- Get to Know

Capcom - Management

Strategy - Business Activity

Achievements - ESG-based Value

Creation - Financial Data

CEO Commitment

To Create the World’s Most Entertaining Games

With a Solid Management Foundation and Capabilities,

We Aim to Enhance Corporate Value through Content Branding

Five Elements Required for

Sustainable Corporate Value Enhancement

I think a manager’s corporate social responsibility is exceedingly simple: by setting up a business and employing people, you grow your company, earn profit, pay taxes and then provide dividends; this allows you to build a relationship of co-existence and co-prosperity with stakeholders, and allows the Company to continue on.

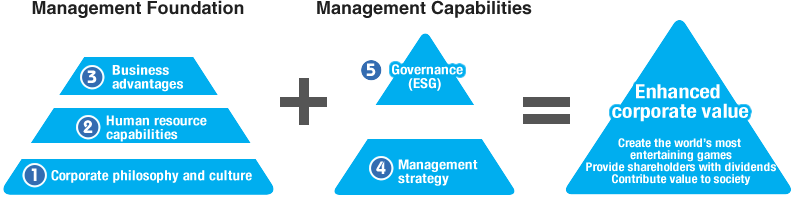

I believe the perpetuation of this cycle leads to the sustainable enhancement of corporate value. However, this requires the incorporation of five elements: ❶ a corporate philosophy and culture that fosters the ambitions and values set out at our founding, ❷ human resources that are passionate about growing the Company, ❸ business advantages that leverages the Company’s competitiveness, ❹ management strategy that quickly responds to market changes and ❺ governance (ESG) that facilitates risk control.

I will explain to our shareholders how we are favorably positioned in each of these five elements that facilitate sustainably enhancing corporate value.

- ❶ Philosophy and culture

❷ HR capabilities

❸ Business advantages - ❹Management strategy

- ❺Governance (ESG)

- Enhancing Corporate Value and Shareholder Returns

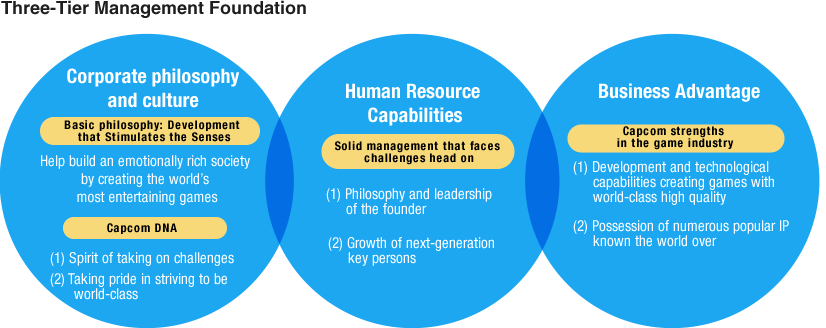

Elements for Enhancing Corporate Value ❶Corporate philosophy and culture ❷Human resource capabilities ❸Business advantages

Our Three-Tier Management Foundation is the Bedrock of our Competitive Advantage

Corporate Philosophy and Culture—

We Value the Ambition to be the Best in the World

Capcom’s basic philosophy is to create an entertainment culture though the medium of games by developing highly creative content that excites and stimulates the senses. In other words, we help build an emotionally rich society by creating entertainment culture with the world’s most entertaining games.

In 1983, I founded Capcom under the motto of "originality and ingenuity" with the vision of developing games people would find entertaining; in a word, wanted to create games of world-class quality. Underpinning this was my belief that increasingly sophisticated graphics and more immersive worlds would eventually make games as moving and impressive as a Disney film.

34 years later, I have amassed more than 2,800 colleagues who share this vision. These values have become our corporate culture and DNA, with (1) a spirit that is always eager to take on new challenges and (2) a sense of pride to constantly strive to be world-class deeply ingrained in every Capcom employee.

Again and again, we have been able to produce unique series, including Street Fighter, Resident Evil and Monster Hunter because of the fertile soil of a corporate culture cultivated over many years.

Human Resource Capabilities—

A Sincere and Unwavering Spirit

Within corporate management, people’s character and spirit are important management resources that have a substantial impact on corporate value. In last year’s integrated report, I discussed my management philosophy and capabilities as founder, demonstrated by: (1) realizing the ambitions I had for Capcom at its founding to create multiple worldwide major hit titles and (2) persevering until we succeed, establishing both earnings growth and earnings volatility control since our founding.

At present, one of the concerns among our investors is the thinness of our management team as a founder-run company; in other words, have we prepared a management structure for the next-generation?

Key people for the next-generation are President Haruhiro Tsujimoto and Executive Corporate Officer Yoichi Egawa. Both have the qualities necessary for management. For example, even when Capcom was a small business, President Tsujimoto was on hand as a member of the founding family, working with the sense of responsibility and self-awareness inherent in a family-run operation. Even after becoming president, he never rested on his laurels: leveraging his diligence and sincerity, he went on to establish the Arcade Operations business, while also taking pains to utilize our content across multiple mediums. As for Executive Corporate Officer Egawa, who joined Capcom right after its founding, he has a track record of delivering results: from working on the development of CP system boards to establishing the Pachinko & Pachislo and Mobile businesses, he has led R&D with an attitude of never running away, never giving up—no matter how tough the circumstances.

These two distinct individuals were also thoroughly trained by me, and when combined with the corporate culture we have cultivated over many years with the aforementioned approach to visualizing management, I think we have in place a robust team in whose management style long-term investors can place their trust.

Business Advantages—

Two Competitive Barriers

Capcom’s strengths are (1) the development and technological capabilities to create world-class, high-quality games and (2) numerous popular branded IP known the world over.

Combining these strengths with our capital and the relationships of trust we have with hardware manufacturers creates significant competitive advantages (profitability) in the Consumer sub-segment. Against this backdrop, in the consumer market, technological standards and development costs rise with each hardware cycle, while the life of major titles has grown longer and models for capturing user time and spending have come to predominate.

[Business Activity Achievements] Digital Contents

Furthermore, while strictly speaking not a competitive advantage per se, in sub-segments other than Consumer our rollout of popular IP across multiple mediums contributes to stable earnings. Moreover, if we make use of our strengths in the Mobile Contents sub-segment, there is a potential for it to become a core business in the future, thus we will continue to treat it as a management priority issue.

The COO’s Discussion of Growth Strategies

Elements for Enhancing Corporate Value ❹ Management Strategy

Increasing Fans of Capcom IP via Strategic Shift to Recurring Revenue Model

1. Summary of Former Medium-Term Goals

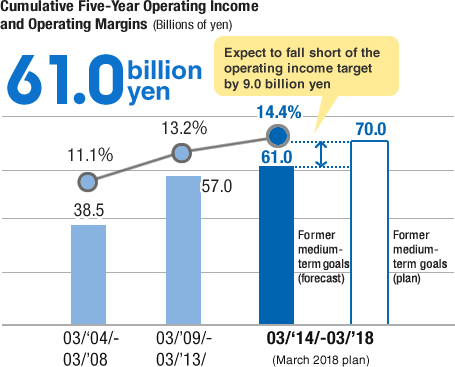

Up to now, we had aimed for operating income of 70.0 billion yen for the cumulative five-year period ending on March 31, 2018, and an operating margin of 20% in the fiscal year ending March 31, 2018 as our medium- term goals.

Our current forecast calls for operating income of 61.0 billion yen for the cumulative five-year period and an average operating margin of 14.4%, both of which are solid improvements over the previous two cumulative five-year periods.

However, we will fall short of our cumulative operating income target by 9.0 billion yen.

Breaking down causal factors by business segment, in the Amusement Equipments business, by expanding our pachislo lineup and strengthening our sales structure, we were able to significantly exceed the profit level (1.6 billion yen over the target) of the previous ten years when we focused on the consignment business. The Digital Contents business made contributions through concentrating on in-house development of Consumer games and improving our download ratio. At the same time, although we focused efforts on in-house development to acquire Mobile management know-how, these efforts did not bear fruit. PC Online in-house development and alliances in Asia also failed to meet expectations, resulting in our falling short of the target by 5.4 billion yen. In the Arcade Operations business, we felt the impact of consumption tax hikes beginning in April 2014, resulting in lower earnings per customer and increased costs due to tax increases, causing us to miss targets by 3.8 billion yen.

Operating Income by Business Segment (Cumulative Five-Year) (Billions of yen)

| ’03/’04 – 03/’08 |

’03/’09 – 03/’13 |

03/’14 – 03/’18 |

Medium term goals |

Compared to previous fiscal year |

Compared to goal |

||

|---|---|---|---|---|---|---|---|

| Digital Contents | 28.0 | 59.5 | 51.6 | 57.0 | -7.9 | -5.4 | |

| Arcade Operations | 9.8 | 5.4 | 4.7 | 8.5 | -0.7 | -3.8 | |

| Amusement Equipments | 13.2 | 8.9 | 21.6 | 20.0 | 12.7 | 1.6 | |

| Other Businesses | 1.1 | 4.8 | 4.5 | 5.5 | -0.3 | -1.0 | |

| Adjustment | -13.6 | -21.6 | -21.4 | -21.0 | -0.2 | -0.4 | |

| Total | 38.5 | 57.0 | 61.0 | 70.0 | 4.0 | -9.0 |

Next, regarding the operating margin in the fiscal year ending March 31, 2018, we have been able to improve margins and maintain them in the mid-15% range, however this will put us 4.3% under the target.

Similar to the reasons we failed to achieve operating income targets, the challenging conditions faced by our individual businesses were a factor. On the other hand, we have been flexibly making development and business investments for the future beyond those in our plans in order to achieve sustainable growth. For example, even if the construction of R&D Building #2 (increase in amortization expenses) and the hiring of more than 100 new graduates each year (lower productivity) impacts current margins, these were positioned as upfront investments executed to increase profits stably in the future.

In summation, we have made significant strides toward establishing the foundation for our core Consumer business to be a future driver of growth. This leaves us with the issue of the Mobile business, which can become the next pillar of growth.

Given the above, we have rescinded our previous medium-term business goals, and will work toward new medium-term business goals going forward.

2. Establishment of New Medium-Term Goals

(1) Management Direction

Capcom management policies are to (1) create exciting, world-class content (IP), (2) maximize earnings by leveraging our rich library of IP across multiple platforms and media and (3) maintain these activities to become a continuous sustainable growth company.

(2) Management Goals

We have established operating income growth each fiscal year as the KPI for achieving the above. Rather than struggling to coordinate major title launch periods for this, we intend to take a natural approach of establishing a build-up model of stable growth. This will enable institutional investors managing pensions and individual investors on fixed incomes to maintain long-term holdings with confidence. As we are emphasizing annual growth, we have not announced a specific rate of increase, but we are considering a profit growth rate between 5%–10%.

(3) Management Strategy

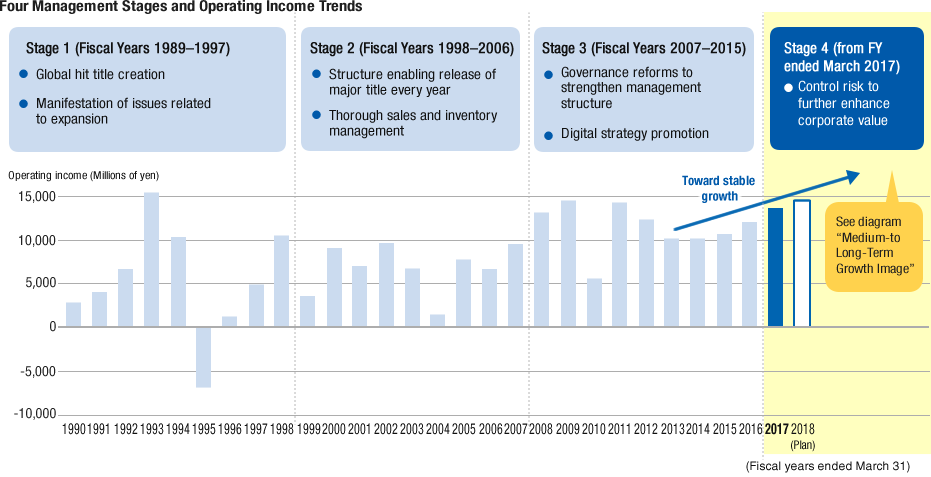

We are currently in the fourth stage (beginning in fiscal year ended March 31, 2017), which is the culmination of my experience as a manager. The main theme now is controlling risks to further enhance corporate value as a sound growth strategy.

As a manager, I classify corporate risks into two main categories: earnings volatility risks and management decision risks. First I would like to discuss the control of earnings volatility risks.

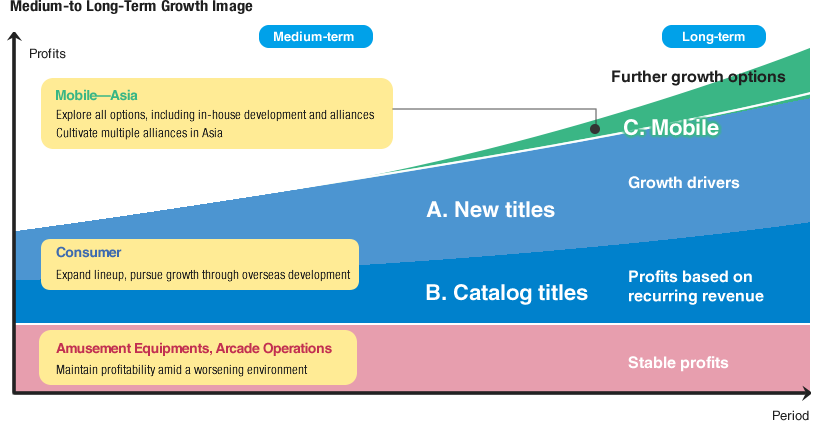

To mitigate earnings volatility risks over the medium-to long-term, measures enabling sustainable growth must include (1) transforming the foundation of our Consumer business model from a traditional one-time sale "transactional model" to a continuous "recurring revenue model" and (2) creating a business portfolio and diversifying earnings risks by thoroughly leveraging Capcom’s basic strategy, Single Content Multiple Usage.

Historically, earnings in Capcom’s core Consumer business fluctuated depending on whether or not we created hit titles. Although we achieved some success (controlled earnings volatility) through timing the releases of multiple hit titles in the past, it did not meet my objectives for stable growth. However, since 2013, game consoles have been equipped with robust online functionality, enabling us to develop growth strategies around digital.

Specifically, new titles will work as growth drivers as we (1) release approximately three major titles each year, (2) extend the sales life of the full game and additional digital downloads to 3–4 years, and (3) strengthen our presence overseas, which comprises approximately 85% of the market.

Next, in terms of catalog titles, we will generate profits on a recurring revenue basis through (1) download sales of past titles and (2) the launch of past hit titles for current-generation game consoles.

Furthermore, our Single Content Multiple Usage strategy has not yet been of a scale sufficient to offset volatility in Consumer games. However, in addition to the fact that now Mobile and PC Online account for 75% of the market as game platforms, because both are recurring revenue businesses, we will thoroughly leverage our IP to pursue in-house development, alliances, M&A and a variety of other possibilities, building a business foundation as a further growth option (second pillar).

In the game industry, which is often called the hit business, Capcom will establish a management structure and strategy able to achieve sustainable growth other companies have yet to achieve while enhancing corporate value.

Elements for Enhancing Corporate Value ❺ Governance (ESG)

Creating Shared Value Unique to a Game Company

while Tackling Social Issues

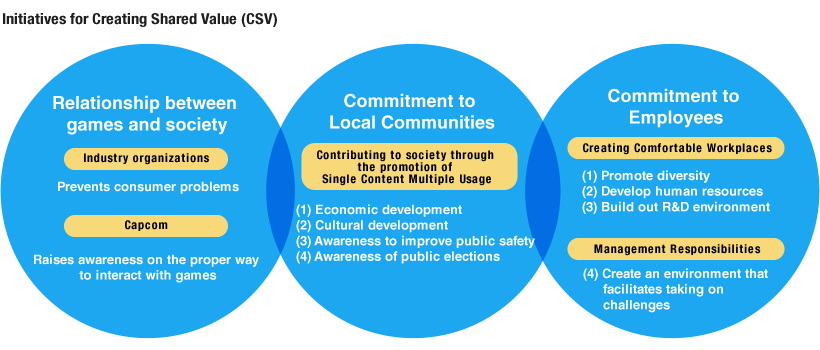

I believe that resolving social issues through business activities and building healthy relationships with stakeholders, while at the same time promoting the Creating Shared Value (CSV) concept that generates social and economic benefits, will lead to the enhancement of corporate value.

1. Building a Healthy Relationship Between Games and Society

Traditionally, games have provided joy and stress relief; in recent years however, following an increase in mobile games, new issues such as minors spending large amounts of money on in-game purchases and real money trading (RMT) are beginning to appear. In recognition that this is a substantial problem for the industry overall, companies are working together primarily through industrial organizations to (1) establish guidelines and educate, (2) share information on issues and examples among member companies and (3) regularly exchange information with guardians, educators, consumer organizations and governments.

[ESG-based Value Creation] Relationship with Customers

In addition, Capcom conducts literacy and career education to spread awareness of the proper way to interact with games as part of its educational support activities. These efforts are aimed at supporting the healthy development of young people and easing the concerns society has about the influence of video games.

2. Commitment to Regional Communities

The promotion of our Single Content Multiple Usage strategy provides society with a wide range of benefits. Specifically, these include the use of popular Capcom IPs in local revitalization activities to support (1) economic development, (2) cultural development, (3) awareness for improved public safety and (4) awareness of elections. We are achieving quantitative social outcomes through solving the common problem of attracting and appealing to the youth demographic.

[ESG-based Value Creation] Relationship with Regional Communities

At the same time, these four activities deliver value to Capcom in the form of (1) improving existing user satisfaction through event participation and (2) enhancing the image of games among middle-aged and seniors. With respect to (2) in particular, this segment cannot be considered current users, thus by contributing popular contents to local communities, we are able to ultivate new game users through their personal smartphones.

3. Commitment to Employees

As can be seen from the fact that labor costs (base costs) account for approximately 80% of development costs, the game industry is a labor-intensive industry and an extraordinarily knowledge-intensive industry, thus human resources are an especially important management resource.

I recognize the importance of diversity for creating content that will resonate globally, thus Capcom promotes the retention and training of talented human resources without regard for gender or race. We also conduct various development programs, because human resource development is directly linked to strengthening our R&D capabilities. In addition, we not only bring together the world’s most advanced development facilities and technologies, but also ensure a robust development environment that includes facilities such as an onsite daycare center, all of which allows developers to concentrate on their work. Regarding remuneration, in addition to regular bonuses, Capcom has introduced a system offering incentives and assignment allowances for each title in an attempt to further increase motivation.

[ESG-based Value Creation] Relationship with Employees

In my view, the most critical aspect of human resource development is providing an environment that enables employees to take on new challenges.

Managers typically tell their employees to do this, but I think that if employees are being urged to, they must be provided with a proper safety net. Without a safety net in place, no one will jump onto the flying trapeze, even if they are pushed. The manager’s role is to push employees to take on one new challenge after another, identify obstacles and come up with solutions. This enables employees to take on challenges without fear of failure, develop the world’s most entertaining games and create new businesses leading to a virtuous cycle that creates business opportunities.

The management visualization initiatives in which I am engaged play a role in providing employees with a space in which they are free to grow and be active.

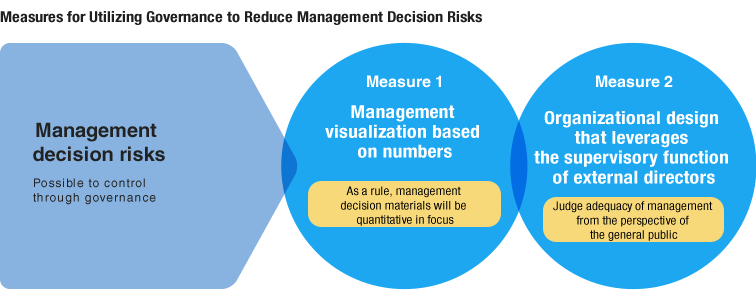

Reducing Management Decision Risks through

Governance Reforms Spanning 18 Years

The more we accelerate the execution of our growth strategies, the higher the risks become. I think governance is useful for avoiding and minimizing these risks. As risks can be broadly categorized into earnings volatility risks and management decision risks, I will now explain how governance can be used to control management decision risks.

Measure 1: Management Visualization Based on Numbers

In line with changes in company scale and business characteristics, I think it is important that management also be able to flexibly change its management style.

For example, when a company is small, management is like the pilot of a propeller aircraft engaging in visual flight. They are always present and make decisions based on confirming conditions with their own eyes. On the other hand, when a company is large, management is more like the pilot of a jumbo jet. In this case, it is too risky to make decisions based solely on visual flight.

Accordingly, the pilot switches to instrument flight to control the aircraft. Similarly, corporate managers must rely on numbers to make decisions.

For this reason, I require that materials (documents) used for decision-making are, in principle, quantitatively focused. Specifically, these materials compare and contrast net sales, year-on-year performance and earnings forecasts, which make it easier to identify problems by enabling us to confirm complex combinations of data. Furthermore, these materials are used by external directors for supervisory purposes and provided to investors as part of our IR activities. This is part of the mechanism I call "management visualization." Management decisions based on visualizing operations enable us to evaluate the Company with two sets of eyes using a system attempting to achieve management transparency.

Even when I talk with developers, numbers are the common language. Using only qualitative words and sentences leaves significant room for arbitrariness on the part of the person in charge. In comparison, numbers enable comparisons from a variety of angles, facilitating decisions based on real conditions.

"Businesses performing well should be left alone. The manager’s job is to focus initiatives on businesses that are facing problems or not proceeding according to plans, and to make changes enabling them to succeed.

Top management exists to make decisions, not constantly hang around the workplace." The risk control efforts I am engaged in at present, involve teaching next-generation members to effectively utilize the management experience I have accumulated as founder of the Company. The systemization of management will enable Capcom to continue functioning steadily into the future.

Measure 2: Organizational Design that Leverages the Supervisory Function of External Directors

For the past 18 years, Capcom has executed a variety of governance reforms.

Since introducing the external director system in the fiscal year ended March 31, 2002, external directors have increased to account for 50% of the Board of Directors as of June 2016. This is based in part on investor concerns that "as a founder-run company, Capcom can quickly make management decisions and respond to changes in the business environment, but isn’t there a risk of arbitrary decisions and execution?"

External director appointment criteria has not changed since the system was introduced, but in short, we appoint directors who are specialists and command the highest level of ‘insight’ into their respective areas, and who are able to objectively make decisions regarding Capcom’s management and business activities. With the avoidance of business investment risk as a priority issue, Capcom appoints individuals from Japan’s leadership class (in terms of business crisis management, law and government) who are able to provide sound opinions without making allowances for industry conditions, who are not intimidated by the company founder and who are able to determine validity from the general public’s point of view.

Furthermore, in June 2016 Capcom transitioned from a company with a board of corporate auditors to a company with an audit and supervisory committee.

We determined that to maintain stable corporate management, we must further strengthen our management base and ability to thoroughly manage risks.

For additional details, please refer to the Governance section.

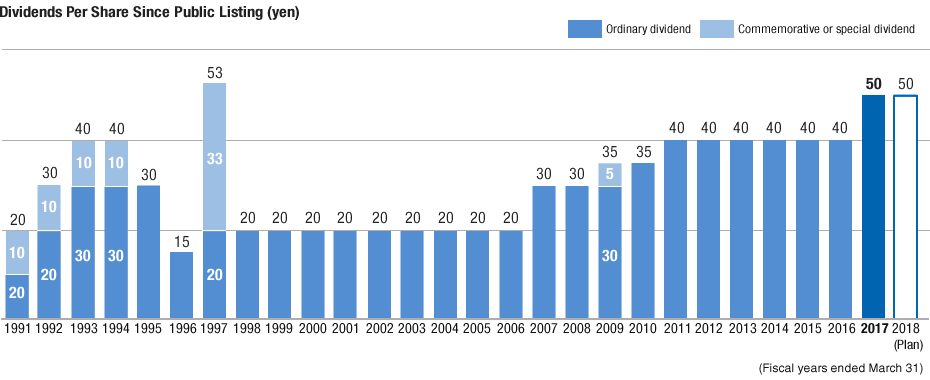

Enhancing Corporate Value and Shareholder Returns

Management Philosophy Balancing 27 Consecutive Years of Dividend Payments and All-Time Highest Dividends*

1. Basic Policy Regarding Dividends

"Given that we are building a foundation for stable growth and have achieved the fourth consecutive year of operating income growth, how do we approach shareholder returns?"

I think shareholder returns are an important management issue, thus dividends are determined with consideration for future business development and changes in the management environment.

And, the conclusion arrived at through discussions by the Board of Directors was that, to place more emphasis on the return of profits, we will strive to pay stable dividends with a consolidated dividend payout ratio of 30% as our basic policy. This means that we will pay dividends steadily in accordance with profit growth, without making judgments based on performance volatility in a single fiscal year, while also bearing in mind the continuation of stable dividends.

The reason I think both the payout ratio and stable dividends are important is, for example, because a sudden decrease or cessation of dividends can be the difference between life and death for pensioners who depend on dividends to cover part of their lifestyle expenses. Regular and stable revenue enables the reliable establishment of future lifestyle plans. This belief is based on my background, on having lost my father when I was young; even though I opened a retail business I struggled, however I felt gratitude for the stable revenue I earned each day. We also receive requests for stability from long-term investors who manage pensions.

Capcom shareholders represent all types of people, and I assume some of them may be facing these kinds of issues, which is why we have never once failed to provide dividends during the 27 years since we went public in 1990, and have steadily increased our dividend amount.

* Ordinary dividends excluding commemorative or special dividends

Capcom’s basic shareholder return policy aims to (1) enhance corporate value through investment in growth, (2) continue paying dividends (30% payout ratio) according to performance levels while striving for stable dividends and (3) acquire treasure stock to increase the value of earnings per share. Over the past ten years, the dividend amount has increased 1.7 times. Furthermore, we believe it is also important to efficiently utilize shareholders’equity, thus we are improving ROE along with the acquisition of treasury shares.

Financial Strategy According to the CFO

2. Dividends for This Fiscal Year and the Next

In the fiscal year ended March 31, 2017, the ordinary dividend (excluding commemorative or special dividends) for the full fiscal year was an all-time high of 50 yen. Also, we acquired treasure stock in the amount of 1.48 million shares. In the next fiscal year (ending March 31, 2018), we plan on paying a dividend of 50 yen.

Going forward, we will continue to strengthen shareholder return by securing investment capital, buying back shares and gradually raising the dividend in line with earnings.

As a senior manager with 50 years of experience in this industry, my goal is to increase market capitalization and achieve corporate growth exceeding that of the past 34 years to continue meeting the expectations of all Capcom shareholders.

Kenzo Tsujimoto

Chairman and Chief Executive Officer (CEO)

PDF download

-

Management Strategy (PDF: 2.62MB/22 pages)