Business Segments

-

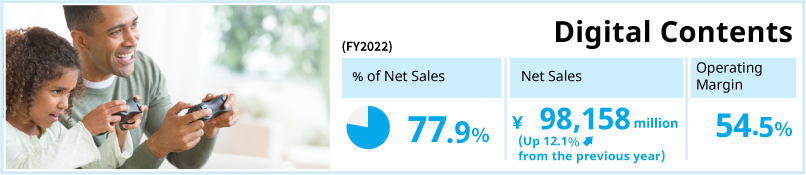

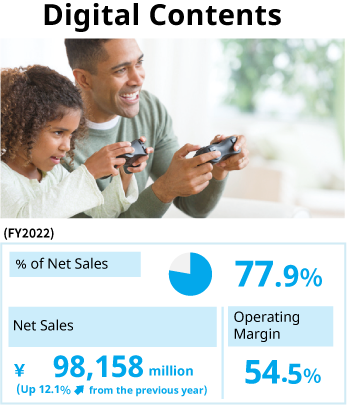

This business develops and sells digital game content for consumer home video game and PC platforms. It also develops and manages Mobile Contents. Using our world-class development environment, we deliver high-quality content digitally to more than 230 countries and regions, resulting in long-term and continuous sales that underpin our robust profitability.

FY2024 Financial Results

-

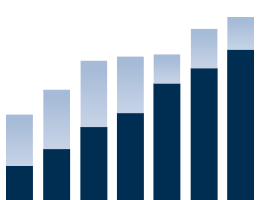

Net Sales/Operating Margins

-

Assets

Topics in FY2024

-

Monster Hunter Wilds

-

Catalog title Resident Evil 4

Outlook (Business Divisional Strategies and Projections)-

Earnings Supplement (FY25/3 Results & FY26/3 Plan)

PDF

-

-

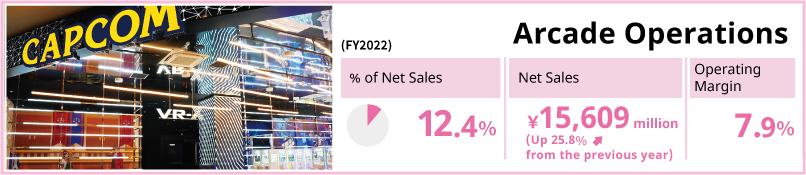

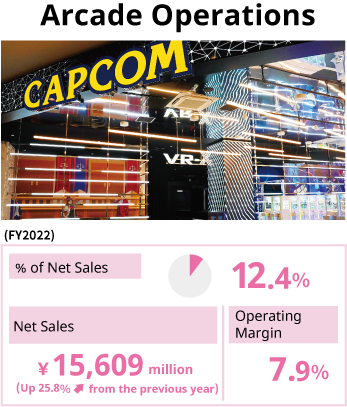

We operate amusement facilities, primarily Plaza Capcom arcades, in Japan. These arcades are predominantly in large commercial complexes. We have diligently followed a scrap-and-build policy to maximize our efficiency in arcade operations, and have been hosting various events designed to attract families and younger customers.

FY2024 Financial Results

-

Net Sales/Operating Margins

-

Assets

Topics in FY2024

-

Capsule Lab Kobe Nankin-machi

Outlook (Business Divisional Strategies and Projections)-

Earnings Supplement (FY25/3 Results & FY26/3 Plan)

PDF

Related Article -

-

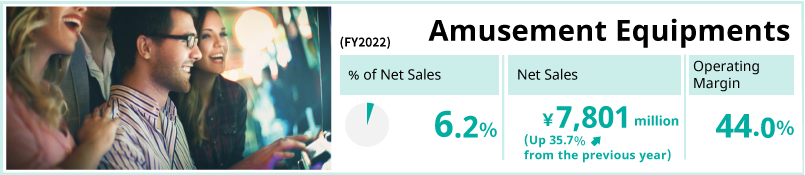

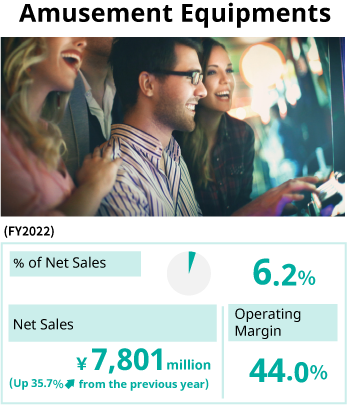

This business utilizes the content from our home video games. We focus primarily on the development, manufacture and sales of software, frames and LCD devices for gaming machines.

FY2024 Financial Results

-

Net Sales/Operating Margins

-

Assets

Topics in FY2024

-

Smart Slot Monster Hunter Rise

Outlook (Business Divisional Strategies and Projections)-

Earnings Supplement (FY25/3 Results & FY26/3 Plan)

PDF

Related Article -

-

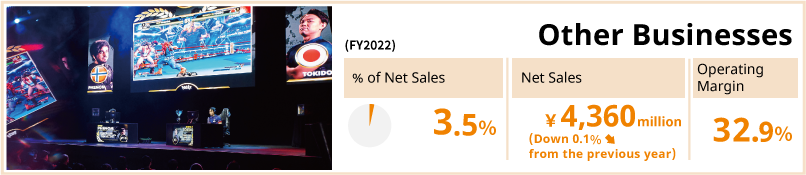

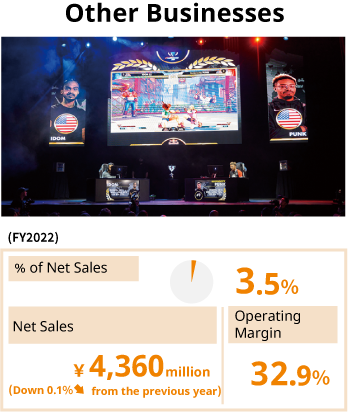

Based on our Single Content Multiple Usage strategy of leveraging game IP across different media, we pursue a variety of licensing business opportunities. In addition to adapting game content into movies, animated television programs, music CDs, character merchandise and other products as part of our licensing business, we are also devoting resources to our esports business.

FY2024 Financial Results

-

Net Sales/Operating Margins

-

Assets

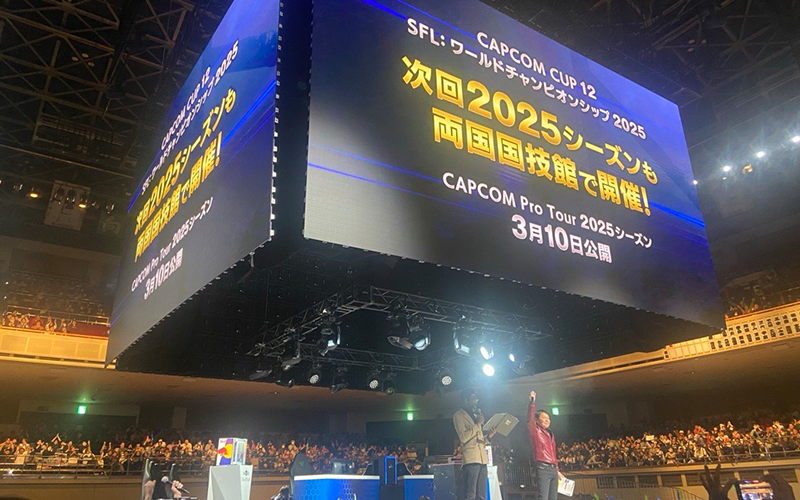

Topics in FY2024

-

CAPCOM CUP 11

Outlook (Business Divisional Strategies and Projections)-

Earnings Supplement (FY25/3 Results & FY26/3 Plan)

PDF

Related Article -