- Get to Know

Capcom - Management

Strategy - Business Activity

Achievements - ESG-based Value

Creation - Financial Data

Arcade Operations

We operate amusement facilities, primarily Plaza Capcom arcades, in Japan.

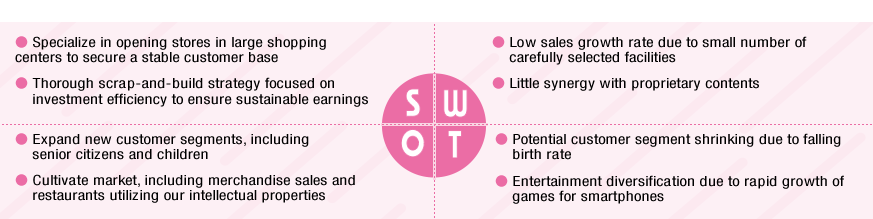

These arcades are predominantly in large commercial complexes. We have diligently followed a scrap-and-build policy to maximize our efficiency in arcade operations, and have been hosting various events designed to attract families and female customers.

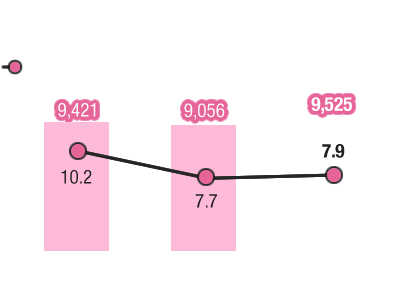

Net Sales/Operating Margins

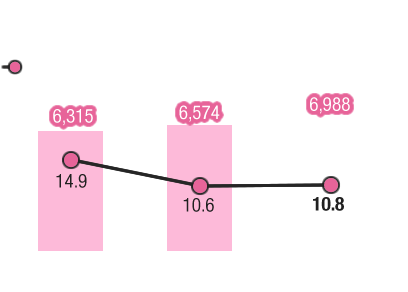

Assets/ROA

SWOT Analysis

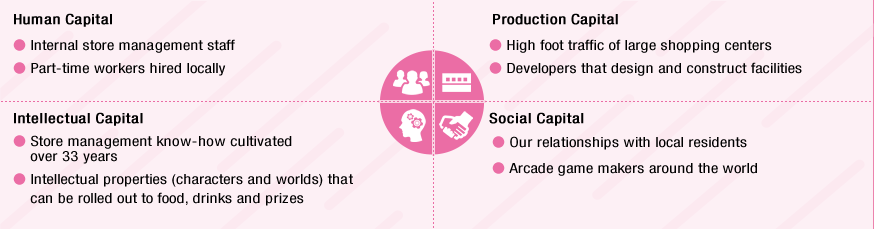

Utilization of Non-Financial Capital

Market Trends and Operating Results for This Fiscal Year

The Market Bottomed Out Followed by a 2.7% Increase;

Both Sales and Profits Were Up due to Improvements at Existing Stores Accompanying Deregulation

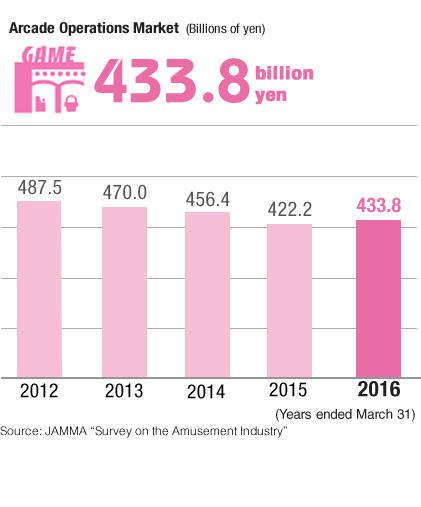

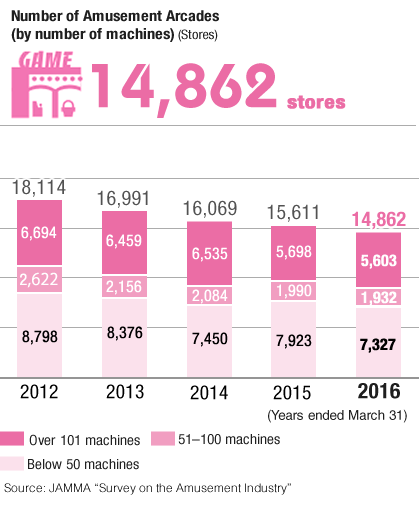

The domestic arcade facilities market grew during the previous fiscal year (ended March 31, 2016) for the first time in nine years to 433.8 billion yen (up 2.7% from the previous year). This was due to a slowing of the downturn in consumer spending following the consumption tax increase of April 2014. The total number of arcades decreased to 14,862 (down 4.8% from the previous year), but the number of units installed at each arcade increased to 33.6 (up 2.5 units from the previous year), and annual sales per facility increased to 29.19 million yen (up 7.9% from the previous year), demonstrating that the closing of unprofitable locations and streamlining of management by many companies has been successful. This fiscal year (ended March 31, 2017), the market showed a recovery with increased sales per customer due to restrictions on the time that minors can be in arcades while accompanied by a guardian being relaxed in the Entertainment and Amusement Trades Act (Entertainment and Amusement Trades Rationalizing Act).

Capcom continued providing game center tours and service days for middle-aged adults and senior citizens, allowing them to play games for free. Further, we created new earnings opportunities and expanded our customer base by opening themed Capcom Cafés that utilize Capcom characters and Chara Cap stores that specialize in character merchandise sales. We also launched a new VR attraction called Tokusatsu Taikan VR Daikaijyu Capdon. .

During this fiscal year, three stores were opened, including GAMELAND Shin-Sapporo in Hokkaido, and one was closed, bringing the total number of stores to 36.

Comparison of Arcade Operations Performance (Year ended March 31, 2017)

| Net sales (billion yen) |

Operating income (billion yen) |

Operating margin (%) |

|

|---|---|---|---|

| Capcom | 9.5 | 0.7 | 7.9 |

| Adores | 11.5 | 0.7 | 6.5 |

| Aeon Fantasy | 65.0 | 3.7 | 5.8 |

| Sega Sammy | 37.2 | 2.2 | 5.9 |

| Bandai Namco | 60.9 | Undisclosed | – |

Source: Financial reports and earnings materials of each company (Aeon Fantasy fiscal year ended February 2017)

Note: Segments include businesses other than arcade facilities operations and exclude corporate.

As a result, and with the relaxed restrictions of the Entertainment and Amusement Trades Act providing a boost, net sales at existing stores were up 2% from the previous year, bringing overall net sales to 9.525 billion yen (up 5.2% from the previous year) and operating income to 752 million yen (up 7.5% from the previous year), so that both sales and profits were up compared to the previous year.

Plaza Capcom Ishinomaki

Chara Cap Morioka

you me PARK Tokuyama

GAMELAND Shin-Sapporo

Market Forecast and Outlook for the Next Fiscal Year

Projecting a 5% Increase in Net Sales from Market Recovery and Opening Five New Stores

In terms of market outlook, we expect a continued recovery due to relaxed restrictions of the Entertainment and Amusement Trades Act. In the next fiscal year (ending March 31, 2018), Capcom will promote streamlining of management through its ongoing scrap and build policy and ensure earnings at the same level as the previous fiscal year through the creation of new earnings opportunities.

We will continue to hold events for seniors with the aim of attracting middle-aged and senior customers, while strengthening our business foundation by developing new business formats, such as Capcom Café and Chara Cap. In terms of the opening and closing of facilities, in an attempt to further strengthen efficient arcade management operations, we will open new facilities in locations with high concentrations of customers to secure new revenue streams. In the next fiscal year, we plan to open five facilities and close one, bringing the total number of stores to 40.

As a result of these measures, we expect year-over-year sales of existing stores to be up 3%, we forecast net sales of 10 billion yen (up 5.0% from the previous year) and operating income of 700 million yen (down 6.9% from the previous year).

PDF download

-

Business Activity Achievements (PDF:2.72MB/12 pages)