Stock Quote

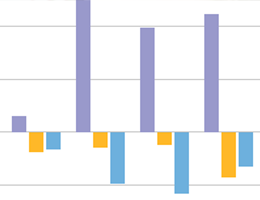

Key Financial Data

"Key financial indicators" has been moved due to page reorganisation.

Related Article

-

-

October 29, 20252Q FY2025 Financial Results Announcement

-

October 16, 2025-October 28, 2025Quiet Period

-

September 25, 2025-September 28, 2025Tokyo Game Show 2025

-

Integrated Report

Integrated Report-

IR Materials Download

-

IR Social Accounts

-

Top 5 Recommended Pages

(as end of Sep. 30, 2025)