Q2 FY2025 Financial Results

Press Conference

Press Conference

Financial Results Press Conference for Q2 FY2025 is available on YouTube at our Capcom IR-Channel. (Japanese Only)

Latest Financial Results

-

October 29, 2025 (Wed.): 2Q FY2025 Financial Results Announcement

Press Release

-

December 12, 2025

All-new IP PRAGMATA to Launch on April 24, 2026!

-

December 01, 2025

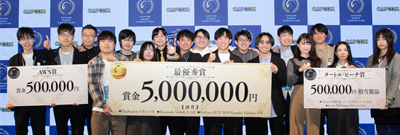

Capcom Announces Winners of Capcom Games Competition, a Student Game Development Competition!

-

October 29, 2025

Consolidated financial results for the 2nd Quarter of FY2025

-

October 29, 2025

Sales and Profits Increase Year-over-Year in Capcom’s Consolidated Results for the Six Months Ended September 30, 2025

What's New

-

December 10, 2025

Stock & Debt

“Analyst Consensus” Analyst Consensus updated. -

December 08, 2025

Reports and Materials

“Integrated Report 2025” added. -

December 03, 2025

Stock & Debt

“Analyst Consensus” Analyst Consensus updated. -

November 18, 2025

Corporate Information

“Corporate Philosophy and Vision” -

November 18, 2025

Stock & Debt

“Stock Data” updated.