Stock Quote

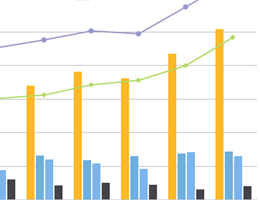

Shareholder Return

These tables and graphs present information about shareholder returns such as dividends, acquisition of own shares over the past years. This page also contains information about the Capcom shareholder benefits program.

1. Dividend Policy

One of our management priorities is to share profits with all our shareholders. Our basic policy is to aim for a payout ratio of 30% while taking into account our business development and changes in the future business strategies, and going forward we will strive to provide stable and continuous dividends.

In terms of our shareholder return policy,

- (1) Capcom will enhance its corporate value through investment and growth;

- (2) the Company will aim for payout ratio of 30%, and going forward strive to provide stable and continuous dividends.

- (3) we will raise earnings per share through share buybacks.

Our surplus dividend is basically paid twice a year, that is, at the end of mid-term and fiscal year. Dividend payment amount is decided by a competent corporate body, which is the board of directors for the mid-term, and during the shareholders meeting for the fiscal year.

2. Shareholder Benefits

Capcom does not currently offer shareholder benefits.

Our basic principle is to share our profits with our shareholders via dividends.

Also, for the sake of the majority overseas shareholders who are more likely to be unable to enjoy the benefits of a shareholders’ hospitality program, we do not have plans to implement such a program yet in order to be fair to all of our shareholders.

3. This Year’s Dividends

Cash dividends per share of the fisncal year ending March 31, 2026 is below:

(Yen)

| 2026/3 ( Forecast ) | Dividends |

|---|---|

| 1st Quarter-end | – |

| 2nd Quarter-end | 20.00 |

| 3rd Quarter-end | – |

| Year-end | 20.00 |

| Annual | 40.00 |

4. Dividends and Payout Ratio

| Dividends (Yen) | Payout Ratio (%) | |

|---|---|---|

| 2026/3 ( Forecast ) | 40.00 | 32.8 |

| 2025/3 | 40.00 | 34.5 |

| 2024/3 | 70.00 | 33.7 |

| 2023/3 | 63.00 | 36.1 |

| 2022/3 | 46.00 | 30.2 |

| 2021/3 | 71.00 | 30.4 |

| 2020/3 | 45.00 | 30.1 |

| 2019/3 | 35.00 | 30.3 |

| 2018/3 | 60.00 | 30.0 |

| 2017/3 | 50.00 | 31.2 |

| 2016/3 | 40.00 | 29.0 |

| 2015/3 | 40.00 | 34.0 |

-

- * Effective April 1, 2018, Capcom implemented a stock split of two shares for every share.

- * With an effective date of April 1, 2021, Capcom performed a 2-for-1 split of its common stock. For dividends for the year ended March 31, 2021, the above dividends paid were the actual amounts before the stock split.

- * Breakdown of the year-end dividend for the fiscal year ended March 31, 2023: ordinary dividend: 30 yen, 40th anniversary commemorative dividend: 10 yen

- * Regarding the year-end dividend for the fiscal year ended March 31, 2025, please refer to the April 24, 2025 announcement "Capcom Announces Revision of Full-Year Consolidated Earnings Forecast, Variances Between its Non-Consolidated Estimated Earnings and the Previous Fiscal Year’s Actual Results, and a Dividend Forecast Revision (Upward)".

- * With an effective date of April 1, 2024, the Company performed a 2-for-1 split of its common stock.

For dividends for the year ended March 31, 2024, the above dividends paid were the actual amounts before the stock split.

For dividends for the year ended March 31, 2025 and the year ending March 31, 2026 (forecast), the Company took the stock split into consideration.

5. Share Repurchases

| Repurchase period | Repurchase method | Type of shares | Number of shares | Total cost |

|---|---|---|---|---|

| Oct. 1, 2002 through Oct. 31, 2002 |

Purchase at Tokyo Stock Exchange | Common stock | 550,000 shares | 1,363,994,000 yen |

| Nov. 21, 2002 through Dec. 27, 2002 |

Purchase at Tokyo Stock Exchange | Common stock | 430,000 shares | 933,085,900 yen |

| Jan. 23, 2003 through Feb. 25, 2003 |

Purchase at Tokyo Stock Exchange | Common stock | 520,000 shares | 758,690,900 yen |

| Jun. 10, 2004 through Jun. 17, 2004 |

Purchase at Tokyo Stock Exchange | Common stock | 444,400 shares | 534,159,400 yen |

| Nov. 22, 2004 through Dec. 24, 2004 |

Purchase at Tokyo Stock Exchange | Common stock | 1,500,000 shares | 1,474,044,300 yen |

| May 24, 2006 through Jun. 8, 2006 |

Purchase at Tokyo Stock Exchange | Common stock | 1,000,000 shares | 1,231,894,900 yen |

| Jun. 27, 2006 through Jul. 21, 2006 |

Purchase at Tokyo Stock Exchange | Common stock | 1,500,000 shares | 2,005,986,000 yen |

| Aug. 1, 2009 through Aug. 31, 2009 |

Purchase at Tokyo Stock Exchange | Common stock | 1,471,900 shares | 2,703,220,800 yen |

| Jan. 4, 2010 through Jan. 29, 2010 |

Purchase at Tokyo Stock Exchange | Common stock | 1,502,700 shares | 2,420,722,500 yen |

| Jun. 9, 2011 through Jul. 20, 2011 |

Purchase at Tokyo Stock Exchange | Common stock | 1,500,000 shares | 2,701,644,300 yen |

| Apr. 22, 2013 through May 31, 2013 |

Purchase at Tokyo Stock Exchange | Common stock | 1,347,200 shares | 2,281,065,100 yen |

| Aug. 26, 2016 through Sep. 5, 2016 |

Purchase at Tokyo Stock Exchange | Common stock | 1,480,600 shares | 3,299,875,500 yen |

| Oct. 30, 2018 through Nov. 27, 2018 |

Tender Offer | Common stock | 2,737,100 shares | 5,999,723,200 yen |

| May 16, 2022 through Jun. 13, 2022 |

Tender Offer | Common stock | 4,387,353 shares | 13,644,667,830 yen |

-

-

November 17, 2025Cash Dividend Disbursement (Plan)

-

October 29, 20252Q FY2025 Financial Results Announcement

-

October 16, 2025-October 28, 2025Quiet Period

-

Integrated Report

Integrated Report-

IR Materials Download

-

IR Social Accounts

-

Top 5 Recommended Pages

(as end of Sep. 30, 2025)