- Value

Creation

Story(PDF) - CEO

Commitment - COO Growth

strategy - CHO

COMMITMENT - CFO

COMMITMENT - Development

- Corporate

Governance

Addressing the challenges presentedby sustainable growth based on analysis of 10 consecutive years of operating income growth

Kenkichi Nomura

Director,

Executive Corporate Officer and Chief Financial Officer (CFO)

Addressing the challenges presentedby sustainable growth based on analysis of 10 consecutive years of operating income growth

Kenkichi Nomura

Director,

Executive Corporate Officer and Chief Financial Officer (CFO)

-

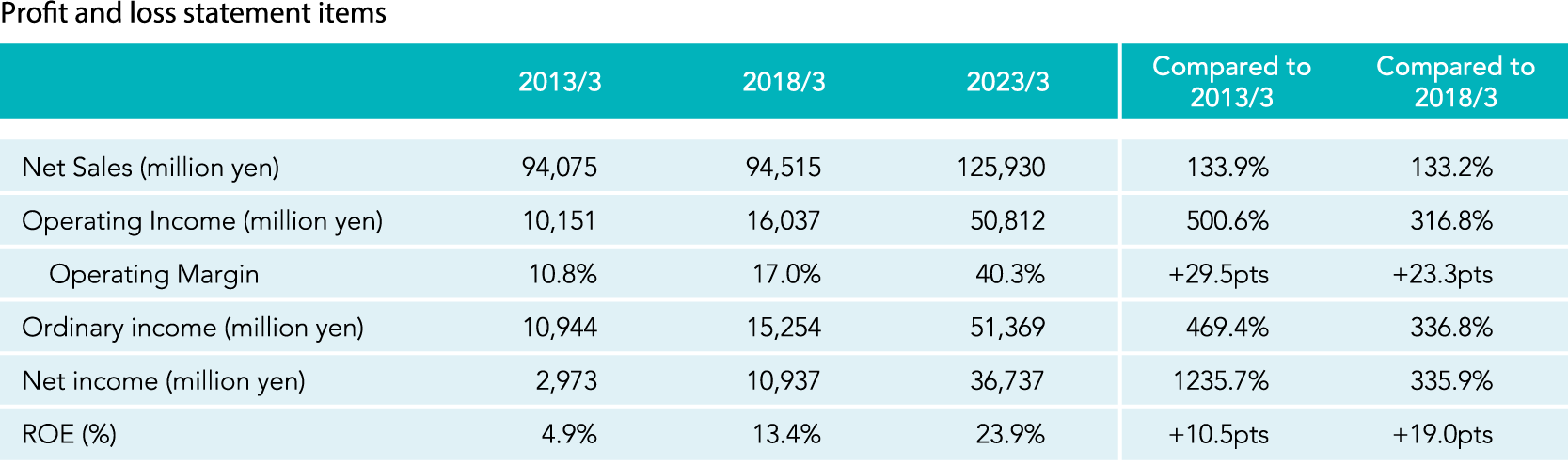

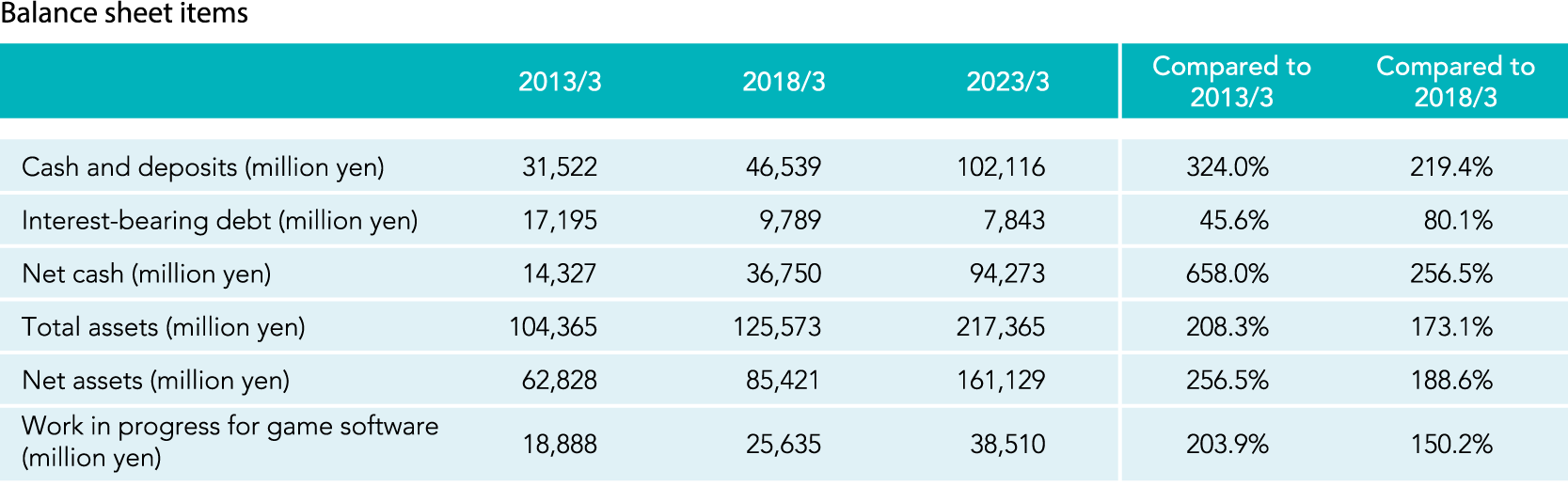

Thanks to the understanding and support of our users and stakeholders, we were able to achieve operating income growth for the 10th consecutive year in fiscal 2022. As a result, our financial position has also changed significantly. A summary of is below. The table provides a better understanding of these changes.

-

Changes in Capcom’s financial position over the previous 10 years

Changing our financial position through business model transformation

As the CEO and COO have stated, Capcom has pivoted to digital sales, driving operating income, which has been our primary KPI, to increase 5 times compared to 10 years ago, and 3.2 times compared to five years ago. In addition, ROE for the most recent fiscal year was 23.9%, exceeding 20% for three consecutive years.

The main reasons for this were: (1) a significant increase in annual unit sales due to the expansion of sales territory; (2) significant growth in sales of content released in previous years; (3) a decrease in expense items (cost of sales + selling, general, and administrative expenses) beyond net sales growth; and (4) amusement arcades and amusement machines, along with their businesses, overcame their respective challenges and entered a phase of stable growth.

Digital download sales have eliminated the constraints of retail locations and the period titles are available on shelves, enabling long-term sales of content. As a result, in fiscal 2022, the number of products sold including past games was 307 titles, with catalog titles topping 29.3 million units sold and marking a 7.5-fold increase from 10 years ago.

Although there are fluctuations in the level of unit sales for new titles in the first year of sales due to the accumulated history of each IP, we have developed a structure such that titles can contribute significantly to profits through ongoing sales in years thereafter. Since the production cost for our content is recouped in approximately one to two years after launch, the profit margin of subsequent sales increases significantly. Expansion of catalog sales has contributed significantly to our earnings growth, as seen in fiscal 2022 where the profit margin for catalog titles exceeded 90%.

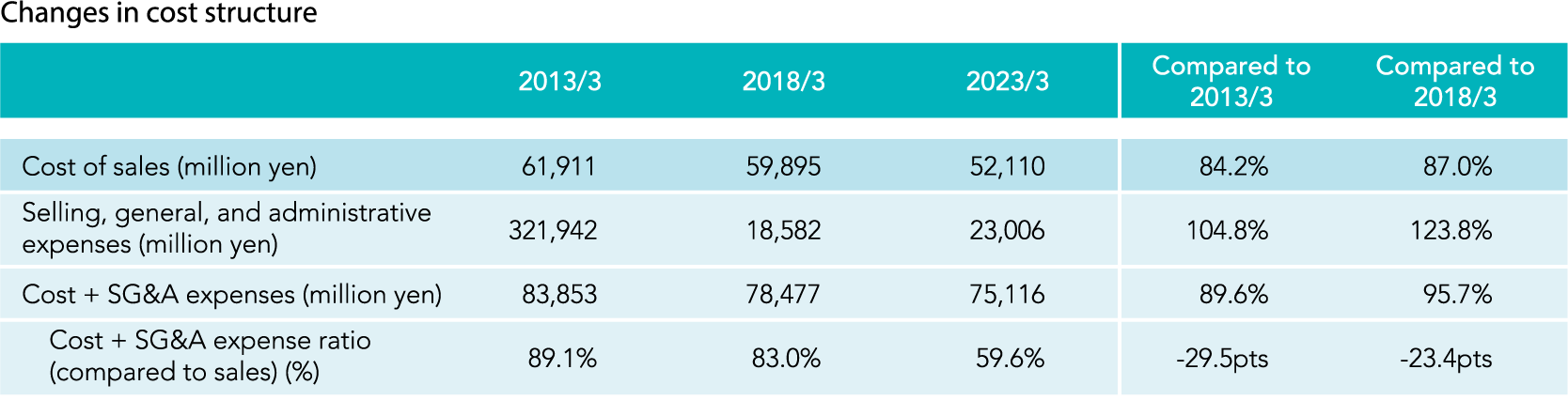

At the same time, major changes are taking place in terms of cost. Increased download sales have reduced manufacturing and sales costs. The cost of sales includes the cost of manufacturing packaging, the cost of selling in retail stores, and the cost of sales promotions, and this overhead was significantly reduced through download sales. At the same time, selling, general, and administrative expenses (expenses) have increased compared to five or ten years ago due to a 5.0 billion yen increase in remuneration following revisions made to the remuneration system in fiscal 2022, but as the CHO stated, this represents an investment in our future. Excluding the increase in personnel costs, expenses were close to 20 billion yen, and together with the cost of selling the combined ratio of costs + SG&A expenses improved to less than 60%.

Changes in cash flow

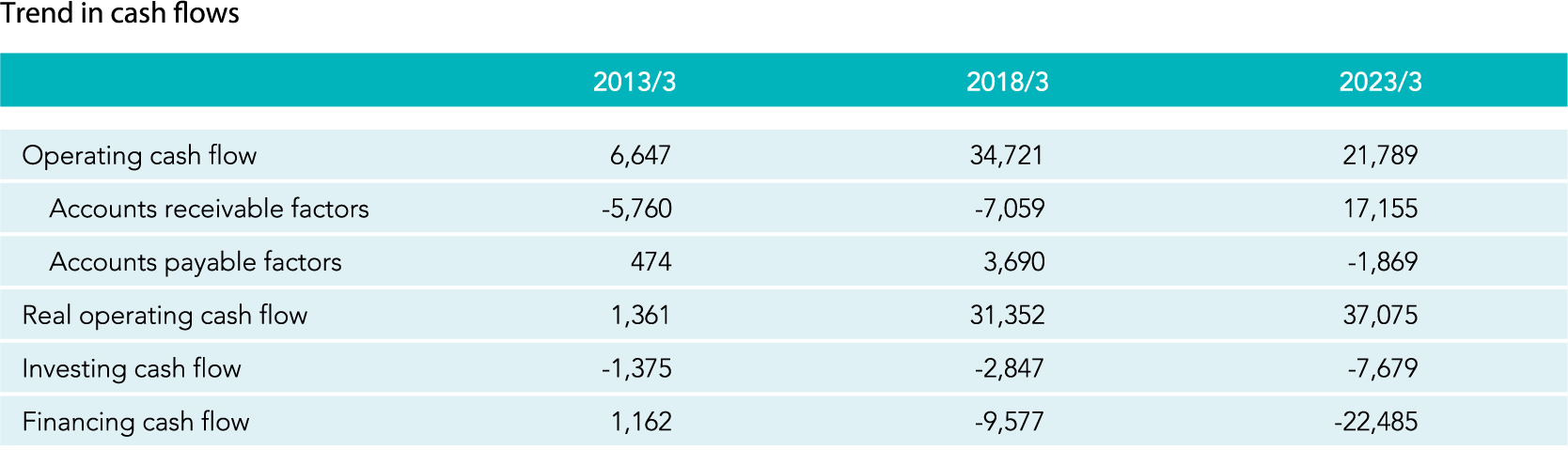

In last year’s integrated report, I discussed how we are closely monitoring cash flows excluding the impact of working capital. Compared to five or ten years ago, real operating cash flow has been steadily increasing. When selling game software digitally there is no need to assign employees to all areas of the world; we have just four primary bases of operations (in North America, Europe, and Asia) from which we are working to expand sales in each area by understanding the trends in the geographic regions they cover and analyzing the characteristics of each. Through these efforts, we will continue to strive to grow cash flow by strengthening our earnings power and appropriately managing spending.

Note: The deterioration in cash flow from financing activities in fiscal 2022 was due to share buybacks (13,645 million yen).

Issues presented by sustainable, consistent growth

Investment in consistent growth

Over the past decade, we have achieved our management goals by transforming our business model as described above. Looking ahead to the next decade, we are using growth simulations to identify and solve issues to achieve these goals on a rolling basis.

Producing appealing content to acquire new users

In order to achieve sustainable growth in the future, it will be important to acquire new users in each area based on our policy to expand sales countries and regions around the world. Toward that end, we believe that our challenge is to refine new titles and convey the appeal of our content, including catalog titles, to game users around the world. In order to create the world’s most advanced and appealing content, it is essential to first invest in securing and developing human resources, production, and improving productivity throughout the company.

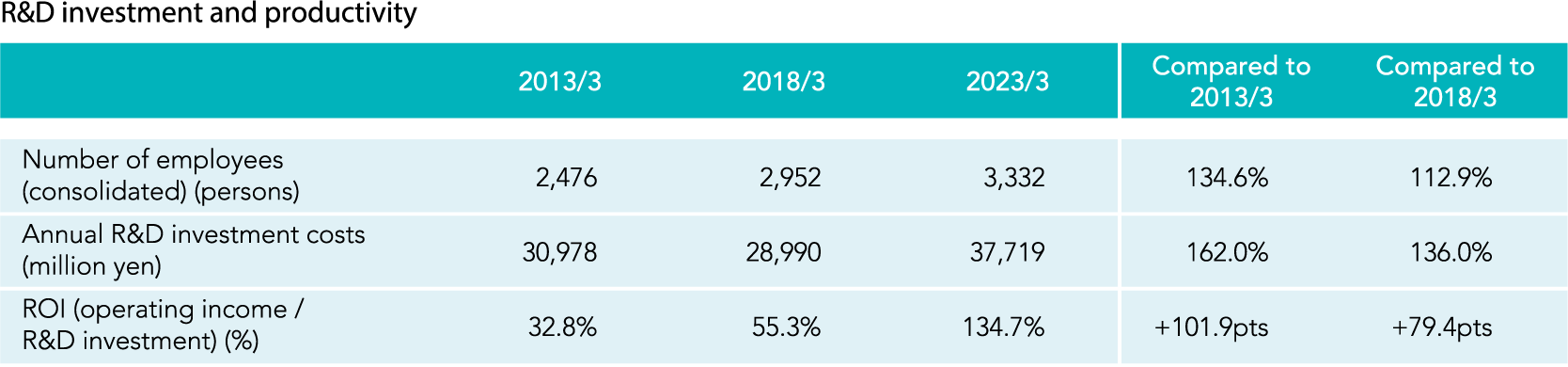

We use the amount of development investment relative to operating income as ROI to measure improvements in productivity. While our ROI over the past 10 years has been steadily improving, we believe that the key to sustainable growth going forward is to invest in our people, increase development spending in response to the heightened performance of increasingly sophisticated devices, and create a system to better understand user trends. We will continue to increase the number of employees by 100 to 150 every year and boost investment to further develop them. Development investment will exceed 40 billion yen from this fiscal year onward, a level we expect to increase going forward.

As of the end of March 2023, we have 2,460 employees in development who are engaged in creating content, including production; this is carried out in the area around our head office, including two company-owned buildings, with some done at our and Tokyo branch. However, we are already in need of more space, so last fiscal year we acquired the land next to the north side of the head office and plan to begin construction of an R&D building. In addition to these investments, we have a slate of other investment projects to consider, such as: investment in the development of systems and networks to accurately grasp the trends of game users in anticipation of future changes in the business environment; M&A investment to support the scaling up of our initiatives; investment in movies and other visual media to bolster awareness of our brands and expand our global user base; and ongoing investment to further strengthen security.

We will strive to manage cash while maintaining sustainable growth through a cycle of planned and continuous investment funded by increased cash flow, which will lead to higher profits.

Shareholder returns

Finally, I would like to talk about returning profits to shareholders. As shown in the table on the page to the right, Capcom’s stock price has risen in step with the increase in our net income. We aim to achieve growth that meets the expectations of shareholders and investors. Our stock price represents an evaluation of the company by investors in the market, and we will continue to make efforts to meet expectations through dialogue.