Business Segments

-

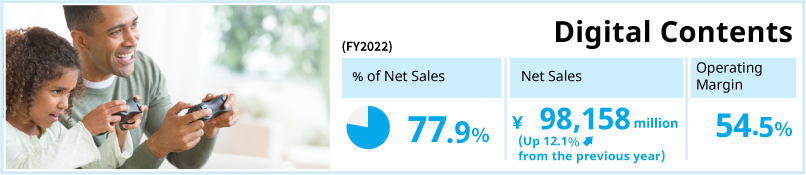

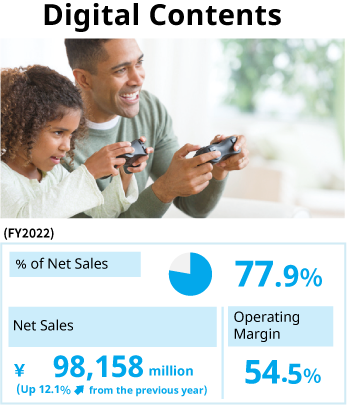

This business develops and sells digital game content for consumer home video game and PC platforms. It also develops, manages, and licenses its IP out for Mobile Contents. Using our world-class development environment, we deliver high-quality content digitally to more than 220 countries and regions, resulting in long-term and continuous sales that underpin our robust profitability.

FY2024 Financial Results

-

Net Sales/Operating Margins

-

Assets

Strengths

- World-class development and technological capabilities

- Own many original popular titles (IP)

- Expanding markets via increased global reach

- RE ENGINE, our proprietary engine that supports the ongoing evolution of development processes and efficiency improvements.

Non-Financial Capital

Human Capital

- Workforce of about 2,800 in-house developers, one of the largest in the country

- Utilization of in-house department specializing in marketing and data analysis

Intellectual Capital

- Own many original popular titles (IP)

- Global sales database

- Patents for games

- User trust in the Capcom brand

Production Capital

- Global penetration of digital storefronts on game consoles, smartphones, and PCs

Social Capital

- Partnerships with developers in Japan and other countries

- Partnerships with mobile online game companies

Topics in FY2024

-

Monster Hunter Wilds

-

Kunitsu-Gami: Path of the Goddess

Outlook (Business Divisional Strategies and Projections)-

Earnings Supplement (FY25/3 Results & FY26/3 Plan)

PDF

-

-

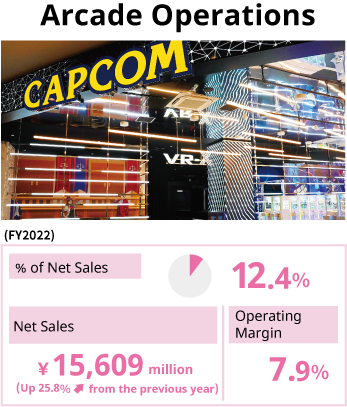

We operate amusement facilities, primarily Plaza Capcom arcades, in Japan. We mainly open arcades in large commercial complexes, and in recent years have also expanded into new store formats such as cafés and merchandising. By holding events and other activities, we aim to maximize the appeal of our brick-and-mortar stores and create synergies with our other businesses.

FY2024 Financial Results

-

Net Sales/Operating Margins

-

Assets

Strengths

- Specialize in opening stores in large commercial complexes to secure a stable customer base

- Thorough scrap-and-build strategy focused on investment efficiency to ensure sustainable earnings

- Access to broad revenue streams through diversified store formats

Non-Financial Capital

Human Capital

- Internal store management staff

- Part-time workers hired locally

Intellectual Capital

- Store management know-how cultivated over 40 years

- Intellectual properties (characters and worlds) that can be rolled out in food, drinks and prizes

- Services utilizing virtual reality (VR) Technology

Production Capital

- High foot traffic of large shopping centers

- Developers that design and construct facilities

Social Capital

- Our relationships with local residents

- Arcade game makers around the world

Topics in FY2024

-

Capsule Lab Kobe Nankin-machi

Outlook (Business Divisional Strategies and Projections)-

Earnings Supplement (FY25/3 Results & FY26/3 Plan)

PDF

Related Article -

-

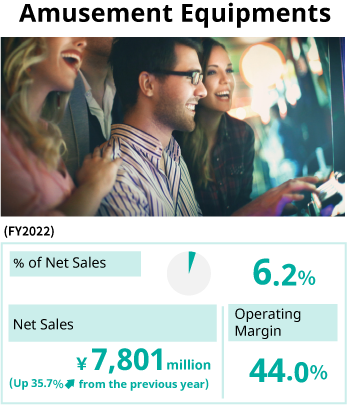

This business utilizes the content from our home video games. We focus primarily on the development, manufacture and sales of software, frames and LCD devices for gaming machines.

FY2024 Financial Results

-

Net Sales/Operating Margins

-

Assets

Strengths

- High caliber development capabilities cultivated through home video games

- Leveraging of rich in-house contents

- Diversified sales channels

Non-Financial Capital

Human Capital

- Internal developers in charge of planning and development

Intellectual Capital

- Own many original popular titles (IP)

- Development technology compliant with pachislo certification rules

Production Capital

- Manufacturing plant for machines

- Pachinko/pachislo parlors and video game arcades throughout Japan

- Domestic sales channels including e-commerce website

Social Capital

- Cooperation with major specialist companies

- Administrative organ related to pachislo machine permits and licenses

Topics in FY2024

-

Smart Slot Monster Hunter Rise

Outlook (Business Divisional Strategies and Projections)-

Earnings Supplement (FY25/3 Results & FY26/3 Plan)

PDF

Related Article -

-

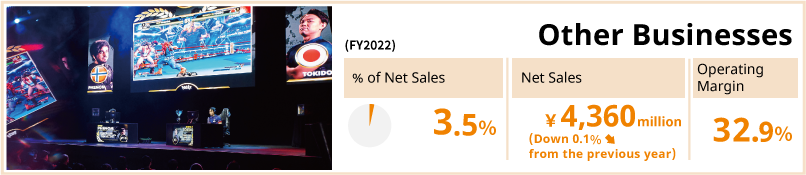

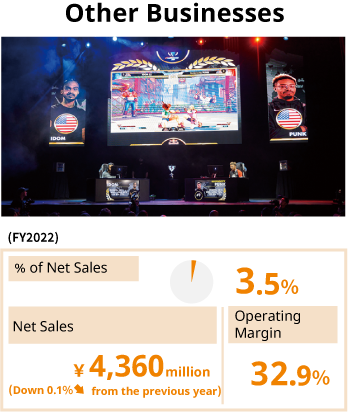

Based on our Single Content Multiple Usage strategy of leveraging game IP across different media, we pursue a variety of licensing business opportunities. In addition to adapting game content into movies, animated television programs, music CDs, character merchandise and other products as part of our licensing business, we are also devoting resources to our esports business.

FY2024 Financial Results

-

Net Sales/Operating Margins

-

Assets

Strengths

- Synergetic effect from multifaceted use of rich contents

- Brand value increased through high exposure across various mediums

- High profitability of character content

Non-Financial Capital

Human Capital

- Planners skilled at content development

- Legal staff in charge of alliance agreements and other arrangements

- Talent from our own production company located in Hollywood

- Organizers of esports events

Intellectual Capital

- Own many original popular titles (IP)

- Brand business (strategy for maximizing value of intellectual properties)

- Experience with running esports events

Production Capital

- Legal framework related to intellectual properties in Japan and other countries

- Collaboration partners and manufacturing companies for character merchandise

- Global video platforms

Social Capital

- Event organizers that engage in joint planning

- Relationship with movie studios, including those in Hollywood

- Relationship with pro-gamers and fans

- Relationship with local governments

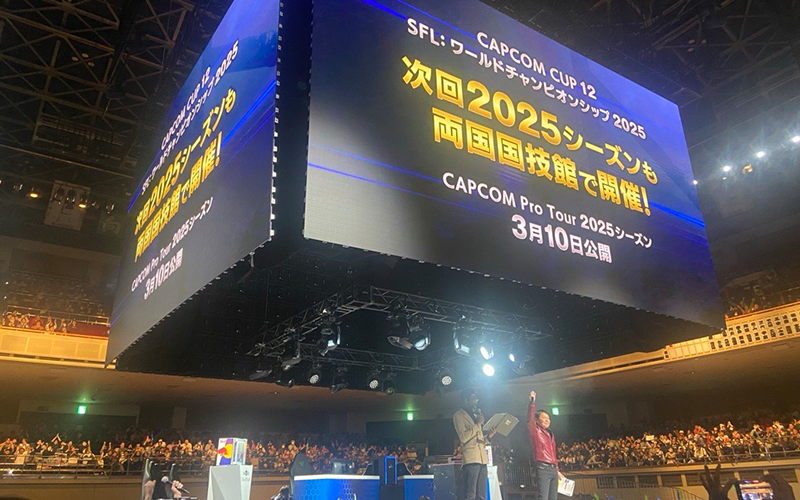

Topics in FY2024

-

CAPCOM CUP 11

Outlook (Business Divisional Strategies and Projections)-

Earnings Supplement (FY25/3 Results & FY26/3 Plan)

PDF

Related Article -