- Value Creation

Story(PDF) - CEO

Commitment - Growth

Strategies - Financial Strategy

- Latest

Creative Report - Message from an External Director

CEO Commitment

Kenzo Tsujimoto

Chairman and

Chief Executive Officer (CEO)

Generating world-class

content to help build

a richer society through

a solid management base and

our growth strategy.

A look at Capcom’s favorable and unique position

from six perspectives

The fiscal year ended March 2019 marked the second consecutive year we achieved record high profits. From the fiscal year ended March 2015, our medium-term management goal has been to increase operating income each year, and we have accomplished this for six consecutive years. These achievements lead me to believe that we are headed in the right direction with our strategy and the business model we are working towards.

Last year, I explained the elements that serve as the source of Capcom’ s sustained growth as 1a corporate philosophy and culture that fosters the ambitions and values set out at our founding, 2a business model that is a competitive advantage, 3important management indicators that function as quantitative guideposts, 4a management strategy focusing on our strengths, mitigating risks, and enhancing sustainability, 5a relationship with society, 6governance, and finally a linking of these elements.

Please continue reading as I explain to our stakeholders once again how these six elements allow us to demonstrate our favorable and unique position.

Corporate philosophy and culture —— Aim to be the best in the world

The world’s best content "from Osaka to the World,"

arising from our unchanging philosophy

I jumped into the world of entertainment 50 years ago with the idea that "games are luxury items, not essentials. This is why the brand must be of world-class quality." I still believe this to be true even today.

Accordingly, Capcom’s basic philosophy is to create an entertainment culture through the medium of games by developing highly creative content that excites and stimulates your senses and brings a smile to your face. In other words, we help make people happy and in turn build an emotionally rich society by creating the world’s most entertaining games.

CAPCOM IR [Corporate Information] Corporate Philosophy

In 1983, I founded Capcom under the motto of "originality and ingenuity," with the vision of developing games offering world-class quality.

Underpinning this was my belief that increasingly sophisticated graphics and more immersive worlds would eventually make games as moving and impressive for the world as a Disney film.

36 years later, I have amassed more than 2,800 colleagues who share this vision. Under the slogan "From Osaka to the World," these values have become our corporate culture, with (1) a spirit that is always eager to take on new challenges and (2) a sense of pride to constantly strive to be world-class deeply ingrained in every Capcom employee.

Again and again, we have been able to produce unique series that are globally recognized, including Street Fighter, Resident Evil and Monster Hunter, because of the fertile soil of a corporate culture cultivated over many years.

Business model —— Competitive advantage centered on global IP

High-quality content creation and the business development

to maximize its use

Capcom’s strengths are (1) the development and technological capabilities to create the world’s finest, high-quality games and (2) numerous popular branded IP known the world over.

In addition, since fiscal 2011, we have hired over 100 new graduate developers every year in anticipation of focusing on in-house development, increasing our development staff to over 2,100 people and further enhancing our strengths.

From game market characteristics and competitive factor analysis, the Consumer sub-segment has high entry barriers; combining the aforementioned strengths with our capital and the relationships of trust we have with hardware manufacturers creates significant competitive advantages (profitability). Against this backdrop, in the consumer market, technological standards and development costs rise with each hardware cycle, resulting in a situation where consumer spending and time is more concentrated on branded, popular titles.

[Financial Analysis] An Analysis of the Market and Capcom (PDF: 676KB)

Furthermore, in sub-segments other than Consumer, our rollout of popular IP across multiple mediums contributes as a stable source of earnings. This is because, in addition to the fact that our IP consists of products developed 100% in-house, possessing numerous global IPs amplifies the effect of our multiple usage strategy. Moreover, expansion into other areas leads to increased brand value and subsequently an influx of new users to the game. In particular, marketing activities utilizing Hollywood adaptations of content further enhances the global competitiveness (brand power) of our IPs and maximizes synergistic effects.

[The COO’s Discussion of Growth Strategies]

In recent years, as a result of these sustained branding measures, we are increasingly seeing multiple generations of fans at event venues as IPs enjoying long-term popularity have firmly taken hold.

Key performance indicators (KPI)

—— Focused on stable growth for 5–10 years into the future

Creating a framework using systematization and establishing a leaner structure by improving performance indicators

1. Analysis of management performance in the fiscal year ended March 2019 (summary)

In the fiscal year under review (ended March 2019), we achieved the sixth consecutive year of operating income growth, and all profit items from operating income downward reached record highs. What I want to point out here is that (1) Resident Evil 2 and Devil May Cry 5 were both indisputable successes, having been developed in-line with the highly stringent, world-class quality standards that drove the success of Monster Hunter: World, (2) following the home video game version, the PC version of Monster Hunter: World has also achieved success as a global brand, (3) catalog sales (past titles, including rereleases and HD versions) also grew, increasing the density of our earnings platform and (4) digital unit sales rose to 61%. All four of these items are part of our growth strategy and demonstrate our successful executions of these initiatives up to now.

[Financial Analysis] Financial Review (PDF: 436KB)

2. Medium-term management goal assumptions and indicators (KPI)

(1) Management direction —— Thinking about what to target in the next five years

I am always thinking about what our management targets should be in the next five years. In this way, I am even able to quickly notice small changes two years from now. And, at present, our management policies are to (1) create exciting, world-class content (IP), and (2) maximize both the number of users supporting our company and earnings by leveraging our rich library of IPs across multiple platforms and media to become a company of continuous, sustainable growth.

(2) Management goals —— Stable growth every year

We have established operating income growth each fiscal year as the goal for achieving the above. Rather than struggling to coordinate major title launch periods for this, we intend to take a natural approach of establishing a model of stable growth through build-up by expanding our title lineup, among other efforts. This will enable institutional investors managing pensions and individual investors on fixed incomes to maintain long-term holdings with confidence. As we are emphasizing annual growth, we have not announced a specific rate of increase, but we are considering a profit growth rate between 5–10%. It is true that achieving growth every year in a hit-driven business like the gaming industry is a lofty goal. However, with the digital shift of sales and marketing these past few years, our profit structure has also changed. We are in fact a leader in the change-over to digital, and the profit margin of our Digital Contents business is growing steadily.

(3) Key performance indicators (KPI) and shareholder value creation achievements

In terms of management, I place importance on operating income (growth indicator) as the basis of corporate earning power, operating margins (efficiency indicator), which are the basis of profitability, and cash flows.

The game industry is prone to drastic change; in terms of engaging in management that is always focused five years ahead, we use the above fundamental indicators, as well as a matrix that compares figures to net sales, year-over-year and to our forecast, to check for anomalies and quickly identify and address problems. This has led to a 66% increase in operating income and a 7.9-point improvement in operating margins over the past five years, placing Capcom at the top compared to other companies in our industry.

Operating income/Operating margin rate of improvement (Compared to the fiscal year ended march 2016)

| Operating income | Operating margins | |

|---|---|---|

| CAPCOM | +66% | +7.9 points |

| KONAMI HOLDINGS | +90% | +7.5 points |

| SQUARE ENIX HOLDINGS | -8% | -3.3 points |

| SEGA SAMMY HOLDINGS | +53% | -1.8 points |

| BANDAI NAMCO HOLDINGS | +41% | +1.1points |

Note: Comparison of the fiscal year ended March 2016

and the forecast for the fiscal year ending March 2020.

Source: Compiled by Capcom from each company’s financial reports and earnings materials.

Further, if we improve these performance indicators, ROE and other related indicators also increase, creating shareholder value. Specifically, in line with improved margins, ROE has improved for six years straight. And, in the fiscal year ending March 2020, the equity spread (ROE – cost of capital) is expected to be 10.5%, adding to corporate value and exceeding the average for companies listed on the Tokyo Stock Exchange (2.5%) as well as those in the same industry.

ROE/Equity spread

| ROE | Equity Spread | |

|---|---|---|

| CAPCOM | 15.8% | +10.5% |

| KONAMI HOLDINGS | 10.9% | +6.1% |

| SQUARE ENIX HOLDINGS | 8.3% | +4.1% |

| SEGA SAMMY HOLDINGS | 5.0% | -0.8% |

| BANDAI NAMCO HOLDINGS | 11.7% | +7.0% |

| TSE 1st Section Average | 8.4% | +2.5% |

Note: Forecast for the fiscal year ending March 2020

Source: Financial reports, Bloomberg

In addition, I think it is important to reward shareholders who trust our Company and hold Capcom shares over the medium- to long-term, and I have strived to deliver sustainable earnings growth and returns to shareholders. As a result, over the past five years capital gains and dividends, which constitute total shareholders return (TSR), are 22.5%, beating TOPIX (8.0%) and propelling Capcom to the top position compared to other companies in our industry.

Going forward, we will create a framework for management systematization with the aim of creating a leaner corporate structure by improving basic performance indicators.

[Financial Strategy According to the CFO]

Total shareholder return (TSR)

| Five-year period (annual rate) | |

|---|---|

| CAPCOM | +22.5% |

| KONAMI HOLDINGS | +16.7% |

| SQUARE ENIX HOLDINGS | +14.4% |

| SEGA SAMMY HOLDINGS | -8.4% |

| BANDAI NAMCO HOLDINGS | +19.4% |

| TOPIX | +8.0% |

Note: Five-year period from fiscal years ended March 2015to March 2019

Source: Bloomberg

Management strategy —— Development and marketing strategies focused on strengths

Further refining IPs with development structure and brand strategy and foraying into new areas

1. Investing in human resources and development equipment to create world-class games

"Without pursuing advancement, we cannot create world-class games." As a manager in the game industry for 50 years, I have always said, "World-class games are not just entertaining, they must also be technically advanced." The evolution of hardware and rising quality of market entrants are proof of this. Accordingly, we must amass human resources that are highly skilled in areas such as programming and the visual arts. We are already engaged in this effort.

I focused on future game market expansion and technological advances, and since 2011, Capcom has hired over 100 new graduate developers every year. Nearly all of them are "game natives" who have played games since they were very young and have witnessed the advances in games of the past 20 years. Moreover, they are overflowing with energy, and desire to use their skills to develop new markets, which is why they joined Capcom, whose DNA is rooted in a focus on global markets. If the employee is highly capable, they may be assigned to the development of major brands, such as Resident Evil or Devil May Cry in the early years of their career. Learning and achieving results under the tutelage of a leader while taking on more responsibility over time readies that employee to eventually take on a leadership role themselves in the future.

In addition, we are actively investing in the world’s most cutting-edge on-site R&D facilities and development equipment, such as our motion capture studio featuring 7-meter-high ceilings, our 3-D scan studio with roughly 100 cameras, and a Foley studio for recording sound effects so that our elite team of world-class creators can work to the absolute best of their abilities.

2. Marketing strategy for creating global brands

Another critical factor is our approach to marketing, focused on branding and increasing awareness of hit titles.

As it takes about three years to develop a game, we used to have issues with a progressive decline in recognition during development. I came up with the idea that the most effective method for ongoing media exposure of game titles was to expand globally using Hollywood movie adaptations. In 1994, we decided to invest 4 billion yen to make a Street Fighter Hollywood movie. At that time, some thought I had taken up movies merely as a hobby, but this investment generated a return of approximately 15 billion yen and successfully established Street Fighter as a global brand. Although games receive only about two weeks of media exposure before and after their release, factors that led to the success of this Hollywood movie include (1) the theatrical release, (2) Blu-Ray and DVD sales, (3) online and cable television broadcasts and (4) broadcasts at hotels and in airplanes. It has been rebroadcast numerous times over years and decades, which has led to maintaining and even increasing the recognition of this title.

A condition to taking this marketing approach is that the games are of world-class quality; Capcom has already succeeded in a similar way with the branding of Resident Evil. We will continue to utilize this branding approach with other Capcom IPs such as Monster Hunter and Mega Man.

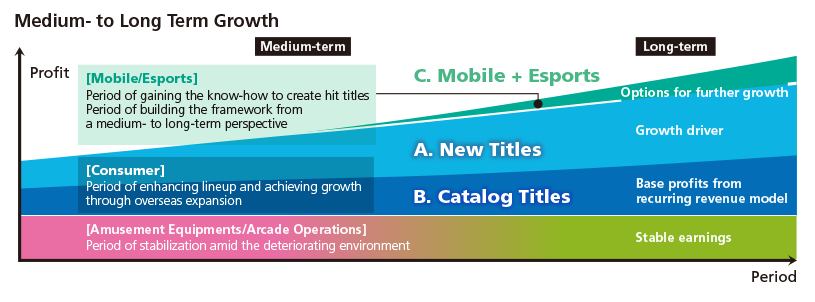

3. Transforming the consumer business model to mitigate earnings volatility risks

As the founder of Capcom, I think it is important to create a structure for passing the business on to the next generation. As with any structure, building the foundation is the most challenging part, but efforts launched six years ago are finally starting to take shape. To establish solid growth strategies and further enhance corporate value, there are two critical risks, earnings volatility and management decisions, that must be addressed. However, first I will talk about the stable growth mechanism (control of earnings volatility risks).

[CEO Commitment] 6. Governance (G)

——Management visualization mechanism creating the next generation

To mitigate earnings volatility risks over the medium- to long-term, measures enabling sustainable growth must include (1) transforming the foundation of our Consumer business model from a traditional one-time sale "transactional model" to a continuous "recurring revenue model" and (2) creating a business portfolio and diversifying earnings risks by thoroughly leveraging Capcom’s basic strategy, Single Content Multiple Usage.

Historically, earnings in Capcom’s core Consumer sub-segment fluctuated depending on whether or not we created hit titles. Although we achieved some success (controlled earnings volatility) through timing the releases of multiple hit titles in the past, it did not meet my objectives for stable growth.

However, since 2013, game consoles have been equipped with robust online functionality, enabling us to develop growth strategies around digital elements.

Specifically, new titles will work as medium- to long-term growth drivers as we (1) steadily release major titles each year, (2) extend the sales life of these titles to 3–4 years with additional content and flexible pricing strategies and (3) strengthen our presence overseas, which comprises approximately 85% of the total market.

Next, in terms of catalog titles, we will grow our user base and generate profits on a recurring revenue basis even during periods in-between new title releases through (1) digital sales of past titles and (2) re-releasing past hit titles for current-generation game consoles.

4.Building a new medium- to long-term revenue pillar

Currently, we are several paces behind our industry competitors in terms of mobile content. This stems from the compatibility between our IPs created for home video game consoles and mobile devices, but as G (communication speed) and K (resolution) technology progresses, we believe that within the next several years we will be able to fully utilize our strength in IPs in mobile content as well. In addition, we are pursuing all immediate possibilities, such as in-house production, collaborations, and M&A, building up a foundation for our mobile business as a further growth option (second pillar).

In addition, with a focus on the future growth of the esports market, we will strengthen title branding and attempt to make the esports business profitable.

In the game industry, which is often called the "hit-driven business," Capcom will establish a management structure and strategy able to achieve sustainable growth other companies have yet to achieve while enhancing corporate value.

Relationship with Society (S) —— Global human resources and new market cultivation

Building a good relationship with our stakeholders,contributing to society through business

From our position as a game publisher, we believe that we can increase our corporate value by building a healthy relationship with our stakeholders while also—through our business activities—nurturing talent that can play an active role on the global stage, as well as by creating new markets with cutting-edge technology that can in turn be combined to create social and economic value (creating common value).

1. Building a healthy relationship between games and society

While games have made people smile, stimulated their senses, and created a new culture up to this point, new challenges have also appeared, such as the expensive in-game purchases by minors and game addiction that have accompanied the increase of online games in recent years. As I mentioned in my explanation of our corporate philosophy, our purpose is to make people happy through games. Making people unhappy because of games is certainly not our intention. If we do not tackle these issues head on, as an industry, company, and member of society, we will not be able to earn people’s trust and continue growing.

[CEO Commitment] 1. Corporate philosophy and culture —— Aim to be the best in the world

We are aware that these are major issues for our industry as a whole, and each company has therefore come together as part of an industry organization to make efforts to (1) establish guidelines and educate people about them, (2) share problems and actual examples among member companies, and (3) exchange information on a regular basis with parents, educators, consumer groups, and government administrators.

In addition, since 2005 Capcom has independently continued literacy and career education support activities to raise awareness about how to properly interact with games in an effort to eliminate the social concern regarding the healthy development of youth with regards to games.

We do our best to ensure that a broad range of customers are able to play safely and fairly. As a general rule, in our mobile games we refrain from utilizing gacha elements, and while we do sell small-scale, inexpensive additional content in games for home consoles, any content that is required to play the main game is provided free of charge.

2. Commitment to regional communities

The promotion of our Single Content Multiple Usage strategy provides society with a wide range of benefits. Specifically, these include the use of popular Capcom IP in local revitalization activities to support (1) economic development, (2) cultural development, (3) awareness for crime prevention and (4) awareness of elections. We are achieving quantitative social outcomes through solving the common problem of attracting and appealing to the youth demographic.

At the same time, these four activities deliver value to Capcom in the form of (1) improving existing customer satisfaction through event participation and (2) enhancing the image of games among the middle- aged and seniors. With respect to (2) in particular, this segment cannot be considered current customers, thus by contributing popular content to local communities, we are able to cultivate new game players through apps and games on their personal smartphones and devices.

3. Commitment to employees

As can be seen from the fact that personnel expenses (costs) account for approximately 80% of development expenses, the game industry is a labor-intensive industry and an extraordinarily knowledge-intensive industry, thus human resources are an extremely important management resource.

I recognize the importance of diversity for creating content that will resonate globally, thus Capcom promotes the retention and training of talented human resources without regard for gender or race. As I mentioned earlier, we have world-leading, cutting-edge development equipment enabling our talented workforce to fully demonstrate their abilities. As part of our efforts to improve the work environment, we have provided equipment that allows creators to give shape to their ideas, which improves product quality while also bolstering creativity. In terms of remuneration, in addition to a well-balanced salary system based on ability, we have also introduced incentives for each title and an assignment allowance system to increase motivation.

Furthermore, in fiscal 2017 we established Capcom Juku, an on-site childcare facility, to provide employees with children a fulfilling work environment where they can concentrate on their work. I would like to make Capcom Juku something beyond a simple childcare facility and see it expand into a place of learning for children all the way up through their junior high school entrance exams. Japan is feeling pressure from countries like the United States and China in the areas of AI and IT, thus I want to provide our children with the tools to succeed when it is their turn to compete on the world stage. I believe that supporting our children up to their entrance into junior high school and nurturing Capcom employees into world-class businesspeople and game creators will contribute to the sustainable growth of our company as well as the industry.

In my view, the most critical aspect of human resource development is providing an environment that enables employees to take on new challenges. The manager’s role is to push employees to take on one new challenge after another, leaving alone what works and devoting their energy to devising measures when things are not working. This enables employees to take on challenges without fear of failure, develop the world’s most entertaining games and create new businesses leading to a virtuous cycle that creates business opportunities.

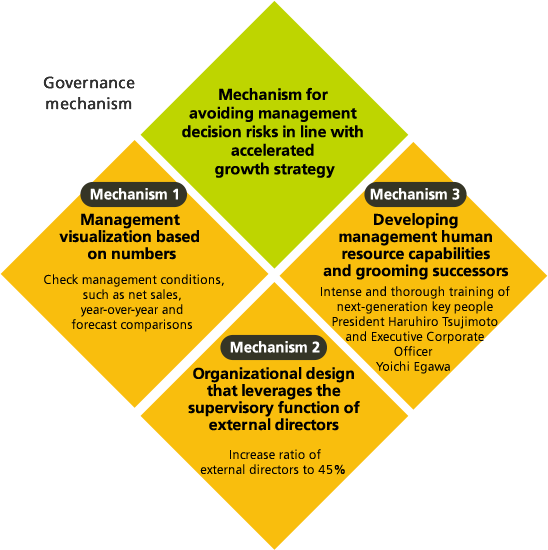

Governance (G) —— Management visualization mechanism creating the next generation

Avoiding management decision risks with transparency and the development of the next generation of leaders

As Capcom further accelerates its growth strategies, the risks become proportionally higher, but I believe that governance is effective at reducing and avoiding these risks.

Specifically, with myself, Capcom’s founder, as CEO and my oldest son as COO, we can avoid management decision risks by sufficiently leveraging the supervisory function of the external directors, and a unique mechanism for highly transparent and rational decision making built by the Board of Directors.

Mechanism 1

Management visualization based on numbers

Despite changes in corporate scale or business environment, to conduct flexible and integrated management, I require that materials (documents) used for decision-making are, in principle, quantitatively focused. Specifically, these materials compare and contrast net sales, year-on-year performance and earnings forecasts, which make it easier to identify problems by enabling us to confirm the details in multiple ways.

Furthermore, these materials are used by external directors for supervisory purposes and provided to investors as part of our IR activities. This is part of the mechanism I call "management visualization." Management decisions based on visualizing operations enable us to evaluate the Company with two sets of eyes using a system attempting to achieve management transparency.

Even when I talk with developers, numbers are the common language. Using only qualitative words and sentences leaves significant room for arbitrariness on the part of the person in charge. In comparison, numbers enable comparisons from a variety of angles, facilitating decisions based on real conditions.

The risk control efforts I am focused on now involve passing on the management know-how I have accumulated as founder to the next generation of management through actual practice and ensuring the Company functions reliably in the future by systematizing management. Both of these efforts are beginning to bear fruit.

Mechanism 2

Organizational design that leverages the supervisory function of external directors

For the past 20 years, Capcom has executed a variety of governance reforms.

Since introducing the external director system in the fiscal year ended March 31, 2002, external directors have increased to account for 45.5% of the Board of Directors. This stemmed from one particular investor’s concern that "as a founder-run company, Capcom can quickly make management decisions and respond to changes in the business environment, but isn’t there a risk of arbitrary decisions and execution?"

External director appointment criteria have not changed since the system was introduced, but in short, we appoint directors with insight who are highly proficient specialists in their respective areas outside the gaming industry, capable of objectively making decisions regarding Capcom’s management and business activities. With the avoidance of business investment risk as a priority issue, Capcom appoints individuals from Japan’s leadership class (in terms of business crisis management, law and government) who are able to provide sound opinions, especially when earnings are subpar, who are not intimidated by the company founder and are able to determine validity from the general public’s point of view. In fact, fierce debates led primarily by our external directors were held regarding agenda items such as the fiscal 2015 reintroduction of takeover defense measures (currently abolished) and fiscal 2016 transitioning to a company with an audit and supervisory committee.

Mechanism 3

Developing management human resource capabilities and grooming successors

Within corporate management, people’s character and spirit are important management resources that have a substantial impact on corporate value. In the 2016 integrated report, I discussed my management philosophy and capabilities as founder. At present, one of the concerns among our investors is the thinness of our management team as a founder-run company; in other words, have we prepared a management structure (successor plan) for the next generation?

Capcom’s key people for the next generation are the head of business and development, Haruhiro Tsujimoto (president) and Yoichi Egawa (executive corporate officer). Both have the qualities required for management. I chose them as keypersons because, as I have discussed in past reports, they have amassed a wealth of experience since our founding and are ready and willing to take on the responsibility. As a member of Capcom’s founding family, from the time it was a small company akin to a neighborhood business, Haruihiro Tsuijmoto has assisted with a sense of responsibility and awareness of the family business. Later, he adopted the motto "diligence and earnestness" as he labored with modesty to launch the arcade operations business and develop our strategy of multiple usage for leveraging content. Yoichi Egawa joined the company soon after it was founded, and since then he has displayed a determination to stay and fight even in the most difficult situations, taking on a leadership role in the development of arcade games and the establishment of both the pachislo and mobile businesses, all the while delivering results. However, due to Capcom’s significant growth over the last 36 years, management responsibilities are also larger and carry more weight. My role as founder is to create a framework that will sustain the company and ensure that my successors have a proper understanding of that framework and can execute within it. However, if I were to simply pass the reins and walk away, management would be unsustainable in this era of rapid change. For as long as I am physically able, I feel it is my duty to remain by the side of our keypersons and guide them, both in the board room as well as in life, by spending time together on a personal level to exchange information and offer advice.

In addition to my intense and thorough training of these two different types of people, it is my intention to combine that with the corporate culture we have cultivated over many years, the aforementioned management visualization and systematization, and just governance. I believe this will result in a profound management team that our long-term investors will trust as managers implicitly.

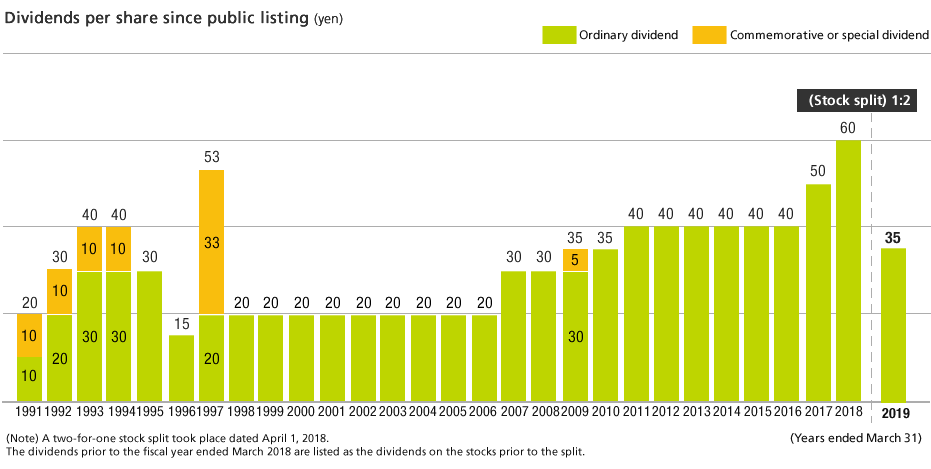

Rewarding long-term shareholders with 29 consecutive years of returns since Capcom’s listing and record-high dividends

1. Basic policy regarding dividends

During my 36 years of management since founding Capcom, my philosophy has been to pursue stable corporate growth and reward long-term shareholders with steady increases in dividend payments despite the constantly changing nature of the game industry.

I have already mentioned the factors critical for sustainably enhancing corporate value; as shareholder returns are also an important management issue, dividends are determined with consideration for future business development and changes in the management environment.

Capcom’s basic shareholder return policy aims to (1) enhance corporate value through investment in growth, (2) continue paying dividends (30% payout ratio) while striving for stable dividends and (3) acquire treasury stock to increase the value of earnings per share.

The reason I think both the payout ratio and stable dividends are important is, for example, because a sudden decrease or cessation of dividends can be the difference between life and death for pensioners who depend on dividends to cover part of their lifestyle expenses. Regular and stable revenue enables the reliable establishment of future lifestyle plans. We also receive requests for stability from the long-term investors who manage those pensions.

Capcom shareholders represent all types of people, and I assume some of them may be facing these kinds of issues, which is why we have never once failed to provide dividends during the 29 years since we went public in 1990. In addition, the fiscal year ended March 2019 was the third consecutive year we achieved increased dividends, and considering the stock split, our dividends have actually doubled over the past 10 years.

2. Dividends for this fiscal year and the next

Dividends for the fiscal year ended March 2019 were 35 yen for the year, which is actually the highest ever taking the stock split into consideration. In the next fiscal year, we plan to pay the same amount of dividends.

As a senior manager with 50 years of experience in this industry, my goal is to increase market capitalization and achieve corporate growth exceeding that of the past 36 years in order to continue meeting the expectations of all Capcom shareholders.

Kenzo Tsujimoto

Chairman and Chief Executive Officer (CEO)