- May 13, 2022

- Press Release

- Company Name: Capcom Co., Ltd.

Representative: Haruhiro Tsujimoto, President and COO

(Code No. 9697 TSE Prime)

Contact: Shin Kurosawa, Senior Manager of

Public Relations and Investor Relations Section

Phone Number: +81-6-6920-3623

Notice Regarding Establishment of Stock Grant ESOP Trust

The Board of Directors of Capcom Co., Ltd. (the Company, below) today approved the establishment of a Stock Grant ESOP trust as an employee incentive plan (the Plan, below) for its permanent employees (excludes employees not living in Japan; eligible employees, below). Details are as follows.

1. Regarding establishment of the Plan

-

1) Following its philosophy of being a Creator of Entertainment Culture that Stimulates Your Senses, the Company has stated in its Corporate Governance Guidelines, dated December 16, 2021, that “In order to realize steady growth over the mid- to long-term, and pursue the enhancement of corporate value, the Company formulates the ‘Capcom Corporate Governance Guidelines’ as basic guidelines on corporate governance, and works to enhance its corporate governance system in a sustained manner.” In order to tangibly foster its relationship with employees as laid out in these guidelines, on March 31, 2022, the Company announced that it would promote strategic investment in personnel to bolster sustainable corporate value, and as of April 1 it streamlined its human resources operations and established the position of Chief Human Resources Officer, in addition to carrying out an average base salary increase of 30% for permanent employees in Japan.

The Company will establish the Plan in order to promote this strategy, with the aim of even further inspiring and incentivizing employees to contribute to bolstering business performance.

-

2) Under the Plan, the Company will establish a Stock Grant ESOP (Employee Stock Ownership Plan) trust (the ESOP Trust, below). The ESOP Trust is an employee incentive plan similar to ESOP plans in the U.S. and will grant the Company’s stock that has been acquired by the ESOP Trust to eligible employees who have satisfied certain requirements, based on predetermined stock transfer rules.

Further, the Company will provide all funds for acquisition of the aforementioned stock by the ESOP Trust, so none of the cost will fall upon the eligible employees.

-

3) The Company anticipates that by establishing the ESOP Trust eligible employees will be able to reap the economic benefits of increases in the value of the Company’s stock, resulting in increased workplace motivation while at the same time enhancing work performance for those employees who will take an interest in the Company’s share price.

Further, voting rights for the Company’s stock held in the ESOP Trust will be exercised within a structure that reflects the will of eligible employees who are candidate beneficiaries, and is an effective way to improve corporate value by promoting participation in management planning.

*Accompanying the establishment of the Plan, the Company has at the same time decided to dispose of 4,000,000 shares (13,820 million yen) of the 57,393,792 shares of treasury stock currently held by the Company (as of March 31, 2022) to the ESOP Trust. For details, please see the separate announcement made today, “Notice Regarding Disposal of Treasury Stock through a Third-Party Allotment and a Change in Principal Shareholder.”

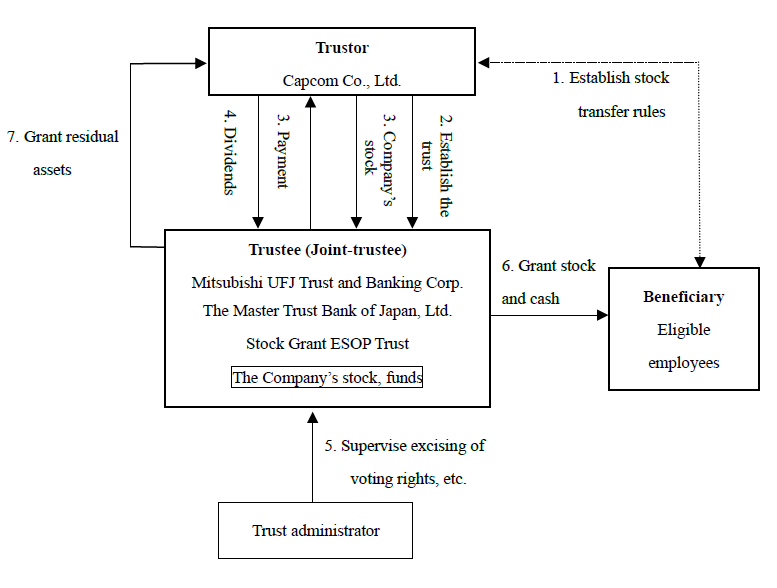

2. Structure of the Plan

- The Company will establish stock transfer rules at the time the Plan is established.

- The Company will entrust the trustee with funds and establish the ESOP Trust for eligible employees who satisfy the requirements to be beneficiaries.

- Under the supervision of the trust administrator, the ESOP Trust will use the funds provided in 2. as capital to acquire the estimated number of shares to be awarded to beneficiaries during the trust period from the Company (disposal of treasury stock).

- Dividends on the shares of the Company under the ESOP Trust will be paid in the same manner as those on other shares of the Company.

- Regarding the shares of the Company under the ESOP Trust, throughout the trust period the trust administrator will supervise the exercising of rights as a shareholder, such as with the right to shareholder voting, and the ESOP Trust will accordingly exercise those rights as a shareholder.

- In accordance with the stock transfer rules, the Company’s shares will be granted and payment for conversion of shares into cash will be provided to eligible employees who satisfy certain requirements.

- Upon the termination of the ESOP Trust, residual assets remaining after distribution to beneficiaries will belong to the Company within the range of the reserve for trust expenses derived by deducting the funds for purchasing shares from the trust money.

(Note) Additional funds may be entrusted to the ESOP Trust should the possibility arise that the number of shares under the ESOP Trust are insufficient to cover the accumulated points provided to eligible employees, or in cases such as if funds in the trust property are insufficient to pay for trust compensation or trust fees.

Reference

Details of the Trust Agreement

| (1) Type of trust: | Monetary trust other than a specified solely administered monetary trust (Third Party Beneficiary Trust) |

| (2) Purpose of trust: | Provide incentive to eligible employees |

| (3) Trustor: | The Company |

| (4) Trustee: | Mitsubishi UFJ Trust and Banking Corporation (Joint-trustee: The Master Trust Bank of Japan, Ltd.) |

| (5) Beneficiaries: | Eligible employees who satisfy beneficiary requirements |

| (6) Trust administrator: | A third party with no interest in the Company |

| (7) Trust agreement date: | June 14, 2022 (planned) |

| (8) Trust period: | June 14, 2022 – June 30, 2032 (planned) |

| (9) Commencement of the Plan: | June 14, 2022 (planned) |

| (10) Exercise of voting rights: | The trustee uses the voting rights of the Company’s stocks under the supervision of the trust administrator who reflects the voting rights exercised by the candidate beneficiaries. |

| (11) Class of shares to be acquired: | The Company’s common stock |

| (12) Value of stock to be acquired: | 13,820 million yen |

| (13) Method of share acquisition: | Acquisition of the Company’s treasury stock through a third-party allotment |

-

Notice Regarding Disposal of Treasury Stock through a Third-Party Allotment and a Change in Principal Shareholder

-

Private: (公開終了)Governance

-

Capcom Promotes Strategic Investment in Personnel to Bolster Sustainable Corporate Value

– Reorganizes Human Resources operations and establishes Chief Human Resources Officer, will carry out average base salary increase of 30% –