- Value

Creation

Story(PDF) - CEO

Commitment - COO Growth

strategy - CHO

COMMITMENT - CFO

COMMITMENT - Development

- Corporate

Governance

Sustaining our digital strategy and aiming for annual software sales of 100 million copies as we increase the number of Capcom users.

Haruhiro Tsujimoto

President and Chief Operating Officer (COO)

Sustaining our digital strategy and aiming for annual software sales of 100 million copies as we increase the number of Capcom users.

Haruhiro Tsujimoto

President and Chief Operating Officer (COO)

Capcom celebrated its 40th anniversary in June 2023 thanks to the support of our many stakeholders over the years. I would like to take this opportunity to express my appreciation to you all now.

Since our founding in 1983, we have grown into one of the top game manufacturers in the world today, having continuously created content known for its outstanding quality. Seeking to further expand sales and establish a stable earnings base, in the mid-2010s we began a comprehensive shift to our digital strategy, including the transition to digital sales.

Until that time, game publishers had primarily provided physical cartridge- or disc-based content to game users via retail stores. However, with retail store sales, there are issues such as (1) limits to physical in-store shelf space, and (2) hurdles for us to carry out price promotions as in some countries retailers control pricing, all of which constrained our global expansion. In addition, disc sales required investing in countermeasures to combat unauthorized and pirated copies. We began shifting to digital sales as a means of overcoming these issues and bringing game content to users throughout the world.

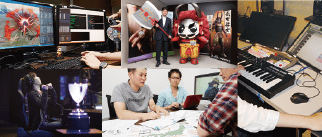

As a result, compared to the fiscal year ended March 2013, when our sales territory consisted of 167 countries and regions, our content is now available in 230 countries and regions, and our revenue base has shifted away from a dependency on new title releases to a more stable foundation of catalog title sales.

However, it will be essential for us to further strengthen our organization in order to continue growing sustainably over the next 10 years, as we foresee even greater change on the horizon in the video game market. This encompasses not only our game development organization, but extends to all aspects of our business, including our ability to understand and analyze the market as well as the strength of our brand. By enhancing our organization and work environment, along with continuing to bolster our workforce, we will be able to deliver our games to even more people. And by increasing the number of people who enjoy our content, I believe that our long-term goal of 100 million units sold annually will be in sight.

Now I would like to explain the measures we have carried out thus far, as well as our concrete initiatives for the future.

Our Measures Thus Far

– Grow markets globally with digitalization –

Tailwinds from the evolution of infrastructure

During the era of physical disc sales, game content was mainly played on dedicated game consoles. With the evolution of game consoles and the spread of the Internet, always-online network connectivity became the norm for these platforms.

This made it possible to directly sell content via digital downloads, in addition to allowing players to both compete and cooperate in games remotely over the network on dedicated home consoles. In digital sales, a wide variety of content is available for purchase at any given time, regardless of the business hours or shelf space of physical brick and mortar stores.

Digital sales improve user convenience and help prevent piracy. This evolution of infrastructure has laid the groundwork for our global sales expansion.

Stepping up our support of the PC platform

Within our Digital Strategy, we have also focused on expanding our support for the PC platform.

Since the distribution of dedicated game consoles is inevitably limited to major developed countries with advanced infrastructures, we decided to proactively offer our content on the PC platform in order to acquire more users, as this platform allows us to appeal to customers in emerging countries as well.

As a result, we now sell our game content in more than 230 countries and regions, far exceeding the market for conventional game consoles.

Currently, the ratio of PC games accounts for roughly 40% of unit sales, but analysis shows that there is still great potential for future growth in this area and we have designated PCs a priority platform.

Strengths propelling our digital strategy

As noted above, the expansion of sales areas and lineup has made long-term sales possible. Over the past 10 years, we have expanded the number of countries and regions in our sales territory, and at the same time, the number of titles we are selling has grown to over 300 annually.

We believe that the following three main factors have enabled this expansion.

(1) From the time the company was established with our main business being arcade game circuit

boards, Capcom had already started expanding throughout the world, giving us a certain brand

status.

(2) Due to the efforts of our development team, Capcom has the technical and developmental

abilities to regularly produce high-quality titles.

(3) Thanks to strategic pricing, long-term sales of our back catalog of titles is now possible.

I am convinced that we were able to open up the market to this extent not only because of Capcom’s excellent brand value, but also because of the even greater entertainment value provided by the content itself.

Looking at the Next 10 Years

– Accelerating sustainable growth led by long-term sales of content –

Development prowess for creating world-class content

We have consolidated game development operations in Osaka, our home base, and have established a system to create high-quality content by accumulating know-how.

We are also making efforts to improve productivity, including with our in-house game development engine, RE ENGINE, and by putting together a world-class environment for development.

Further, we are accelerating the enhancement of our development organization, as evidenced by the acquisition of a 3D computer graphics specialist studio as a wholly-owned subsidiary in July 2023, which aims to bolster our development structure.

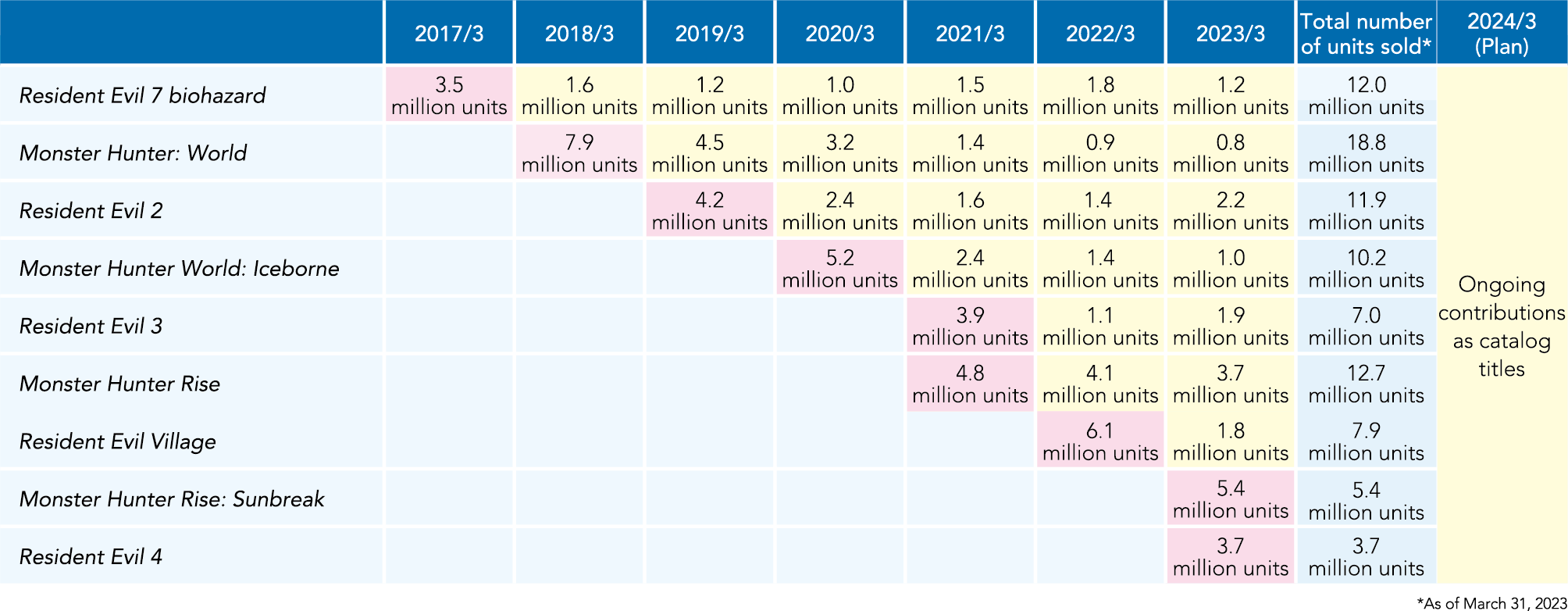

With this approach, since the release of Resident Evil 7, which was launched in January 2017, sales of our titles have been exceeding our expectations thanks to high praise from the media and positive user reception.

To continuously produce high quality titles going forward, in addition to strengthening the brands of existing IP that complement the larger Resident Evil, Monster Hunter, and Street Fighter brands, which already have fans worldwide, we are taking on the challenge of creating new IPs. In order to achieve that, we must steadily increase personnel in the development division, and we are responding to that need by continuously and proactively hiring new graduates and mid-career talent while also considering M&A options to acquire necessary technological capabilities.

Improving profitability with long-term sales

Due to the shift to digital sales for games I explained above, we’ve become able to discount our prices in step with the amortization of a title’s development cost. With our pricing measures, we carry out discount sales for titles that have been released and available for a certain period of time, making that game content gradually more accessible to people in countries and regions with different income standards.

Comparing our sales territory now with 2018, there are countries and regions where annual sales are gradually shifting from less than 100 units annually to more than 100, more than 1,000 more than 100,000, and more than 1 million units. Indicative of this, as income levels rise due to economic growth in each country and region, we should see greater growth of our markets. Given this, one of the decision-making criteria for giving the go ahead to game production is maximizing sales over a five-year period.

One good example is the long-term sales of Monster Hunter: World (MH:W). More than five years have already passed since its initial release in January 2018, but as a result of maintaining the freshness of its content while gradually lowering the price and striving to expand sales, its cumulative sales volume has exceeded 22 million units*; more than 60% of the initial MH:W units were sold in the second year or later. The lowest price it has sold for thus far on sale is approximately five dollars, but its development costs have already been recouped, so it is contributing to income sufficiently. Similarly, the cost of high-quality titles are also being recouped at an early stage after their release. Today, sales of catalog titles account for more than 70% of annual unit sales and more than half of the profits from our digital content business.

This was a major factor in establishing a stable profit structure over the last 10 years.

Looking ahead to the next 10 years, we will further enhance the pricing measures for our catalog titles in order to expand sales of our game software in countries with a broad range of economic conditions.

* Including Monster Hunter World: Iceborne Master Edition

Enhancing brand power through initiatives with outside organizations

Until now, digitalization has allowed us to expand our content to many countries and regions. However, sales volumes still vary by country. In order for more people around the world to become Capcom fans in the future, it is vital that we further grow Capcom’s corporate and content brands to reach a broader audience.

With a strengthened financial base, we will now work harder than ever before on measures to expand and penetrate our brands. We have started taking steps to help strengthen our global brand, including the decision to sponsor the Japan Volleyball Association, the Cerezo Osaka soccer club, and the Tokyo International Film Festival, and to participate in Expo 2025, Osaka, Kansai, Japan, all of which were announced from May 2022 onward. These measures will strengthen communication of our brand, going “from Osaka, to the world.” As for progress, in 2023, we are promoting brand exposure among people other than traditional game fans, which included creating a Street Fighter 6 collaborative t-shirt for Cerezo Osaka’s Capcom Matchday and providing novelty items featuring collaborative illustrations with the Japan Volleyball Association.

Enhancing brand power using existing businesses Japan

It is also important to utilize our existing businesses to strengthen our brands.

Our Arcade Operations and Amusement Equipments businesses are working independently to expand their earnings while we endeavor to expand our business foundation by linking these with our domestic game content brand expansion.

Among Capcom’s businesses, Arcade Operations has an important position as our direct customer touchpoint. Specifically, we have demonstrated the significance of its role with the useful information it provides. That information contributes to measures in stores and the expansion of our content and brands, and is also linked to various customer analyses. The business is a valuable face-to-face touchpoint with the end user, including typical consumers, and at the same time, it is also a place where we can seek synergy with our Consumer sub-segment by holding hands-on game demos, arcade tours for seniors, and other events. In the Amusement Equipments business, game content and pachislo machines go well together, and we have seen growth due to a shift from licensing to in-house production.

Compared with the growth of the global market in recent years, sales in the Japanese market naturally lag behind due to the distribution of users. However, the game industry was originally born in Japan and historically took flight from there. We will continue to promote and utilize both of these businesses for sustainable expansion in our home market of Japan.

Enhancing brand power using existing businesses Overseas

Additionally, our licensing, eSports, and movie businesses are all essential in growing and penetrating our brand further outside of Japan where greater market growth is expected.

Revenues are at an all-time high in our licensing business due to an increase in collaborative products and in-game collaborations that coincide with the release of new titles. Currently our licensing business is conducted mainly in Japan and the Asian region, but we are moving forward with measures to strengthen the business with global expansion in mind.

Although many of the real events planned for the eSports business in the past few years were greatly affected by the COVID-19 pandemic and we were forced to change the format in consideration of the safety of players and spectators, in fiscal 2022, we were able to expand the scale of these events by adding a new category, “World Warrior,” to the Capcom Pro Tour 2022. In addition to diversifying the host regions and participants of the tournament, in February 2023, we were able to hold the Capcom Cup IX for the first time in three years to determine the world’s top player.

Regarding the movie business, in the early 90s, Street Fighter II provided the opportunity for Capcom to proactively create merchandise and Hollywood movies based on content, and in the 2000s, we adopted the Single Content Multiple Usage strategy, leading the industry in development across multiple forms of media. Within this, it was Hollywood films, such as Resident Evil, that played a major role in the branding of our content. In order to be even more proactive in promoting the global branding of Capcom content going forward, we established a subsidiary film production company in Los Angeles, California in the U.S. in 2022. Using our own capital, we will strengthen the connection between games and the movie business as well as our expansion into movies and video streaming services, while adhering to the same standard of quality as our games. Currently, this same division is now spearheading work on a new Street Fighter live-action movie and TV series, and we look forward to further leaps forward for the brand.

Enhancing local marketing

Looking ahead, room for future growth is going to be found in the Global South: in developing and emerging countries that include India and Brazil. Additionally, we will bolster our local marketing in these areas in order to increase awareness of our content and build out a network of partners that are knowledgeable of each local market. We are still evaluating what specific challenges we will face in these developing countries. This is why I believe it is important that we send our people to these areas to gain hands-on experience with each market. We will seek to understand which of our games resonate best in each area by establishing area managers in each country or region and reflect those findings back into our future marketing strategies.

Using data analysis to streamline operations and maximize revenue opportunities

We have organized and refined past sales data and now utilize it to carry out future sales forecasting.

In recent years, we have been (1) promoting the formulation of sales dates and prices optimized for user needs by improving the accuracy of pricing measures, and (2) strengthening digital promotions to further visualize the buying process, from the awareness stage up through purchase, aiming to further improve business efficiency and maximize revenue opportunities.

However, given our agreements with platform holders and the protection of personal information, it is not easy to accumulate detailed data linked to individuals. Therefore, in the future, we will use CAPCOM ID, which is an identifier that can be used across the games and services provided by our company, to accumulate and analyze data such as user play trends.

Sustaining growth by addressing the constantly evolving market

The appearance of new services, such as cloud gaming and the metaverse, and technologies such as AI-powered content development, have the potential to bring dramatic changes to the game industry going forward. In addition to adopting a multi-platform strategy, Capcom has a track record of being quick off the mark in adapting to new technologies, such as VR. It goes without saying that we will continue to maintain a keen awareness of new fields and conduct technical testing. Specifically, I believe we must proactively address the challenge of cross-play, which enables users to compete or cooperate in games played on different hardware.

In recent years, our end users have developed more discerning views on how they evaluate games, in step with the global increase of the game player population. Even if you have the latest technology, just incorporating it into a game doesn’t guarantee a positive reception from fans. I believe future hits are going to stem from addressing the balance between evaluating technology and analyzing the market, with an understanding of just how new technologies and experiences can deliver benefits to game players. As I have stated, by continuing to strengthen our digital strategy I see the ongoing future growth of our company as possible.

Finally, I want to properly convey that although our business format may change, Capcom’s top priority will not. That is to consistently produce world-class, meticulously refined content as we have always done. If our salespeople are properly communicating our appeal, then consumers will always choose our products, even if the platforms or services change. Conversely, if our content or services are deficient, even if we are able to ride the transient wave of a trend, growth will not be sustainable. We are convinced of this based on our experience standing at the forefront of the industry. We are committed to the ongoing challenge of delivering joy and excitement to people around the world.