- Value Creation

Story(PDF) - CEO

Commitment - Growth

Strategies - Financial Strategy

- Latest

Creative Report - Message from an External Director

The COO’s Discussion

of Growth Strategies

Haruhiro Tsujimoto

President and

Chief Operating Officer (COO)

Enhance

digital strategy and

pursue maximizing revenue

from IPs geared toward the

expanding market

The game market continued to boom this fiscal year with the performance of each home video game platform, the popularity of new game genres in the mobile market, and the further growth of our esports business. In addition, with the next-generation mobile communication standard, 5G, being rolled out from July 2019, structural changes to the gaming business are starting to be explored, such as major IT companies announcing plans for new platforms that feature cloud gaming.

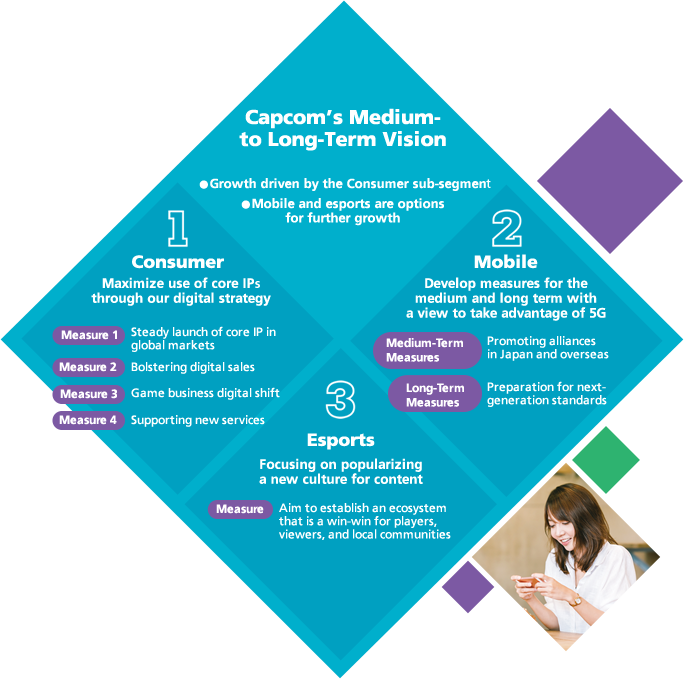

In this environment, areas of the market we are focused on are 1 the shift to digital, which has allowed us to directly address customer needs from a business standpoint, as well as achieve remarkable globalization and platform growth in step with the spread of digital sales in our core Consumer sub-segment, 2 5G, which if widely adopted will increase the likelihood of mobile content undergoing significant changes, and 3 esports, which has the potential to change the social value of games in addition to revenue opportunities.

The game market is evolving at breakneck speed; however, through integrating the development, sales and marketing aspects of our digital strategy with our single content multiple usage strategy, which allows us to leverage our rich library of original IP across a wide array of media, we will expand our global base of customers who support and trust Capcom’s brands and continue growing our operating income annually.

Consumer

Maximize use of core consumer IP

through our digital strategy

Use digital sales to increase pricing and region opportunities while extending the life of both new and catalog titles globally

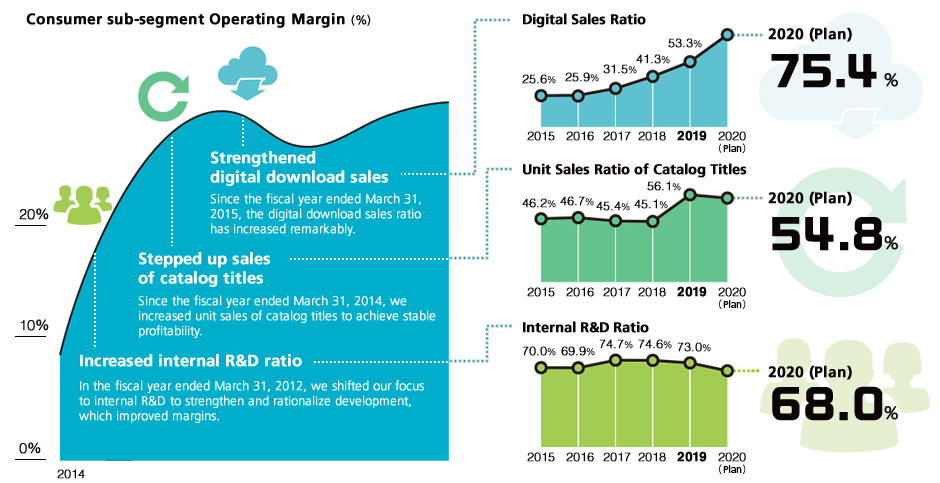

The consumer market is expected to grow to 47.9 billion dollars by 2023 (a 60.2% increase compared to 2018), thus Capcom continues to position our Consumer sub-segment as our driver of growth. We made progress toward establishing a recurring revenue model through achieving longer product lives, which includes sales growth for catalog titles, and improved profitability for new titles via ongoing initiatives that included expanding our new title lineup and strengthening digital sales. This is in addition to increased sales in emerging markets on PC platforms, which has grown in recent years, resulting in a profit margin of approximately 30% in the fiscal year ended March 2019.

In the next fiscal year and beyond, we will further promote our digital strategy and globalization as the foundation for a development structure that produces world-class quality, and aim for greater growth and stability in our business results.

The Head of Development Discusses Development Strategy

Measure 1 Steady annual launch of core IP in global markets

Since structural reforms in the fiscal year ended March 2013, and the full-fledged use of our strategic map (60-month), we have formed a title portfolio focused on delivering stable growth, and established a mechanism for placing more than 2,000 developers on the required development team at suitable times via a year-long assignment map. As a result, we shortened the launch cycle for each series, enabling the launch of multiple major titles each fiscal year.

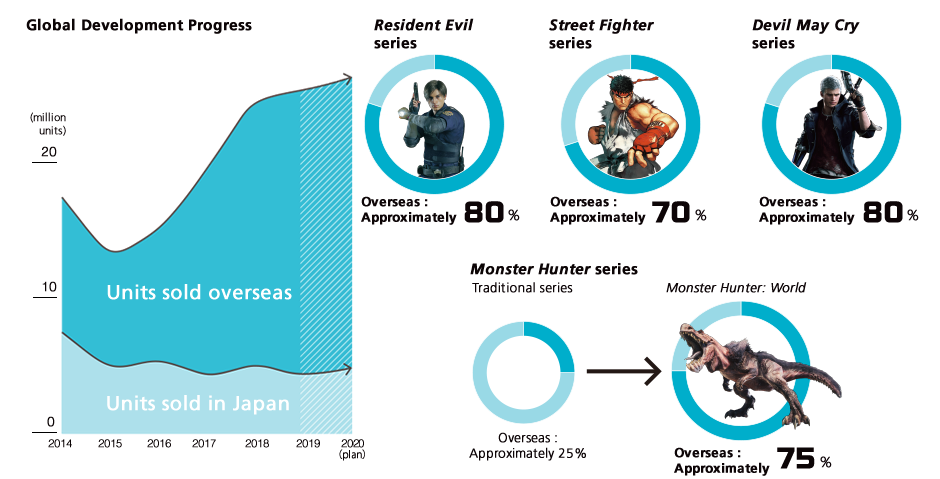

Based on this structure, we think there is substantial room for growth in the overseas markets, which comprise 85% of the consumer market, and in addition to Resident Evil and Street Fighter, which are already popular overseas, our strategic plan to make Monster Hunter a global brand with the release of Monster Hunter: World (MH:W) in January 2018 resulted in record sales of 13.1 million units (as of June 30, 2019).

Additionally, we maintained the same meticulous commitment to quality on this year’s Resident Evil 2 and Devil May Cry 5 as we had on MH:W, which, in conjunction with leveraging our know-how in digital marketing and promotion, resulted in these titles performing favorably to our sales plan.

Case Study: Analysis of a Top Hit Resident Evil 2

We will continue to strengthen our development structure and promote further systemization to grow our pipeline of new titles geared toward the global market.

For the time being, while we are placing a priority on maximizing the revenue from current core IP, we are also actively looking to utilize dormant IP.

Further, as the creation of new IP is indispensable in generating medium- to long-term growth, we are working to develop new brands as well.

Measure 2 Bolstering digital sales

The merits of digital sales include (1) improved profitability due to package production cost reductions and avoidance of inventory risk (full-game downloads), (2) additional earnings opportunities through digital sales of catalog titles, which are difficult to acquire shelf space for at physical retail shops (full-game downloads), and (3) anchoring players by providing content on an ongoing basis and acquiring additional revenue (additional content).

Up to this point, Capcom has worked to strengthen our digital sales of both new and catalog full-game titles, resulting in 41 billion yen in digital sales this fiscal year and a digital sales ratio in the Consumer sub-segment of 53.3%, surpassing the 50% we set as our medium-term target. During this time, consumer profitability has improved significantly, and business performance volatility has been reduced in line with our progress toward establishing a recurring revenue model that accompanies the achievement of long-term sales.

A major driver in the rapid growth of digital sales this fiscal year was increased PC game sales, as illustrated by the PC version of MH:W, a new release. Our analysis shows that compared to conventional platforms, PC provides an advantage in expanding sales to emerging markets such as Asia, South America, Eastern Europe, and the Middle East, where we can expect it to continue contributing to the globalization of Capcom’s business and acquisition of new users. In addition, purchases of new titles among customers are gradually shifting away from physical packages and toward digital, as evidenced by the digital sales ratio of both of our major titles this year exceeding 40%.

In the next fiscal year, we plan to further increase the digital sales ratio to 75.4%. The main contributing factor in this is that we are not releasing our new major title Monster Hunter World: Iceborne as a conventional standalone new title (at full-price), but rather as a massive expansion for MH:W. In other words, while the game content will be of a volume equivalent to that of a new title, we are selling and distributing it as additional content primarily through digital sales channels. In light of global user trends, we expect overall sales units to drop and net sales to decline in our Consumer sub-segment next fiscal year as we attempt this new sales method, but at the same time, we expect the profit margin to rise further.

Monster Hunter World: Iceborne

We expect that moving forward with these policies will bring the digital sales ratio closer to 80–90% or more in the medium to long-term, as well as improve Consumer sub-segment profitability, providing further progress in establishing our recurring revenue model.

Measure 3 Game business digital shift

It has long been our belief that the game business could be made more efficient by utilizing state-of-the-art internet technology.

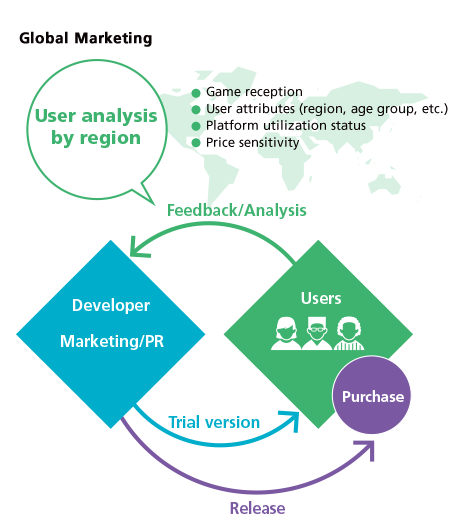

Therefore, in addition to proposing an internal change in our way of thinking, we established the Global Marketing Group, as well as quarterly Global Marketing meetings for management and global business executives to better align our aims amongst other efforts towards improvements. As a result, MH:W, released in January 2018, became the first title on which management, development, and business came together to make full use of internet connectivity to expand sales and realize improved quality. For example, the analysis of global user preferences, which were collected through an online demo version, contributed to this record-breaking hit, and we have applied this method to the two major titles released this fiscal year with successful results. The critical factor is to extract and analyze data from the standpoint of user satisfaction, which is extremely important for luxury items like games. This importance will continue to increase going forward as digital natives—those people who grew up with the internet and social media—grow into core-segment game users.

Amid the global expansion of markets, it is essential to develop detailed IP brand strategies. To comprehensively analyze user attributes, platform utilization status, and price sensitivity for each IP, we are shifting the function of our overseas subsidiaries from that of sales to marketing and promotion. In addition, from this fiscal year, we have integrated management of Japan and Asia to focus our business resources on the rapidly growing Asian market. We are also conducting proactive assignments of key persons, including offering positions to those from other industries, to catalyze the evolution of our organization with new knowledge and know-how.

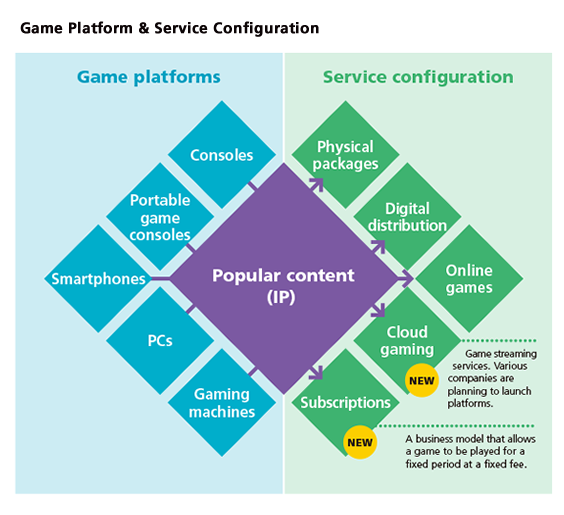

Measure 4 Support for new services such as cloud gaming and subscriptions

In step with the launch of 5G service, both existing platform providers and global IT firms, one after another, are announcing new cloud gaming and subscription services in the field of consumer games. Capcom pays close attention to future developments, and has adopted a multi-platform strategy under which we welcome the opportunity for new services to enhance the game environment for users, for example: the potential that wide adoption of cloud gaming will increase the overall game player population (where "cloud gaming" implies access to games through a variety of different hardware at a lower initial cost to the user).

At the same time, it will also be necessary to objectively analyze developments as we move forward, such as what actual merits users find in the new services and whether changes will arise in doing business with platform providers.

Capcom’s top priority remains as the meticulous refinement of our content to maintain our unflagging, consistent world-class quality. If we can accomplish that, then customers will always choose us, regardless of platform. Our experience from many long years of standing at the forefront of the industry has convinced me of this.

Mobile

Develop measures for the medium and long term with a view to take advantage of 5G

Amassing know-how geared toward next-generation mobile content

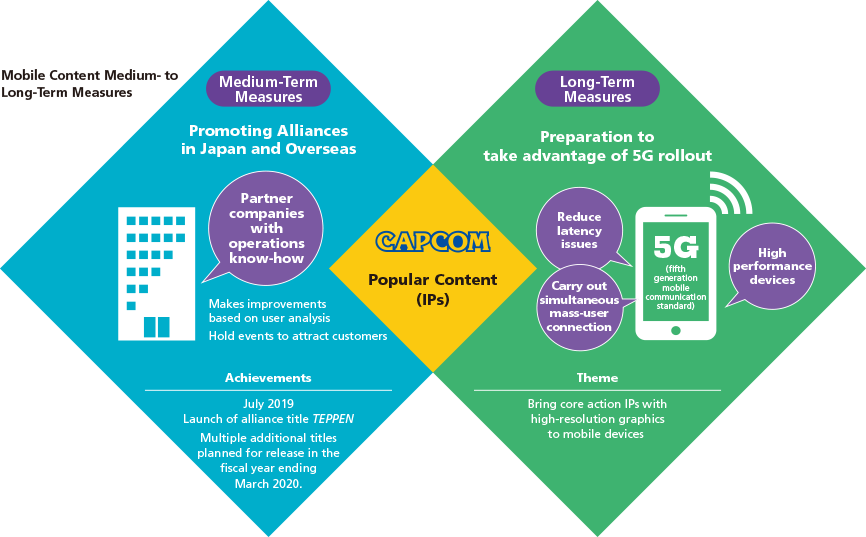

Capcom continues to lag behind other companies in our industry in the mobile domain, and this fiscal year sales declined due to postponing some titles and a general sentiment that the "gacha" business model has reached its peak. Meanwhile, full roll out of 5G, the next-generation telecommunications standard, is rapidly approaching. If vast improvements in communication speed result in reduced latency and the ability for simultaneous multi-user connections, according to our analysis, the likelihood will increase for us to achieve significant growth in the mobile segment with our numerous core action game IPs. We are undertaking measures for both current and new technology in order to achieve growth in the mobile segment, where strong global growth is expected to continue.

Medium-Term Measures Promoting alliances in Japan and overseas

In preparation for the full-scale roll out of 5G, Capcom must amass the operational know-how to improve game content and implement timely events within games; a prerequisite for success in the mobile business and something that we are lacking. In order to do so, for the last two years we have been focusing on alliances that utilize our IPs in conjunction with companies specializing in the mobile segment. As a result of the projects we have undertaken with multiple collaborators who have track records of hits in their respective markets, as of July 2019 we have already released two titles, domestically and overseas. Further, we plan to release several more titles, including some titles developed in-house, during the fiscal year ending March 2020.

Long-Term Measures Preparation for next-generation standards

Some regions overseas have already begun tentative 5G service, and in the future, with a leap forward in communication speed said to be 100 times faster than 4G, there are expected to be dramatic advancements in services using IoT as well as in the richness of content in line with device advancements. In terms of games, we believe there are possibilities for utilizing Capcom’s action-oriented games, distinctive for their high-quality graphics, on mobile devices.

At the moment, there is still room for us to choose the timing for full-scale support of 5G and the level of service we will offer. While we conduct analysis of actual 5G use, our development divisions are engaged in technological research and the acquisition of development know-how to ensure we are able to seize this coming opportunity for growth.

Esports

Focus on popularizing new content culture

Fully-operational dedicated department

Promoting market base expansion with a view to future profitability

About Esports

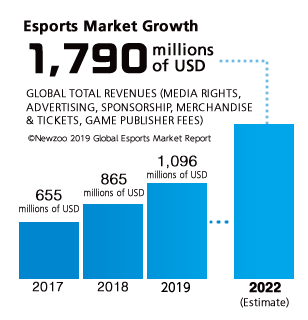

Esports stands for "electronic sports," which are video games played in competitions viewed as sporting events. They became popular in Europe and North America in the late 90’s and now enjoy popularity among young people in particular, with numerous and varied game events held throughout the world, including in Japan and Asia. They are also garnering attention as a new category in the game business.

2018 is known as the first year esports experienced widespread popularity in Japan, and it was the turning point in development. The Japan Esports Union (JeSU) was established as the supervisory sports organization, and social interest is growing with daily media reports of participation from companies in other industries and organizations intrigued by its business potential. We do not see esports as a passing fad, but rather as a new area of business in the game market. In other words, we are on the verge of seeing a new culture of content rise up, and I think it is important to cultivate it from a medium- to long-term perspective of five to ten years. To bring this idea to fruition, just as with soccer and other sports, Capcom is working to expand the market base by not only providing top professionals with a place to shine, but also by encouraging participation among young people and amateurs.

Measure

Aiming to establish a win-win ecosystem for players, viewers,and communities

There are three main points to the measures we will implement from this fiscal year through the next. (1) Further improved appeal with the creation of team-based Street Fighter leagues. (2) Thorough trend analysis to attract new player and audience participation. (3) Promotion of regional development through cooperation with companies and local governments in each locality.

Regarding the first item, in addition to conventional one-on-one battles, we feel that the same allure found in traditional sports can be rendered through the human drama seen in bonds formed among team members and in playing as a team. For the second item, thoroughly analyzing player and audience data from each event, grasping what appeals to which demographics and then compiling the critical measures will lead to an increase in the number of participants. In terms of the third item, we aim to contribute to spreading esports outside of major cities as well as to regional revitalization by creating professional team franchises in various regions from 2020.

Currently, we are strengthening the workforce of our dedicated esports department, which we established early in the fiscal year, and are taking proactive steps to implement the aforementioned measures. We believe that the adoption of esports at international sporting events will increase awareness and understanding of esports among the general public, which will not only increase the value of our IPs, but will also lead to the improved status of the game industry and greater societal contributions.