- Value Creation

Story (PDF) - CEO

Commitment - COO Growth

strategy - CHO

Commitment - CFO

Commitment - Development

- Corporate

Governance

Accelerating our digital strategy and aiming for 100 million units in annual sales

Haruhiro Tsujimoto

President and

Chief Operating Officer (COO)

We began the roll out of our full-scale digital strategy in the mid-2010s. Our major aim was to expand Capcom’s content throughout the world and establish a stable revenue base, and a major part of that tactical shift is the move to digital download sales. Until that time, game publishers had primarily provided disc-based content to game users via retail stores. However, retail store sales are (1) dependent on the location of the store, and (2) subject to price protection in some countries, which means when the prices of games are reduced at a retail store, the publisher bears the loss from the amount lowered, which removed our ability to make policy-based decisions on price promotions. It was these two main points that were becoming constraints on our global expansion. In addition, disc sales required strong focus on countermeasures to combat unauthorized and pirated copies. We began shifting to digital download sales as a means of overcoming these issues and bringing game content to users throughout the world.

As a result, compared to the fiscal year ended March 2013, when our sales territory consisted of 167 countries and regions, we have now expanded to 219 countries and regions, and our revenue base is shifting from new releases to catalog title sales.

In the last 10 years, our business model has transitioned from B2B to B2C, and in recent years, it is transitioning to D2C (Direct to Consumer). Capcom’s tactical transformation these 10 years has also followed this trend. I am adding another reading of D2C: Digital to Consumer. We will further accelerate our digital strategy, and to do that we are rebuilding our human resources investment strategy.

The CHO Discusses Our Human Resources Strategy

Measure 1

Accelerating global market expansion

In the era of disc sales, the main markets for game content were in Europe and North America, which were the leading regions in the game industry. From there, it became the norm for gaming devices to be always online.

Digital sales have naturally worked to strengthen anti-piracy measures, enabling long-term sales. Over the past 10 years, we have expanded the number of countries and regions in our sales territory, and at the same time, the number of titles we are selling has grown to over 300.

We believe that there are two main factors that have enabled for this expansion.

(1) From the time the company was established with our main business being arcade game circuit boards, Capcom had started expanding throughout the world, giving us a certain brand status.

(2) Due to the efforts of our development team, Capcom has the technical and developmental abilities to regularly produce high-quality titles.

Game content declines in value over time and prices decrease. However, the decrease in price means that game content will be more accessible to people in countries and regions with different income standards.

Comparing our sales territory now with 2013, there are countries and regions where annual sales are gradually shifting from less than 100 units annually to more than 100, more than 1000, more than 100,000, and more than 1 million units. As income levels rise due to economic growth in each country and region, we will develop strategies to further expand our market.

Measure 2

Continue producing the world’s best content

Our new releases since fiscal 2016 have outperformed our sales expectations and are on the way to even greater growth.

It goes without saying that this is underpinned by our world-class developmental and technical capabilities. We do not aimlessly start working on creating games. The process involves detailed advance preparation, understanding of user trends, repeated prototyping, and quality checks before we begin production.

In particular, we perform repeated quality checks until just before a title is released. Additionally, we are making efforts to improve productivity with measures such as our in-house game development engine, RE ENGINE and the automation of content production. This is within a framework where the technical research division, which is responsible for fundamental technology research, development management division, and development human resources department support production.

Since the release of Resident Evil 7, which was launched in January 2017, our titles have been exceeding our expectations in Metacritic scores and user evaluations, while also achieving sales results.

It can be said that it is our world-class content that is enabling the long-term sales of content explained below.

In addition to strengthening the brands of existing IP that complement the larger Resident Evil, Monster Hunter, and Street Fighter brands, which already have fans worldwide, we are taking on the challenge of creating new IPs. In order to achieve that, we have to steadily increase personnel in the development division, and we are responding to that need by continuously and proactively hiring new graduates and mid-career talent.

Measure 3

Long-term sales and improved profitability

in the global market

At Capcom, one of our criteria we look at when creating games is the maximization of sales in a five-year period. Behind this is the efforts we have made over the last two years reorganizing our past sales data—data which is now available for future sales projections.

In recent years, PC platform versions have also increased their contribution to digital sales. We are now able to sell in more than 200 countries and regions, a number that far exceeds the conventional console market, and we have analyzed that there is strength in expanding sales in emerging regions, such as Asia, South America, Eastern Europe, and the Middle East. Currently, unit sales of games for PCs account for roughly 40% of unit sales, but analysis shows that there is still great potential for future growth in this area and we have designated PCs a priority platform.

We will continue promoting these digital sales in fiscal 2022 and project achieving record high net digital sales of 73.4 billion yen. Looking to the future, there is still room for growth in pipeline expansion, long-term sales, and in global markets, and we expect the digital sales ratio to rise to a level of roughly 90% in the longterm, both in terms of revenue and volume, and we believe that the profitability of the Digital Contents Business will continue to increase sustainably.

One positive example is the long-term sales of Monster Hunter: World (MH:W). Initially it was released for game consoles, and then a PC platform version was released, and that finally led to the release of the massive premium expansion Monster Hunter World: Iceborne. More than four years have passed since its initial release in January 2018, but as a result of maintaining the freshness of its content while gradually lowering the price and striving to expand sales, its cumulative sales volume has exceeded 20 million units*; more than half of the initial MH:W units were sold in the second year or later. The lowest price it has sold for thus far on sale is approximately five dollars, but its development costs have already been recouped, so it is contributing to income sufficiently. Similarly, the cost of other high-quality catalog titles has also been recouped at an early stage after their releases. Today, sales of catalog titles account for more than 70% of annual unit sales and more than half of the profits from our digital content business.

This was a major factor in establishing a stable

profit structure over the last 10 years.

* Including Monster Hunter World: Iceborne Master Edition

Measure 4

Diversification and streamlining of sales

measures with a shift to digital business

Most companies are already making use of internet information and working to expand sales of proprietary products. At Capcom, we are also evolving our traditional advertising and promotion methods with the expansion of digital download sales. It goes without saying that the key is in how to deliver the most up-to-date information regarding content to users as quickly and efficiently as possible.

This is why we have reorganized our internal structures and have started to reform our business infrastructure.

First, until now our overseas offices (subsidiaries) had been positioned as sales companies, but in the future, their role as information bases will become more important. I believe it will be essential to know how game users in each country and region are enjoying our game content by linking our overseas bases with the business and sales divisions at the head office in order to not only produce games, but also to develop sales strategies in the future.

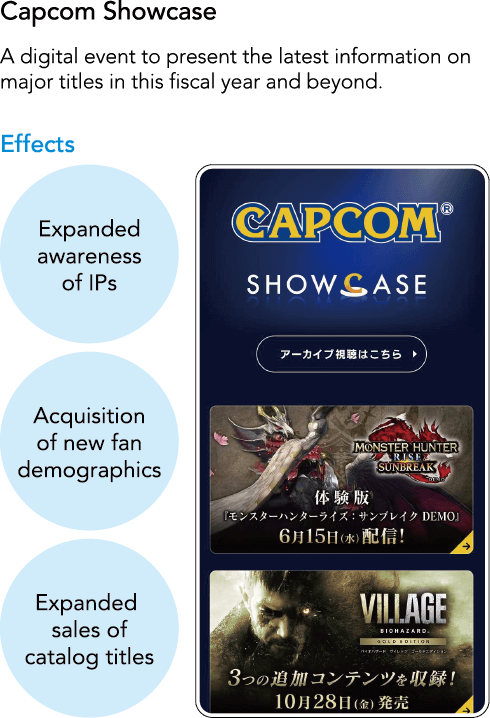

Also, as one of our measures for strengthening information communication, in addition to our official Twitter and other social media, we have started providing the digital event, “Capcom Showcase.” We will continue to strengthen our digital promotions with this event at the core, and advance the diversification and streamlining of our sales measures.

Game users have a strong interest in not only new game information, but also in information for those games they have already purchased. We believe that delivering useful information that meets the expectations of users is also an essential aspect of expanding the user base of our content.

Measure 5

Brand expansion (1)

–Strengthening coordination with

peripheral businesses

Looking around the globe, it is essential that we further expand the penetration of our corporate brand and content brands for sustainable growth.

With a strengthened financial base, we will now work harder than ever before on brand expansion and penetration measures. We have started taking steps to help strengthen our global brand, including the decision to sponsor the Japan Volleyball Association, the Cerezo Osaka soccer club, and the Tokyo International Film Festival, and to participate in the Osaka World Exposition, all of which were announced from May 2022 onward. These measures will strengthen our message of “from Osaka, to the world.”

In addition, our Arcade Operations and Amusement Equipments businesses will work independently to expand their earnings while we work to expand our business base by linking these with our domestic game content brand expansion.

Among Capcom’s businesses, Arcade Operations has an important position as our direct customer touchpoint. Specifically, we have demonstrated the significance of its role with the useful information it provides. That information contributes to measures in stores and the expansion of our content and brands, and is also linked to various customer analyses. The business is a valuable face-to-face touchpoint with consumers, including users, and at the same time, it is also a place where we can seek synergy with our Consumer sub-segment by holding hands-on game demos and other events. As we accelerate our digital strategy, we will strengthen this even further.

In the Amusement Equipments business, game content and pachislo machines go well together, and we have seen growth due to a shift from licensing to in-house production.

In recent years, game content sales performance in the Japan market has fallen behind when compared to the growth in the rest of the world. The history of the modern game industry originally began in Japan and then spread to the rest of the world. We will look to promote and use both businesses in expanding the Japanese market.

Additionally, our licensing, eSports, and movie businesses are all essential in growing and penetrating our brand further.

Measure 6

Brand expansion (2)

-Strengthening our licencing, eSports,

movie businesses

Revenues are at an all-time high in our licensing business due to an increase in collaborative products and in-game collaborations that coincide with the release of new titles. Currently our licensing business is conducted mainly in Japan and the Asian region, but we are moving forward with measures to strengthen the business with global expansion in mind.

Our eSports business has been significantly impacted by the spread of Covid-19 these past two years, and for the safety of the players and spectators we were forced to change the way in which most live events we had planned were held. However, one major advantage of eSports is the fact that we can hold alternate events online and stream them. In order to maintain our efforts to popularize eSports under the pandemic restrictions, we have implemented two main initiatives. (1) For individual competitions, the year-long world tour, CAPCOM Pro Tour was held online in 2021 in the same format as the previous year. (2) For team competitions, the domestic Street Fighter League: Pro-JP 2021 was held, increasing the number of participating teams to eight and adopting a corpoate ownership system for the first time. We are laying the groundwork for future regional franchising and the establishment of training institutions. In the U.S., Street Fighter League: Pro-US 2021 is being held online.

In 2022, the CAPCOM Pro Tour Online 2022 will be expanded in scale with the addition of a new “World Warrior” category, while holding some events in person. We will also incorporate measures to diversify the regions and participants for tournaments. In the team competition, Street Fighter League, “Street Fighter League Pro Europe 2022” will be held from October following the “JP” and “US” tournaments, and a final battle will be held to determine the champion from among Japan, the U.S. and Europe, aiming to invigorate the scene through further expansion of regions where events are held. From a medium- to long-term perspective, we will continue to promote and expand eSports to establish a new genre of entertainment and work to ensure eSports are more widely known and understood by society.

Regarding the movie business, in the early 90s, Street Fighter II provided the opportunity for Capcom to proactively create products and Hollywood movies based on content, and in the 2000s, we adopted the Single Content Multiple Usage strategy leading the industry in development across multiple forms of media. Under these circumstances, it was Hollywood films, such as Resident Evil, that played a major role in the branding of our content.

In order to be even more proactive in promoting the global branding of Capcom content going forward, we established a subsidiary film production company in Los Angeles, California in the U.S. in 2022. Using our own capital, we will strengthen the connection between games and the movie business as well as our expansion into movies and video streaming services while adhering to the same standard of quality as our games.

Measure 7

Support for new areas,

such as cloud gaming and the metaverse

We expect the growth Capcom has achieved from executing our digital strategy, as detailed above, will continue into the foreseeable future. Meanwhile, the appearance of new services and technologies, such as cloud gaming and the metaverse, have the potential to bring dramatic changes to the game industry over the next 10 years. In addition to adopting a multi-platform strategy, Capcom has a track record of being quick off the mark in adapting to new technologies, such as VR. It goes without saying that we will continue to maintain a keen awareness of new fields and conduct technical testing.

What is important is that we use new technologies to provide users with new game experiences. Even if the technology is ahead of its time, it is meaningless if a game is not interesting. If we look at it from a historical perspective as well, we can see that it has been new services and technologies that have expanded upon the fun provided by games. I have great expectations for the further evolution of the world of games, and further am also very interested to see both when and what kind of benefits there will be for game players. I am currently watching this trend with great interest while directing our development and business divisions to analyze and respond to developments.

Finally, I want to properly convey that although our business format may change, Capcom’s top priority will not. That is to consistently produce world-class, meticulously refined content as we have always done. If our salespeople are properly communicating our appeal, then consumers will always choose our products, even if the platforms or services change. Conversely, if the content is deficient, even if we are able to ride the transient wave of a trend, growth will not be sustainable. We are convinced of this based on our experience standing at the forefront of the industry.

CAPCOM INTEGRATED REPORT 2022

PDF (Complete version) (PDF: 12.2MB / 104 pages)

PDF (by section)

Value Creation Story

(PDF: 3.5MB / 24 pages)

- Create Financial and Non-Financial Value

- Corporate Philosophy

- Value Creation Model

- History of Value Creation

- Major Intellectual Properties (IP)

- Effectively Leveraging IP

- Digital Strategy / Human Resources Strategy Performance

- ESG Highlights

- Business Segments Highlights

- Financial Highlights

- Medium- to Long-Term Vision