thus far, as one of our two main pillar initiatives the Capcom Pro Tour, a worldwide series of one-on-one tournaments that are held throughout the year, was held online as it has been since June 2020. The second initiative, team battles, has also moved online since September 2020 with the domestic Street Fighter League: Pro-JP 2020 competition—for which we have brought on roughly 10 new tournament sponsors. In addition, Street Fighter League: Pro-US 2020 is being held online in the U.S.

In 2021, as well, the Capcom Pro Tour Online 2021 is being held with approximately double the number of tournaments compared to the previous year, and the Street Fighter League: Pro-JP 2021 tournament has expanded to eight teams participating in the team battles. These developments, and the fact that we introduced a corporate-ownership systems for teams for the first time, are helping us lay the groundwork for establishing regional team franchises and training institutions in the future. We will continue to work on promotional measures and to expand our esports foundation from a medium- to long-term perspective to firmly establish this new form of entertainment and implement initiatives so that when esports is widely recognized and understood by the general population, it will not only increase IP value, it will elevate the status of the game industry as well as contribute to society.

Multiple-usage content

Become a digital content company with a scope beyond games

Shifting from a stable business to a growth business

I believe that game content will eventually achieve a status on par with the world’s most famous animated characters. In the early 1990s, the booming popularity of Street Fighter II became the spark that led us to actively pursue adapting our content to products and Hollywood films. In the 2000’s, Capcom universally adopted the Single Content Multiple Usage strategy leading the industry in the development of cross media expansion. Today, as the number of users playing Capcom games around the world increases along with the growth of our business performance, I believe we are on the brink of major growth for our content business as well. In addition, my long-term vision is to see further growth in our business performance while we become one of the world’s leading digital content companies with our brand’s content reaching beyond the boundaries of games as we adapt them to movies, merchandise, and esports, turning our brands into well-known staples worldwide.

Measure Consolidating strategic functions domestically

Traditionally, we have developed content at each of our offices in Japan, the U.S., and Europe, which has contributed to supplementing software income, increasing awareness, and expanding our base of loyal users. However, in terms of growth rate, game sales have grown 80% over the last eight years where our content business (Other Businesses) has experienced a growth rate of 12%. I believe there is still a lot of room for growth in this area and have therefore consolidated all of the strategic functions of our content business at our Japan offices just as it oversees our entire Consumer digital strategy. We have divided global operations into four zones: Japan, the U.S., Europe, and Asia, and will implement measures geared toward growth based on software sales trends and brand popularity in each respective region. The industries that we collaborate with are also diversifying to include industries such as apparel and theme parks. We can already feel the brand influence of our IPs increasing, and we will link this to the rapid expansion of this business.

Measure Promotion of Hollywood movie adaptations and films for streaming

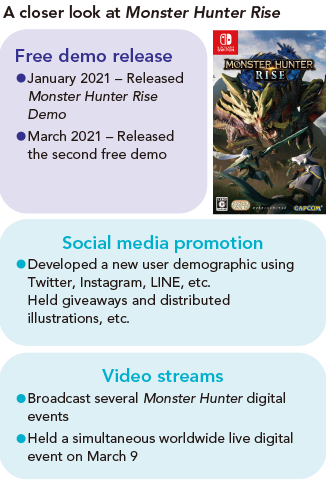

From a content branding standpoint, the effects of a Hollywood movie adaptation are immense. Adding to our track record with the Street Fighter and Resident Evil brands, the first Hollywood movie adaptation of Monster Hunter, released in 2020, was instrumental in providing a foundation for Monster Hunter Rise getting off to a strong start and helping MH:W get closer toward its goal of 20 million unit sales. In the future, we are planning to leverage our content into video streaming services which are becoming increasingly popular.

CAPCOM INTEGRATED REPORT 2021

PDF (Complete version) (PDF:12.5MB/ 103 page)

PDF (by section)

Value Creation Story

(PDF: 6.2MB / 24 page)

- Create Financial and Non-Financial Value

- Corporate Philosophy

- History of Value Creation

- Major Intellectual Properties (IP)

- Effectively Leveraging IP

- World Leading Development Capabilities / Digital Strategy Performance

- ESG Highlights

- Value Creation Model

- Financial Highlights

- Business Segments Highlights

- Medium- to Long-Term Vision